Benefits work drains time fast. HR teams fix eligibility errors, chase carriers, and explain deductibles. Manual tasks like open enrollment management, ACA reporting, claims resolution, and COBRA administration never stop.

Many companies now use employee benefits administration outsourcing because it cuts paperwork and reduces compliance problems. Studies show the average cost of employee benefits administration outsourcing is about twenty-four dollars per employee each month.

More than half of employers use outsourcing employee benefits administration services to simplify enrollment and improve carrier connectivity. This keeps data accurate and gives employees a clear digital benefits platform. You get fewer questions, cleaner payroll deductions, and less stress during enrollment windows.

7 Proven Benefits Administration Providers

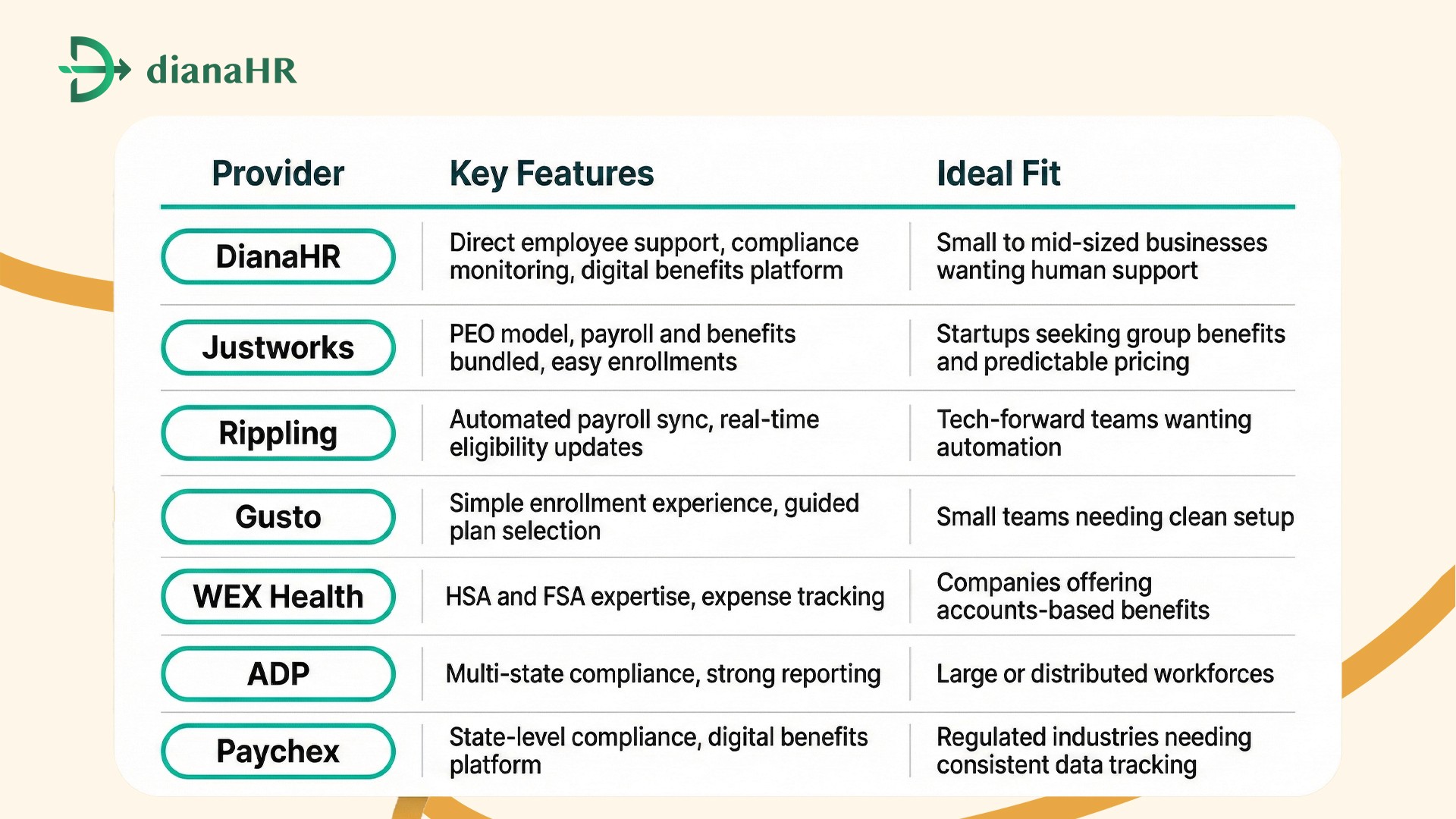

1. DianaHR

DianaHR handles employee benefits administration outsourcing for busy HR teams. It reduces errors in open enrollment management, improves carrier connectivity, and adds human support for coverage questions.

Companies using outsourcing employee benefits administration avoid delays with ACA reporting and COBRA administration issues.

Key Features:

Automated eligibility updates and compliance monitoring

Direct help for claims resolution and voluntary benefits

Digital benefits platform with employee self-service portal

Smooth payroll deduction and health savings account (HSA) tracking

Services Offered: open enrollment management, carrier connectivity, ACA reporting, compliance monitoring, health savings accounts (HSA), flexible spending accounts (FSA), COBRA administration, voluntary benefits, claims resolution

Why Choose DianaHR: Employees get answers fast, and HR gets time back.

Customer Reviews: 4.7/5 stars

2. Justworks

Justworks offers employee benefits administration outsourcing through a PEO model. It gives smaller companies access to strong medical and dental plans while handling payroll deductions, ACA reporting, and carrier connectivity.

Many teams use outsourcing employee benefits administration to keep enrollment clean and simple.

Key Features:

Group benefits access with competitive rates

Digital enrollment tools and compliance monitoring

Integrated payroll and carrier communication

Support for voluntary benefits and COBRA administration

Services Offered: open enrollment management, carrier connectivity, compliance monitoring, payroll integration, voluntary benefits, COBRA administration, claims resolution

Why Choose Justworks: You get predictable monthly pricing and a single point of contact for benefits.

Customer Reviews: 4.5/5 stars

3. Rippling

Rippling uses automation to handle employee benefits administration outsourcing with fast syncing for payroll deductions and benefit elections. Companies that use outsourcing for employee benefits administration see fewer eligibility problems because updates happen in real time across systems. Employees get clear options and fewer enrollment delays.

Key Features:

Automatic deduction changes tied to status updates

Built-in compliance monitoring and ACA reporting

Carrier connectivity for clean data transfers

Employee self-service portal with digital enrollment tools

Services Offered: open enrollment management, carrier connectivity, ACA reporting, compliance monitoring, payroll sync, voluntary benefits, claims resolution, COBRA administration

Why Choose Rippling: You reduce manual data entry and fix problems before they reach the carrier.

Customer Reviews: 4.6/5 stars

4. Gusto

Gusto keeps employee benefits administration outsourcing simple for teams that want clean enrollment steps and clear plan choices. Many HR managers use outsourcing employee benefits administration with Gusto to cut constant back-and-forth during open enrollment.

Key Features:

Guided enrollment screens for medical and voluntary benefits

Automatic eligibility updates tied to hiring and exits

Built-in ACA reporting and compliance monitoring

Easy carrier connectivity to reduce data problems

Services Offered: open enrollment management, carrier connectivity, compliance monitoring, ACA reporting, voluntary benefits, payroll deduction syncing, COBRA administration

Why Choose Gusto: You get fast setup and low training needs for internal teams.

Customer Reviews: 4.4/5 stars

5. WEX Health

WEX Health focuses on employee benefits administration outsourcing for accounts-based benefits. Many companies use outsourcing employee benefits administration for HSA and FSA programs because manual tracking creates filing mistakes and delays in claims resolution. WEX Health makes these items easier for employees and reduces backlogs for HR.

Key Features:

Clean management of health savings accounts (HSA)

Flexible spending account (FSA) setup and tracking

Compliance monitoring for contribution limits

Simple digital benefits platform for expense submissions

Services Offered: health savings accounts (HSA), flexible spending accounts (FSA), claims resolution, compliance monitoring, employer contribution management, payroll deduction coordination

Why Choose WEX Health: It removes stress from HSA and FSA administration and cuts processing time.

Customer Reviews: 4.5/5 stars

6. ADP Comprehensive Services

ADP delivers employee benefits administration outsourcing for companies with many benefit plans and strict rules. Teams choose employee benefits administration outsourcing here to cut manual work with ACA reporting, open enrollment management, and COBRA administration.

Many firms adopt outsourcing employee benefits administration through ADP to simplify compliance monitoring and eligibility changes across locations.

Key Features:

Strong carrier connectivity for medical and voluntary benefits

Automated ACA reporting and real-time compliance monitoring

Digital benefits platform with employee self-service portal

Support for claims resolution and payroll deduction sync

Services Offered: open enrollment management, carrier connectivity, compliance monitoring, ACA reporting, voluntary benefits, COBRA administration, claims resolution, payroll deduction coordination, health savings accounts (HSA), flexible spending accounts (FSA)

Why Choose ADP: ADP manages high volumes without slowing down benefits processing.

7. Paychex

Paychex handles employee benefits administration outsourcing for companies that need strong support across regulated states. Many HR teams use employee benefits administration outsourcing with Paychex to reduce errors in ACA reporting, open enrollment management, and claims resolution.

It also helps with outsourcing employee benefits administration when payroll deduction and voluntary benefits create constant updates.

Key Features:

Real-time carrier connectivity for clean data transfers

Automated compliance monitoring and COBRA administration

Digital benefits platform with employee self-service tools

Support for health savings accounts (HSA) and flexible spending accounts (FSA)

Services Offered: open enrollment management, carrier connectivity, ACA reporting, compliance monitoring, voluntary benefits, COBRA administration, payroll deduction sync, claims resolution, health savings accounts (HSA), flexible spending accounts (FSA)

Why Choose Paychex: Paychex reduces manual tracking and keeps enrollment consistent.

Customer Reviews: 4.5/5 stars

Table: 7 Proven Benefits Administration Providers

How DianaHR Can Help You Manage Enrollment Chaos

DianaHR is built to simplify employee benefits administration outsourcing for small and mid-sized businesses in sectors like healthcare, technology, retail, nonprofits, and professional services.

DianaHR helps clients reduce HR costs by up to 60 percent and save 15–20 hours each week. It allows founders and managers to maintain compliance across 40-plus U.S. states and focus on important work instead of correcting benefits problems.

Special Features:

AI-Driven Compliance Management: Automates payroll taxes, ACA reporting, benefits updates, and registrations for multi-state operations.

Human-in-the-Loop Expertise: Every client gets a dedicated HR specialist who manages onboarding, policies, claims resolution, and open enrollment management.

Seamless Integrations: Works with leading systems like Gusto, ADP, and Rippling without tool migration.

Smart Task Automation: Cuts manual benefits tasks by about 60 percent and saves 15-plus hours weekly on enrollment and tracking.

Scalable People Operations: Supports growth across multiple locations with consistent workflows, digital benefits platforms, and compliance monitoring.

These capabilities turn benefits administration from a slow, manual job into a clean, fast, repeatable system backed by automation and expert guidance.

Connect with DianaHR today and make benefits administration simple every week.

Conclusion

Employee benefits administration covers open enrollment, payroll deductions, ACA reporting, and carrier connectivity. Small mistakes turn into stalled claims, missing eligibility updates, and compliance problems.

Teams get stuck fixing COBRA administration issues, answering coverage questions, and redoing forms. Delays frustrate employees and create stress during enrollment periods.

DianaHR and Justworks improve employee benefits administration outsourcing by automating updates and tracking real-time changes. They support outsourcing employee benefits administration with direct employee help, compliance monitoring, and a digital benefits platform.

Switch to DianaHR and keep benefits administration simple all year.

FAQs

1. What is the real cost of outsourcing benefits work?

Most companies spend about twenty-four dollars per employee each month on employee benefits administration outsourcing. This covers open enrollment management, ACA reporting, and carrier connectivity. Businesses using outsourcing employee benefits administration often save time on claims resolution, COBRA administration, and compliance monitoring tasks.

2. Can I keep my existing benefits broker?

Yes. Many firms using employee benefits administration outsourcing keep their current broker. The broker handles plan design and carriers, while outsourcing employee benefits administration providers manage enrollment, eligibility updates, voluntary benefits, and digital benefits platform support for employees.

3. What is the difference between a TPA and a PEO?

A TPA focuses on employee benefits administration outsourcing, like claims resolution, COBRA administration, and compliance monitoring. A PEO handles broader HR work such as payroll, onboarding, and insurance. Companies choose outsourcing employee benefits administration based on internal workload and team size.

4. How does COBRA coverage work with outsourcing?

Employee benefits administration outsourcing providers send COBRA notices, track deadlines, and maintain carrier connectivity. With outsourcing employee benefits administration, former employees receive required documents and plan details on time. This reduces errors and supports compliance monitoring for regulated benefits work.

5. How secure is benefits data with third parties?

Security standards in employee benefits administration outsourcing include encrypted data transfers, compliance monitoring, and role-based access controls. Providers using outsourcing employee benefits administration support digital benefits platforms, claims resolution systems, and employee self-service portals to protect personal and financial information.

Share the Blog on: