Hiring mistakes costs more money now. Many business owners ask: is it illegal to hire an illegal immigrant? Yes, and the Department of Homeland Security (DHS) enforces strict rules in 2025.

Undocumented labor makes up about 8.5 million workers, so the DOJ now prioritizes criminal enforcement. They also raised fines by roughly 2%. One error triggers high undocumented worker penalties.

You cannot ignore employment verification laws or I-9 compliance requirements. Getting work authorization status right immediately is the only way to keep your business safe. That’s why DianaHR automates this process to protect you from liability.

The Law — Hiring Undocumented Workers

The Immigration Reform and Control Act sets the ground rules for every business in the country. You simply cannot employ anyone who lacks permission to work here.

1. What IRCA Prohibits

Many employers ask: is it illegal to hire an illegal immigrant? Yes. Federal law strictly bans knowingly hiring, recruiting, or referring unauthorized people for a fee. It also prohibits keeping them on your payroll after you discover they lack work authorization status. Continued employment constitutes a separate violation of employment verification laws.

2. Knowledge Standard for Hiring

You hold liability for what you should know. Courts call this "constructive knowledge." You face risks if you ignore obvious document inconsistencies or fail to act on a "no-match" letter. Ignoring I-9 compliance requirements creates legal proof that you had constructive knowledge of the unauthorized status.

3. 2025 Hiring Enforcement

Agencies shifted focus this year. The Department of Homeland Security (DHS) prioritizes audits over educational warnings. Immigration and Customs Enforcement (ICE) agents now use data to find pattern violators. You will likely receive a Notice of Inspection before you ever get a chance to self-correct.

Breaking these statutes triggers severe financial pain. Let’s look at exactly how much this costs you.

Your Employment Verification Responsibilities

You control compliance in your office. The law demands specific actions from you to prove you follow the rules.

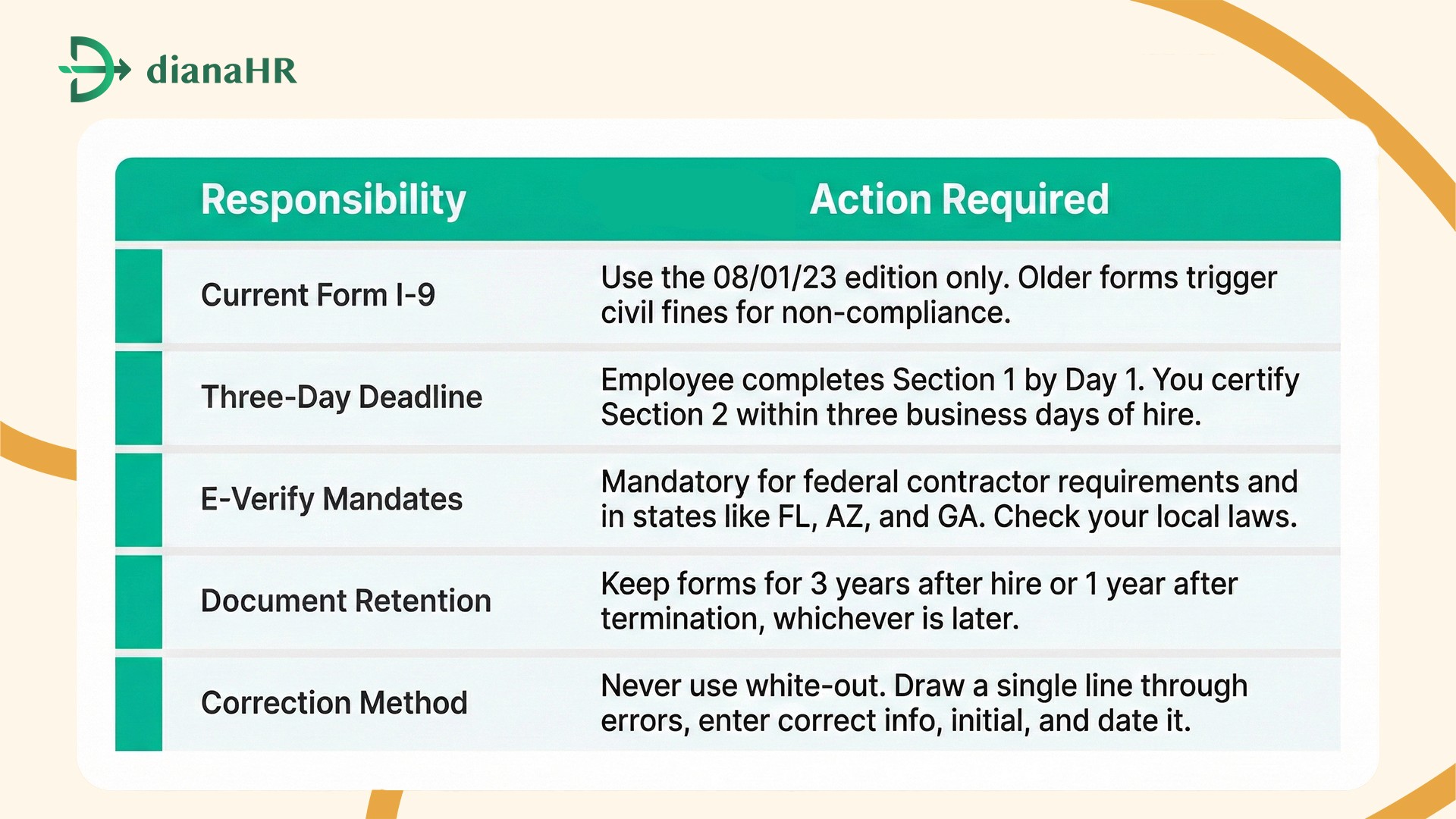

1. Current Form I-9

You must use the current employment eligibility verification form. Using an expired version is a violation. Ensure you use the 08/01/23 edition of the Form I-9. DHS updates these forms regularly. Checking the version date prevents unnecessary civil fines for non-compliance.

2. Three-Day Deadline

Timing matters as much as accuracy. The "Thursday Rule" is standard. Your new hire completes Section 1 on day one. You must complete Section 2 within three business days. Missing this window triggers penalties.

Is it illegal to hire an illegal immigrant? Yes, but even hiring legal workers late violates I-9 compliance requirements. You must adhere to strict employment verification laws here to avoid audit issues.

3. E-Verify Rules

Some states require more than just the I-9. E-Verify mandates apply to federal contractor requirements and businesses in states like Florida or Arizona. You check digital records against government databases here. This step confirms work authorization status instantly.

Manual checks fail often. You need a better system to handle these strict deadlines.

How DianaHR Reduces Verification Risk

Managing compliance manually is risky. DianaHR is an AI-powered HR-as-a-Service platform built to simplify employment verification laws for small and mid-sized businesses across industries like technology and healthcare.

By combining intelligent automation with expert HR guidance, DianaHR helps clients reduce HR costs by up to 60% and save 15–20 hours per week. It enables founders to eliminate repetitive admin work and maintain compliance across 40+ U.S. states.

Here is how our platform specifically tackles verification risks:

Automated I-9 Review: DianaHR’s AI-driven compliance management catches missing fields instantly. We integrate seamlessly with systems like Gusto and ADP to keep your data accurate.

Time Alerts: Our smart automation sends reminders so you always meet deadlines and satisfy employment verification laws.

Secure Storage: We handle document retention for the legal period to support scalable people operations. A dedicated HR specialist manages these policies, ensuring consistent work authorization status records across all your locations.

These capabilities transform compliance into a data-driven process. Explore how DianaHR simplifies employment verification laws and helps your business scale faster → DianaHR.

Conclusion

The answer to "Is it illegal to hire an illegal immigrant?" is a definite yes. HR teams struggle constantly with complex employment verification laws. One small oversight leads to a disaster.

You face massive undocumented worker penalties, strict audits, and potential jail time if the Department of Homeland Security (DHS) finds errors. Your business could fold overnight. Stop guessing.

DianaHR automates your I-9 compliance requirements and verifies work authorization status to lock down liability. We handle the hard work so you never face these consequences.

Let’s connect with DianaHR to simplify employment verification laws and keep your business secure.

FAQs

1. Can I pay an undocumented worker in cash to avoid records?

No. Paying cash to bypass payroll laws constitutes tax fraud. It does not protect you from liability. Agencies trace payments easily during audits. You face severe civil fines and potential criminal charges for knowingly evading employment verification laws.

2. What if an ID looks fake but the employee insists it’s real?

You must reject documents that do not reasonably appear genuine. However, you cannot demand different or specific documents if they look valid. If a document is obviously altered or homemade, you have "constructive knowledge" of unauthorized status. Do not accept it.

3. Is E-Verify mandatory for my business in 2025?

It depends on your location and contracts. Federal contractors must use it. States like Florida, Georgia, and Arizona enforce mandatory E-Verify for many private employers. Check your state's specific labor laws immediately to avoid non-compliance penalties.

4. How long must I keep I-9 forms?

Retain every Form I-9 for three years after the hire date or one year after termination, whichever is later. You must produce these forms within three business days of a Notice of Inspection. Accurate retention is your primary defense.

5. How do I correct a mistake on an I-9 form?

Draw a single line through the incorrect information. Write the correct information clearly. Initial and date the correction. Do not use white-out or erase anything. Transparent corrections demonstrate your good faith effort to comply with DHS regulations.

6. Can I verify remote employees over video?

Yes, but only if you use E-Verify. The "alternative procedure" allows qualified employers to examine documents via live video. You must retain clear copies of all documents (front and back) to prove you followed the strict 2025 remote verification rules.

7. Am I liable if my subcontractor hires undocumented workers?

Yes. You face "joint employer" liability if you know or should know about the violations. Contracts cannot shield you from federal law. You must vet your staffing agencies and subcontractors to ensure they follow strict right-to-work checks.

Share the Blog on: