You know that sinking feeling at 4:00 PM on a Friday. Payroll is due, calculations remain unfinished, and one wrong decimal could upset your whole team. Founders are ditching manual spreadsheets because the risk is too high. The market for payroll outsourcing services will top $13 billion in 2025 for a reason.

A single error now costs $291 on average. This drives 14% of firms to face litigation or payroll tax penalties annually. Paying on time isn't enough anymore. You need to pay correctly across 50 tax jurisdictions.

Reliable payroll processing providers handle this heavy lifting so you stay safe. Here are the 7 best payroll processing providers to help you stay audit-proof.

7 Reliable Payroll Processing Providers for Small Businesses

Finding the right partner matters more than ever. Small business payroll solutions must handle local taxes and benefits without crashing. These payroll processing providers stand out for their reliability and updated 2025 features.

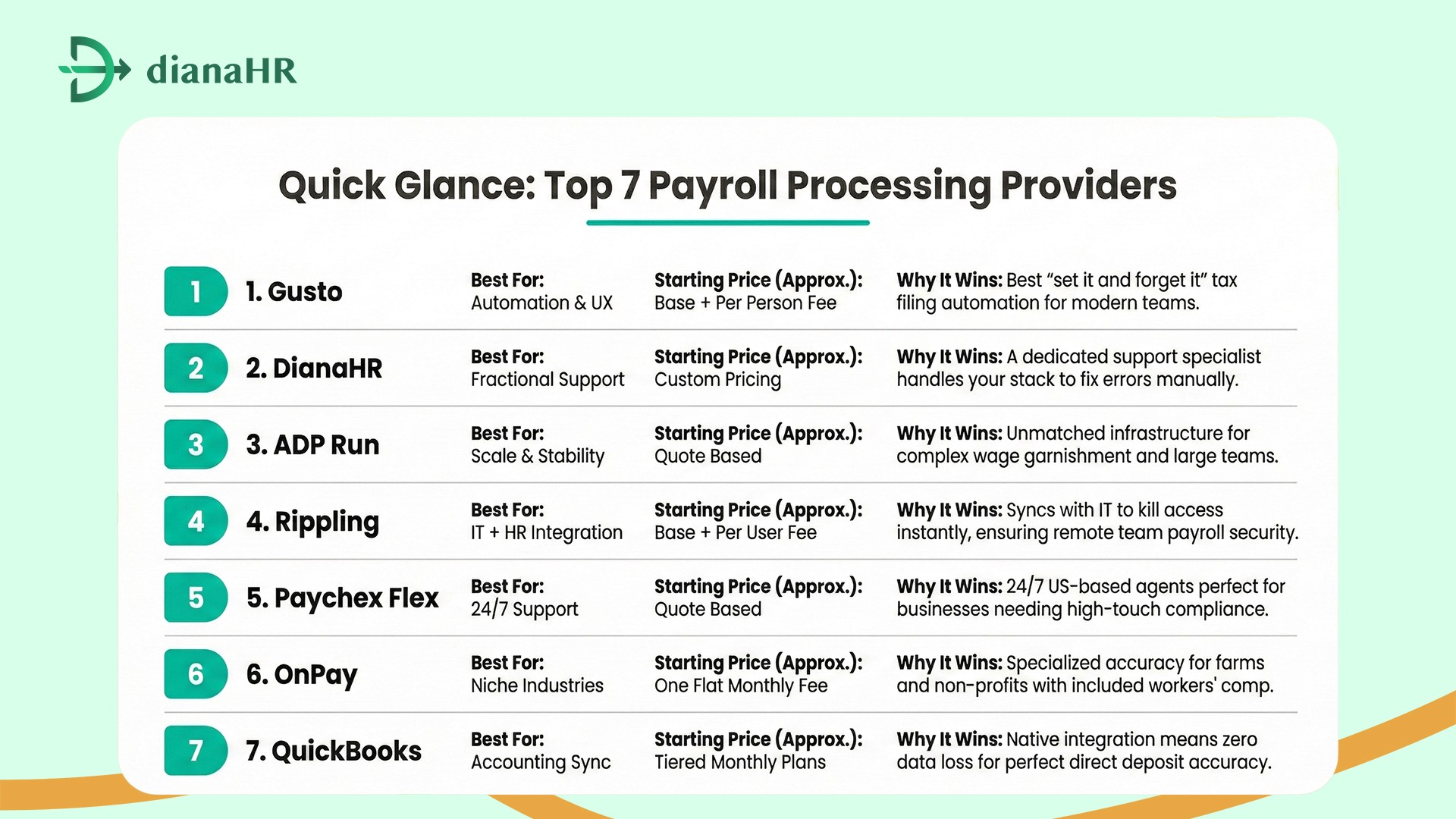

Quick Glance: Top 7 Payroll Processing Providers

1. Gusto

Overview: Gusto leads the pack for modern companies. It simplifies tax filing automation so you never miss deadlines. The platform manages federal, state, and local filings automatically. It suits tech-forward teams looking for an easy, reliable payroll processing provider interface.

Key Features:

Automated multi-state compliance handles taxes for remote workers.

Time and attendance integration syncs hours instantly to prevent data entry errors.

New support for "break premium" laws helps you avoid labor violations.

Why Choose Gusto: It is the best "set it and forget it" option for owners who want direct deposit accuracy without doing manual math.

Extra Services Offered: Health insurance administration, 401(k) plans, hiring and onboarding tools, employee wallet app

Client Reviews: 4.6/5 stars

2. DianaHR

Overview: DianaHR acts as a safety net rather than just software. They pair you with a dedicated support specialist to handle your stack. This saves 15–20 hours a week, positioning them as top payroll processing providers for founders who want to shed administrative weight.

Key Features:

The service reduces HR costs by up to 60% by replacing manual work.

Experts maintain multi-state compliance across 40+ U.S. states.

Real humans resolve wage garnishment issues and complex tax notices.

Why Choose DianaHR: You get direct deposit accuracy and the expertise of a manager without the salary, helping you eliminate repetitive tasks to focus on growth.

Extra Services Offered: HR operations management, state tax registration, compliance audits, benefits support

Client Reviews: 4.8/5 stars

3. ADP Run

Overview: ADP Run brings massive scale to the table. It supports businesses that need robust stability from their payroll processing providers. The platform handles complex scenarios that often break smaller, less experienced tools.

Key Features:

Robust infrastructure manages complex wage garnishment rules easily.

The mobile payroll app lets you approve checks on the go.

Smart detection catches errors before final W-2 and 1099 generation.

Why Choose ADP Run: It offers unmatched stability for payroll outsourcing services, making it ideal if you plan to scale rapidly without changing systems.

Extra Services Offered: Retirement plans, insurance services, HR consulting, talent management

Client Reviews: 4.5/5 stars

4. Rippling

Overview: Rippling unifies HR and IT into one system. It stands out among payroll processing providers because it updates data instantly. When you offboard an employee, the system kills their access and payments immediately to prevent costly remote team payroll errors.

Key Features:

A "single source of truth" ensures direct deposit accuracy by linking pay to active status.

The employee self-service portal lets staff handle their own device and app requests.

New budgeting tools prevent hiring costs from creeping too high.

Why Choose Rippling: It prevents the mistake of paying ex-employees by syncing payroll outsourcing services directly with your IT and computer access.

Extra Services Offered: Device management, app provisioning, benefits administration, PEO services

Client Reviews: 4.8/5 stars

5. Paychex Flex

Overview: Paychex Flex is famous for its support. It helps owners who worry about payroll tax penalties in tricky industries. Their team is available 24/7. This makes them one of the most accessible payroll processing providers when you need answers fast.

Key Features:

Real US-based agents provide 24/7 help for urgent issues.

Specialized tools handle complex restaurant tip credits and overtime laws.

The mobile payroll app gives you full control from anywhere.

Why Choose Paychex Flex: It is the top choice for small business payroll solutions if you operate in regulated sectors like food service or retail.

Extra Services Offered: Business insurance, retirement services, HR consulting, hiring technology

Client Reviews: 4.2/5 stars

6. OnPay

Overview: OnPay offers fair pricing with deep capability. It targets niche markets that other payroll processing providers often ignore. The platform delivers specialized tax filing automation for agricultural and non-profit sectors without hidden fees.

Key Features:

Exact workers' compensation management syncs premiums to actual payroll data.

They guarantee W-2 and 1099 generation accuracy and pay any fines they cause.

One low monthly price covers all features, including special tax forms.

Why Choose OnPay: It provides unmatched value and accuracy for farms and nonprofits that need specific small business payroll solutions big tech can't handle.

Extra Services Offered: HR software, health insurance, 401(k) integration, expert migration support

Client Reviews: 4.8/5 stars

7. QuickBooks Payroll

Overview: QuickBooks Payroll connects directly to your books. It is the default choice among payroll processing providers for teams already using their accounting software. You get instant reconciliation. There is zero data loss between your pay run and your general ledger.

Key Features:

Native integration ensures tax filing automation matches your accounting records.

New tools let you fix errors in closed periods without headaches.

Fast funding options Improve direct deposit accuracy for your team.

Why Choose QuickBooks Payroll: It offers the fastest path to clean books for small business payroll solutions because the data lives where your accountant works.

Extra Services Offered: Bookkeeping, time tracking, bill pay, capital lending

Client Reviews: 4.3/5 stars

Conclusion

Payroll stakes are too high to gamble on cheap tools. A single error often costs more than a year of service fees. While basic software handles the easy math, it frequently fails on complex compliance issues.

Reliable payroll processing providers protect your bottom line. They ensure you avoid payroll tax penalties and keep your team happy. Don't wait for a penalty letter to upgrade your process. Audit your payroll reliability today.

DianaHR offers a smarter way to manage payroll outsourcing services. We combine the efficiency of software with the oversight of a dedicated support specialist. You get a partner who fixes problems before they happen.

Stop the Friday panic. Book a demo with DianaHR to save 20 hours a week on admin today.

FAQs

1. Do these providers handle contractor (1099) payments?

Yes, leading payroll processing providers manage both seamlessly. You can handle full-time staff and remote team payroll for independent contractors in one system. Platforms like Gusto and DianaHR simplify W-2 and 1099 generation automatically at year-end. This integration ensures tax filing automation covers your entire workforce, saving you from manual tracking errors.

2. How much does payroll processing cost for a small business?

Small business payroll solutions typically charge a base fee of $40–$100 monthly, plus $4–$10 per employee. While basic apps seem cheaper, premium payroll outsourcing services often include a dedicated support specialist. Remember, investing in robust workers' compensation management and error protection often costs far less than a single average payroll tax penalty.

3. Can I switch payroll providers mid-year?

Absolutely. You can switch payroll processing providers anytime, though starting at a quarter's end is cleaner. Your new partner will migrate year-to-date data to maintain direct deposit accuracy and multi-state compliance. Services like DianaHR handle this heavy lifting, ensuring wage garnishment and tax history transfer correctly so your operations don't miss a beat.

4. What happens if I miss a payroll deadline?

Speed matters here. Most payroll outsourcing services require wire transfers if you miss the standard processing window. Some platforms offer expedited options for a fee. To avoid this stress, use time and attendance integration to sync hours early. Quick action prevents angry employees and ensures direct deposit accuracy stays on track despite the delay.

5. Is customer support included in the price?

Most payroll processing providers include basic help, but service tiers vary. While some offer 24/7 phone access, others rely on chatbots or an employee self-service portal. For true peace of mind, choose small business payroll solutions that provide a dedicated support specialist. This ensures real humans, not just software, fix your payroll tax penalties issues.

Share the Blog on: