Founders often panic at monthly service quotes. That hesitation disappears when you compare the cost of outsourced HR services to the salary of an in-house HR manager. Base pay for that role hit $85,000 this year. That is why smart teams switch to flexible outsourced HR pricing. You save 20–30% on administrative overhead reduction immediately.

Traditional PEOs often charge up to 12% of payroll. Paying a percentage of your revenue is no longer necessary. Modern partners like DianaHR prove that flat-rate models work better. This guide breaks down real HR outsourcing fees and PEO cost comparison data to help you budget with confidence.

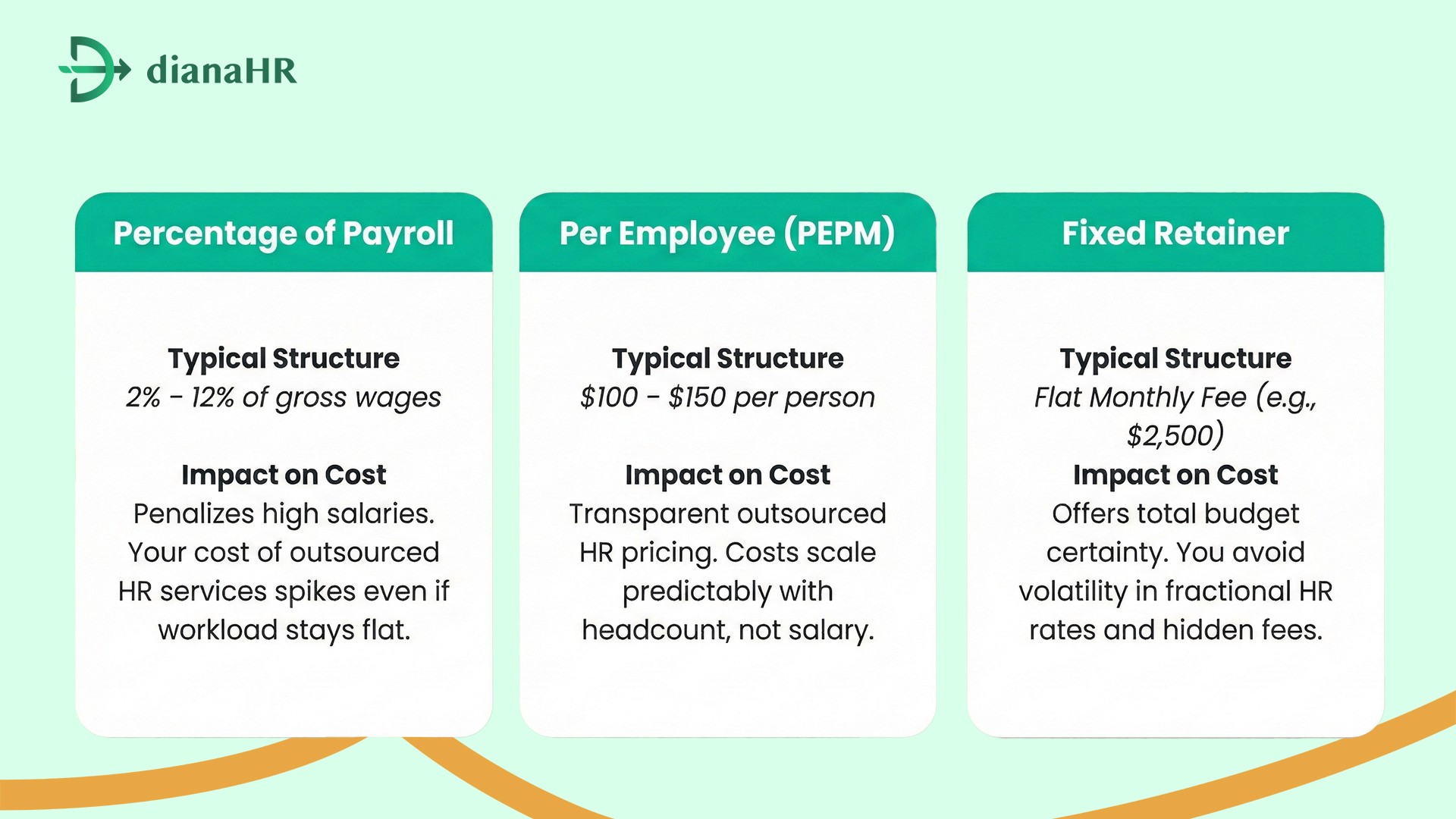

Understanding the 3 Primary Pricing Models

Understanding how vendors charge matters as much as the final price tag. Vendors typically structure their contracts in one of three ways. Knowing the difference between these models helps you spot hidden markups and control your cost of outsourced HR services effectively.

1. Percentage of Payroll (The PEO Standard)

Major PEOs typically use the percentage of payroll models. You pay 2% to 12% of your total gross wages. This structure works for low-wage industries. It penalizes tech companies. Hiring a developer at $180,000 spikes your cost of outsourced HR services even if the administrative work stays the same.

2. Per Employee Per Month (PEPM)

The per employee per month (PEPM) model offers better transparency. You pay a fixed fee like $100 for every worker. Your bill does not change based on salaries. This outsourced HR pricing method helps startups predict expenses accurately. You avoid surprise hikes when you give raises.

3. Fixed Monthly Retainer

Fractional partners often charge a flat monthly fee. You might pay $2,500 for a dedicated scope of work. This eliminates volatility. You get clear fractional HR rates without worrying about headcount fluctuation or payroll spikes. It remains the most stable way to manage HR outsourcing fees.

Quick Glance: Primary HR Pricing Models

Choosing the right model prevents overspending. Now let's look at the actual market rates for each service type in 2025.

Real Cost Ranges for 2025 (By Service Type)

You need accurate data to build your startup HR budget. These ranges reflect what US-based businesses pay right now. Use these benchmarks to validate any outsourced HR pricing quotes you receive.

1. Basic ASO (Admin Services Only)

The ASO pricing model usually falls between $50 and $150 per employee per month (PEPM). You get payroll processing and benefits administration. You receive no strategic guidance. Liability remains your problem. This option offers the lowest cost of outsourced HR services but lacks support.

2. Full-Service PEO (Professional Employer Organization)

A full PEO cost comparison shows higher rates. Expect to pay $150 to $300 PEPM. Some vendors charge 2% to 12% of payroll. This includes co-employment and insurance access. Watch for implementation costs around $1,000 to $3,000. These fees increase your total HR outsourcing fees significantly.

3. Fractional HR Consultant

Fractional HR rates range from $150 to $250 per hour. Monthly retainers sit between $2,000 and $8,000. These experts handle culture and complex problems. They rarely handle daily admin work. You pay for high-level strategy rather than routine tasks.

4. The Hidden Costs to Watch For

Review your contract for hidden HR fees. You might face termination penalties if you leave early. Vendors often charge extra for HRIS subscription access or time-tracking modules. These add-ons inflate the cost of outsourced HR services quickly.

Quick Glance: 2025 Outsourced HR Pricing

High costs do not guarantee better results. You might overpay for features you never use. Next, see how DianaHR helps you avoid these expensive traps.

How DianaHR Can Help You Save on HR Costs

DianaHR is an AI-powered HR-as-a-Service platform built to simplify the cost of outsourced HR services for small and mid-sized businesses. Whether you operate in technology, healthcare, or retail, our model changes the math on traditional pricing.

1. The Flat Fee Advantage

Expensive PEOs penalize you for paying your team well. We do not. By combining intelligent automation with expert HR guidance, DianaHR helps clients reduce HR outsourcing fees by up to 60%. You get scalable people operations designed for startups expanding across multiple locations. This ensures you maintain compliance across 40+ U.S. states without skyrocketing costs.

2. Operational Efficiency ROI

You save more than just the monthly invoice. You save time. DianaHR enables founders to eliminate repetitive admin work and save 15–20 hours per week.

Smart Task Automation: Reduces manual workloads significantly. You save 15+ hours every week on tasks that usually drive up the cost of outsourced HR services.

Seamless Integrations: We work with Gusto, ADP, and Rippling. You avoid expensive tool migration costs.

Human-in-the-Loop Expertise: Every client gets a dedicated HR specialist for startup HR budget planning and complex people operations.

"In 2025, smart founders aren't buying software; they are buying outcomes. The value is in the time saved, not just the tool provided."

These capabilities transform the cost of outsourced HR services from a burden into a streamlined process. Explore how DianaHR simplifies the cost of outsourced HR services and helps your business scale faster → DianaHR.

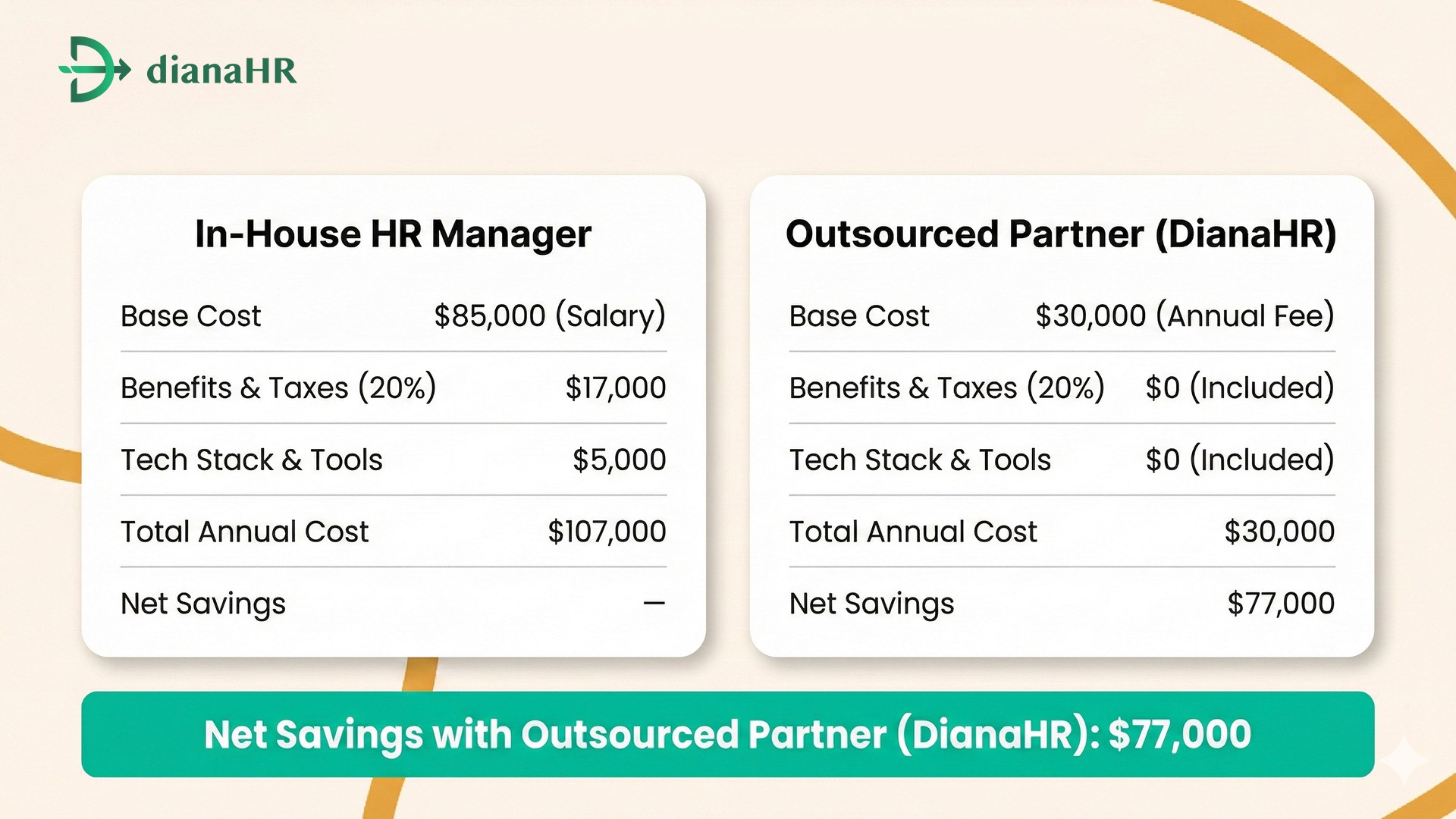

In-House vs. Outsourced: The 2025 Cost-Benefit Analysis

A clear cost-benefit analysis reveals the financial reality. You must weigh heavy salary burdens against flexible service fees to see where your money goes.

The True Cost of In-House

One hire costs much more than their salary. A typical HR generalist commands $85,000. Add payroll taxes, benefits, and an HRIS subscription. Most founders underestimate this expense when comparing it to the cost of outsourced HR services.

Here is the real math for a 40-person company in 2025:

The Outsourced Savings

The numbers speak clearly. You save over $70,000 annually. This math works best for companies with fewer than 50 employees. You access a full expert team for less than half the price of one junior hire.

This maximizes your ROI of outsourcing while keeping your startup HR budget lean. The cost of outsourced HR services drops significantly in this model.

Conclusion

The cost of outsourced HR services varies wildly. Clarity is king. Many businesses face unpredictable HR outsourcing fees hidden inside percentage-based contracts.

These structures penalize you for success. Your overhead spikes simply because you hire top talent or give raises, eroding your margins.

DianaHR eliminates this uncertainty. We provide transparent outsourced HR pricing through a simple flat-fee model. You get predictable expert support without the financial surprises.

Request a transparent quote today and see how much overhead you can cut.

FAQs

1. Is a PEO cheaper than an ASO?

PEOs rarely cost less. A PEO cost comparison shows they charge higher HR outsourcing fees ($150+ PEPM) because they cover liability and insurance. The ASO pricing model is cheaper ($50–$100 PEPM) but only handles admin. Choose carefully to maximize your startup HR budget.

2. What is the average setup fee for HR outsourcing?

Setup adds to the cost of outsourced HR services. Modern platforms often charge $0, while traditional PEOs demand implementation costs up to $3,000. Always check if data migration is included or if it counts as one of those hidden HR fees in your contract.

3. Do I pay extra for new hires?

Yes. The per employee per month (PEPM) model adjusts your bill automatically as headcount grows. If you use a percentage of payroll model, your HR outsourcing fees jump whenever you add salary. Flat-fee fractional HR rates offer the most stability for growing teams.

4. Are fractional HR consultants worth the hourly rate?

They deliver value for high-stakes strategy. However, paying hourly fractional HR rates for daily admin hurts your ROI of outsourcing. A flat monthly retainer typically works better for ongoing administrative overhead reduction compared to unpredictable hourly billing for routine tasks.

5. How can I avoid hidden fees?

Demand a quote that includes everything. Look for hidden HR fees like HRIS subscription charges, year-end tax filing costs, or exit penalties. A complete cost-benefit analysis prevents surprise invoices and keeps your cost of outsourced HR services transparent and predictable.

Share the Blog on: