Payroll runs affect more than just paydays. Every payroll deduction shapes take home pay, tax exposure, and benefit value. Many teams treat deductions as routine line items, yet small choices here change outcomes fast.

A single payroll deduction setup can raise or reduce net pay by double digits across a year. It can shift employer tax costs at the same time. That makes accuracy and intent matter. Missteps around payroll tax deduction rules create rework, penalties, and frustrated employees.

Done right, deductions support benefits, stay compliant, and keep payroll clean. This guide breaks down how the system works in 2026 and what choices mean for you.

The Fundamentals of Payroll Tax Deductions

Every paycheck follows a fixed sequence. Once you know where a payroll deduction fits in that sequence, payroll decisions stop feeling confusing. This foundation explains how deductions interact with gross pay, taxes, and compliance so later choices around benefits and savings actually make sense.

1. Mandatory vs. Voluntary Deductions

Some deductions are required by law. These mandatory deductions include federal income tax, Social Security, and Medicare. Together, Social Security and Medicare fall under FICA taxes, and employers must withhold them correctly every pay cycle. Other deductions depend on employee choice.

These voluntary deductions include retirement plans, insurance elections, and benefit programs. Even though employees choose them, each voluntary payroll deduction still needs proper authorization and accurate payroll setup to stay compliant.

2. Impact on Gross Pay and Taxable Income

A payroll deduction never changes gross pay. It changes how much of that pay gets taxed. Pre tax deductions reduce taxable wages before tax withholding starts. Post tax deductions apply after taxes are calculated.

This placement affects federal income tax, state tax, and payroll tax deduction amounts. When deductions are misclassified, employees see unexpected net pay changes and employers face correction filings.

3. The Employer’s FICA Advantage

Pre tax deductions benefit employers too. Each qualifying payroll deduction lowers the employer share of FICA taxes by 7.65%. That reduction applies to Social Security and Medicare contributions. Across a growing workforce, these savings add up quickly and improve overall payroll efficiency without changing salaries.

Now that the structure is clear, it’s time to focus on how pre tax deductions create immediate savings.

Maximizing Pre Tax Deductions for Immediate Savings

Pre tax options work at the point where payroll decisions matter most. Each pre tax payroll deduction reduces taxable wages before any payroll tax deduction applies.

That single placement affects net pay, benefit value, and employer tax costs in the same cycle. When set up correctly, pre tax deductions create predictable savings without adding payroll complexity.

1. Reducing the Taxable Base

Pre tax deductions lower the income used to calculate taxes. Common examples include 401k contributions, health insurance premiums, and HSA funding. When these items run as a payroll deduction, they reduce federal income tax, most state taxes, and FICA taxes.

An employee earning 80,000 USD who redirects 6,000 USD through pre tax benefits pays tax on 74,000 USD instead. That difference shows up immediately in take home pay and employer tax savings.

2. 2026 Contribution Limits for HSAs and FSAs

Every payroll deduction tied to tax favored accounts has an annual cap. For 2026, healthcare FSAs are projected at 3,300 USD. HSA limits vary by coverage type and adjust yearly.

Payroll teams must track year to date totals across pay periods. Missing a cap creates over contributions, refund processing, and amended reporting. Automated tracking prevents this risk.

3. Commuter and Dependent Care Benefits

Commuter programs and dependent care FSAs reduce everyday expenses using pre tax dollars. Transit passes, parking costs, and childcare fees qualify. These pre tax deductions often deliver 30 to 40% savings through reduced payroll tax deduction exposure. Many employers offer them but fail to educate employees on their value.

4. Strategic Compliance and IRS Limits

Each payroll deduction must align with IRS rules and plan documents. Payroll systems should stop deductions at limits, adjust mid year elections, and reflect changes accurately on pay statements.

Next, let’s look at how post tax deductions fit into longer term planning.

Post Tax Deductions and Long Term Financial Planning

Not every benefit or obligation fits into a pre tax structure. Some choices work better after taxes are applied. A post tax payroll deduction does not reduce taxable wages today, yet it plays a clear role in long term planning, legal compliance, and benefit access. Knowing why these deductions exist helps you avoid setup mistakes and employee confusion.

1. The Logic of Post Tax Withholding

Post tax deductions apply after tax withholding is complete. That means federal income tax, state tax, and FICA taxes are already calculated. Common examples include Roth retirement plans, union dues, and court ordered payments. Each post tax payroll deduction keeps payroll compliant when tax rules do not allow exclusion from taxable income.

2. Roth Accounts: Tax Free Future Growth

Roth retirement plans flip the tax timing. Contributions run as a post tax payroll deduction, so taxes are paid upfront. In return, qualified withdrawals remain tax free later.

This structure appeals to employees who expect higher income in the future or want predictable retirement cash flow. Roth 401k contributions also avoid required minimum distributions during employment.

3. Mandatory Post Tax Garnishments

Some deductions are legally enforced. Child support orders, tax levies, and wage garnishments must run as post tax payroll deductions. Employers must follow strict priority rules and withholding limits. Errors expose payroll teams to penalties and legal claims.

4. Supplemental Insurance and Voluntary Perks

Certain benefits stay taxable by rule. Life insurance coverage over set limits and lifestyle perks often fall here. These employee benefits deductions still add value but must be taxed correctly.

Next, let’s compare how different deduction choices affect real pay outcomes.

Strategic Comparison: Choosing the Right Deduction Mix

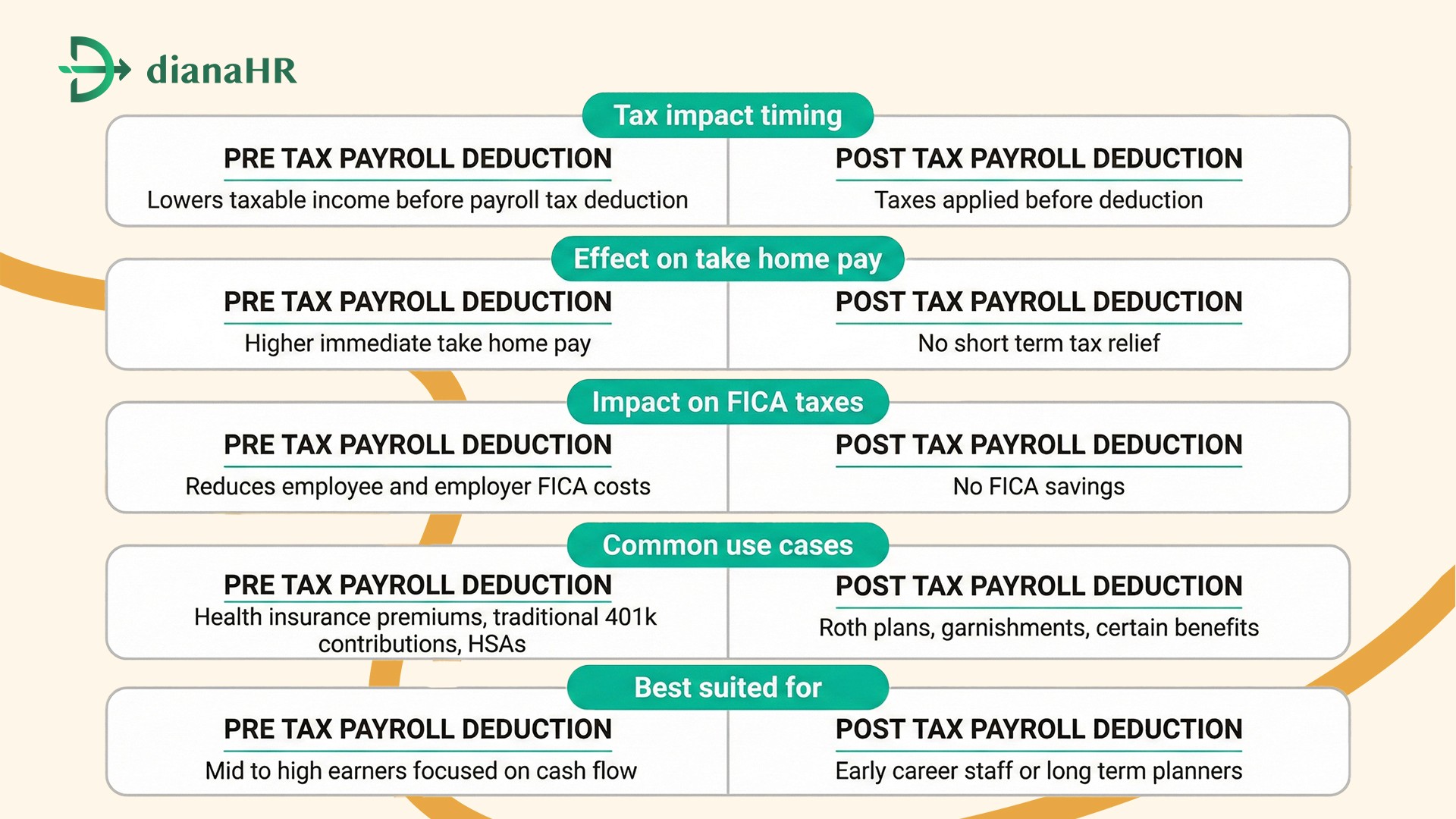

Once both structures are clear, the real question becomes balance. The right payroll deduction mix depends on income level, benefit needs, and future plans. This section shows how different choices affect real pay outcomes for employees and tax exposure for employers.

1. Net Pay Consequences: A Side by Side View

Pre tax deductions increase short term take home pay by reducing taxable wages. Post tax deductions do not change current taxes, yet they support future goals or legal needs. A single payroll deduction decision can shift monthly cash flow by hundreds of dollars. Employees who review pay statements closely see the impact fast, while those who do not often miss easy gains.

2. FICA Savings as a Growth Lever

Employers save 7.65 percent in FICA taxes on every qualifying pre tax payroll deduction. For a mid sized company, higher participation in pre tax benefits can reduce annual payroll costs by tens of thousands. That saving often funds better benefits without raising salaries or overall spend.

3. Use Cases for Different Employee Life Stages

Early career employees often favor Roth options run as post tax deductions. Mid career earners lean toward pre tax savings to lower current payroll tax deduction exposure. Senior employees often split contributions for flexibility.

Pre Tax vs Post Tax Payroll Deductions at a Glance:

Next, let’s see how DianaHR supports this strategy in practice.

How DianaHR Optimizes Your Deduction Strategy

DianaHR helps businesses manage every payroll deduction with accuracy and speed. The platform supports companies across technology, healthcare, nonprofits, retail, and professional services.

Clients reduce HR operating costs by up to 60 percent and save 15 to 20 hours each week by automating deduction logic, tax handling, and benefit elections. Employees see clearer pay statements, and finance teams gain tighter control over each employee benefits deduction without added payroll risk.

Special Features:

AI driven compliance across 40 plus US states for payroll deduction rules

Dedicated HR specialist for setup, audits, and deduction changes

Native integrations with Gusto, ADP, and Rippling

Automation cutting manual payroll work by over 50 percent

Scalable workflows for growing, multi state teams

DianaHR turns payroll deductions into a measurable cost and time advantage. See how DianaHR simplifies payroll deduction management. Book a demo today and get clear, compliant payroll without extra admin work.

Conclusion

Pre tax and post tax choices decide how each payroll deduction affects cash flow, taxes, and benefits. Pre tax options reduce taxable income today. Post tax options support future planning and legal needs. When teams misclassify a payroll deduction, problems follow fast.

Payroll errors trigger wrong payroll tax deduction amounts, failed audits, employee disputes, and correction filings. Missed limits lead to penalties. Garnishment mistakes invite legal risk. Over time, these issues drain time, money, and trust. That pressure grows as teams expand and rules tighten.

This is where a system built for accuracy matters. DianaHR brings structure to every employee benefits deduction, automates compliance checks, and removes guesswork.

Connect with DianaHR to simplify every payroll deduction and keep payroll accurate as your team grows.

FAQs

1. What is a payroll deduction and why does it matter?

A payroll deduction is an amount taken from gross pay for taxes or benefits. It affects take home pay, tax withholding, and compliance. Accurate setup keeps payroll tax deduction calculations correct, avoids corrections, and prevents employee confusion during payroll reviews.

2. How does a payroll tax deduction differ from other deductions?

A payroll tax deduction covers required taxes such as FICA taxes and income tax. Other deductions include employee benefits deduction items like insurance or retirement. Mixing these incorrectly changes taxable wages, creates filing errors, and increases audit exposure.

3. Are employee benefits deductions always pre tax?

No. Some employee benefits deduction items qualify as pre tax deductions, including health insurance premiums. Others run as post tax deductions, such as Roth plans. Each payroll deduction depends on IRS rules, plan structure, and compliance limits.

4. How do pre tax deductions affect FICA taxes?

Pre tax deductions reduce taxable wages before FICA taxes apply. Each qualifying payroll deduction lowers employee and employer Social Security and Medicare costs. This improves net pay and reduces payroll expense without changing base compensation amounts.

5. What risks come from incorrect payroll deduction setup?

Incorrect payroll deduction setup leads to wrong payroll tax deduction amounts, missed limits, penalties, and employee disputes. Over time, errors raise audit risk, increase admin workload, and create compliance gaps across multi state payroll operations.

Share the Blog on: