Many business owners struggle with administrative work. Gusto payroll helps you fix this problem. Over 400,000 customers use this payroll software for small business owners trust to save time. Most users finish their payroll processing in under five minutes.

This HR management platform automates your tax filing and employee benefits. These integrated HR tools give you a clear view of your team in one place. Our review looks at how gusto payroll works for you today. You can stop worrying about paperwork. Focus on your growth instead.

Core Capabilities and Platform Architecture

You need a system that works without constant oversight. Gusto payroll builds its tech to handle the hard parts for you. This HR management platform combines several services into one simple dashboard. It changes how you handle your daily office tasks with gusto payroll efficiency.

1. A Unified People Operations System

Managing staff data often feels messy. This payroll software small business solution stores everything in one place. You can track hiring and performance without switching tabs. It simplifies your workload by connecting your team data. You get a clear picture of your company's health quickly and easily now.

2. Automation and Compliance Infrastructure

Errors in tax filing cost money. The AutoPilot system runs your payroll processing automatically. It calculates local and federal taxes in every state. This payroll automation ensures you stay compliant with current laws. You don't have to study tax codes with gusto payroll handling it correctly.

3. Employee Self-Service Ecosystem

Your team gets more control with employee self-service tools. Workers use the mobile app to check their direct deposit details. They can view their employee benefits or download tax forms anytime. This reduces questions. It makes your staff feel independent with help from gusto payroll software.

Check out the specific features that help your business scale.

Top Features of Gusto Payroll in 2026

Modern features make gusto payroll a top choice for growth. This payroll software small business tool offers more than just checks. It packs powerful HR tools to run your office. You get a complete system that grows with your team.

1. Intuitive Onboarding and HR Tools

Start right with digital offer letters. New hires use employee self-service to sign documents instantly. Gusto payroll files your new hire reports with the state automatically. You save hours on paperwork. It keeps your team organized from day one with simple workflows.

2. Flexible Payment and Direct Deposit Options

You can pay people anytime. Gusto payroll supports next-day direct deposit for most plans. You also get tools for small business payroll abroad. It handles contractors in 120 countries. This makes it a truly affordable payroll software for teams with global reach.

3. Integrated Time and Benefits Management

Sync your hours with one click. This HR management platform tracks time tracking and PTO together. All employee benefits deductions happen during payroll processing. You don't have to calculate health or 401k costs by hand. Gusto payroll does it for you correctly.

4. Robust Integration Marketplace

Connect your favorite apps. Gusto payroll works with 150 tools like QuickBooks and Slack. This payroll automation keeps your books accurate. Your financial data flows between systems without errors. It helps you manage your business without manually moving files or data.

Learn how much these plans cost your business in the next part.

2026 Pricing Plans and Value Analysis

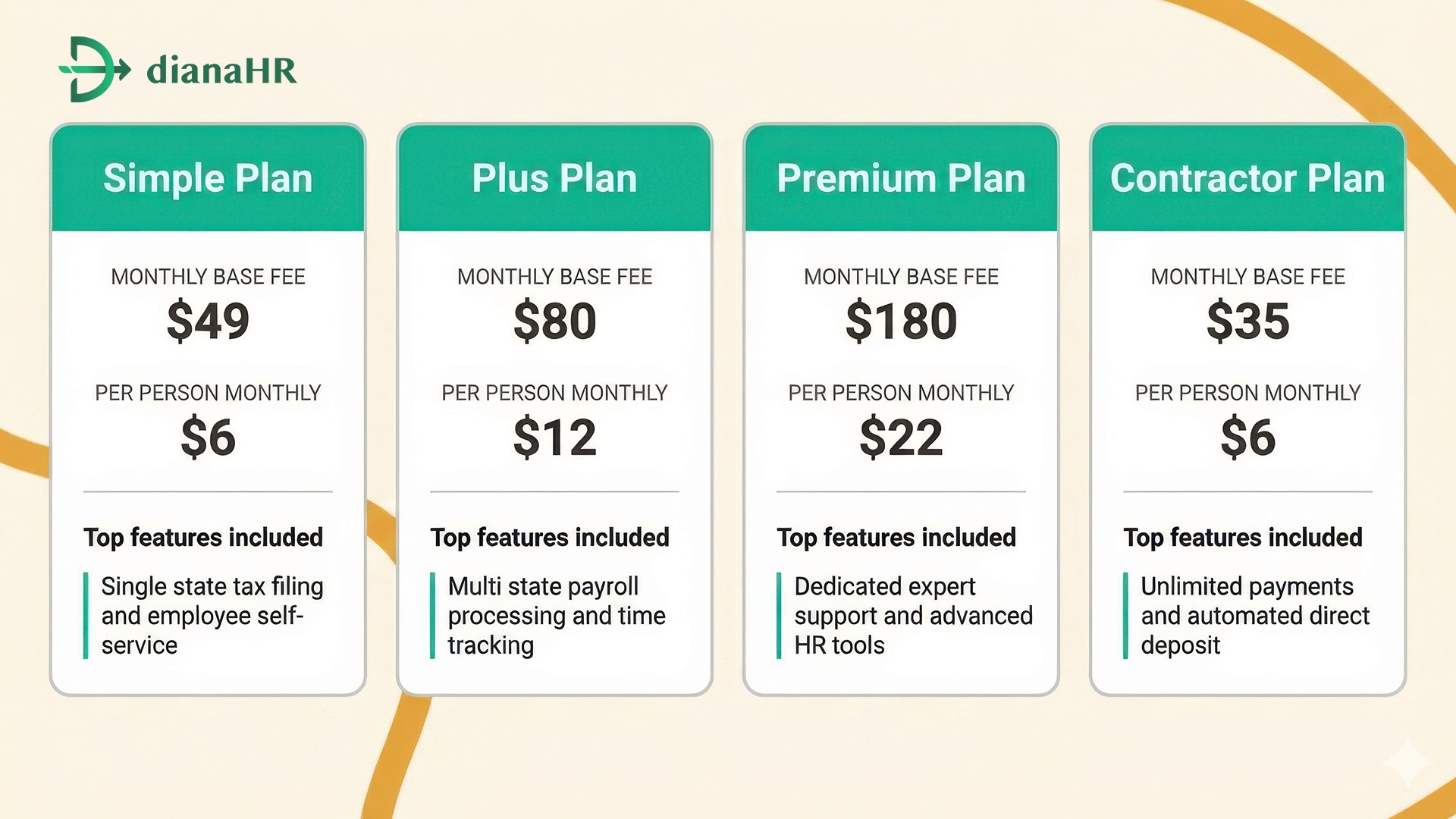

Budget planning matters for your growth. You can choose from four main plans to fit your team size. Each tier offers different HR tools to match your specific needs. Gusto payroll keeps its pricing transparent so you never see hidden fees on your monthly bill.

1. Simple Plan ($49/mo + $6/person)

This plan works best for small businesses in one state. You get essential features to run your office:

Full-service payroll processing

Basic employee self-service

Digital onboarding tools

For a shop with 5 staff, you pay $49 plus $30, totaling $79 monthly. It is the best affordable payroll software choice for basic needs.

2. Plus Plan ($80/mo + $12/person)

Most growing teams pick the Plus option for multi-state tax filing. It includes everything in Simple, plus:

Advanced time tracking

Next-day direct deposit

Custom hiring checklists

If you have 10 employees, your cost is $80 plus $120, which equals $200 per month. This plan scales your small business payroll effectively.

3. Premium Plan ($180/mo + $22/person)

Scaling companies benefit from a dedicated service advisor and payroll automation. You get everything in Plus, along with:

Compliance alerts

Priority support

For a 20-person team, the math is $180 plus $440, totaling $620 monthly. It provides a full HR management platform for expert oversight.

4. Contractor-Only Plan ($35/mo + $6/contractor)

Pay 1099 workers easily without W-2 staff overhead. This plan covers:

Unlimited contractor payments

International worker support

If you hire 3 contractors, you pay $35 plus $18, totaling $53 each month. Gusto payroll makes managing your small business payroll for freelancers very simple.

2026 Pricing Comparison Table

Find out which business types benefit most from these specific plans.

Optimal Use Cases: Is Gusto the Right Fit?

Choosing gusto payroll helps specific business types thrive. This payroll software small business solution fits teams that value speed. You can manage your workforce without deep technical knowledge using gusto payroll tools today.

1. High-Growth Startups and SMBs

Fast-moving companies use gusto payroll to scale. This HR management platform automates hiring and tax filing. It keeps your overhead low while your team expands quickly.

2. Multi-State Remote Teams

Gusto payroll simplifies pay for remote workers. It handles payroll processing across state lines automatically. You avoid legal mistakes with built-in compliance checks for every location.

3. Businesses Hiring a Hybrid Workforce

Manage employees and contractors in one place. Gusto payroll supports 1099 and W-2 payments. It is an affordable payroll software for teams that mix local and global talent.

Know the drawbacks before you sign up.

Limitations and Market Alternatives

No tool fits every single business perfectly. You might find that gusto payroll lacks some features you need for global work. Checking a different payroll software small business solution helps you avoid errors.

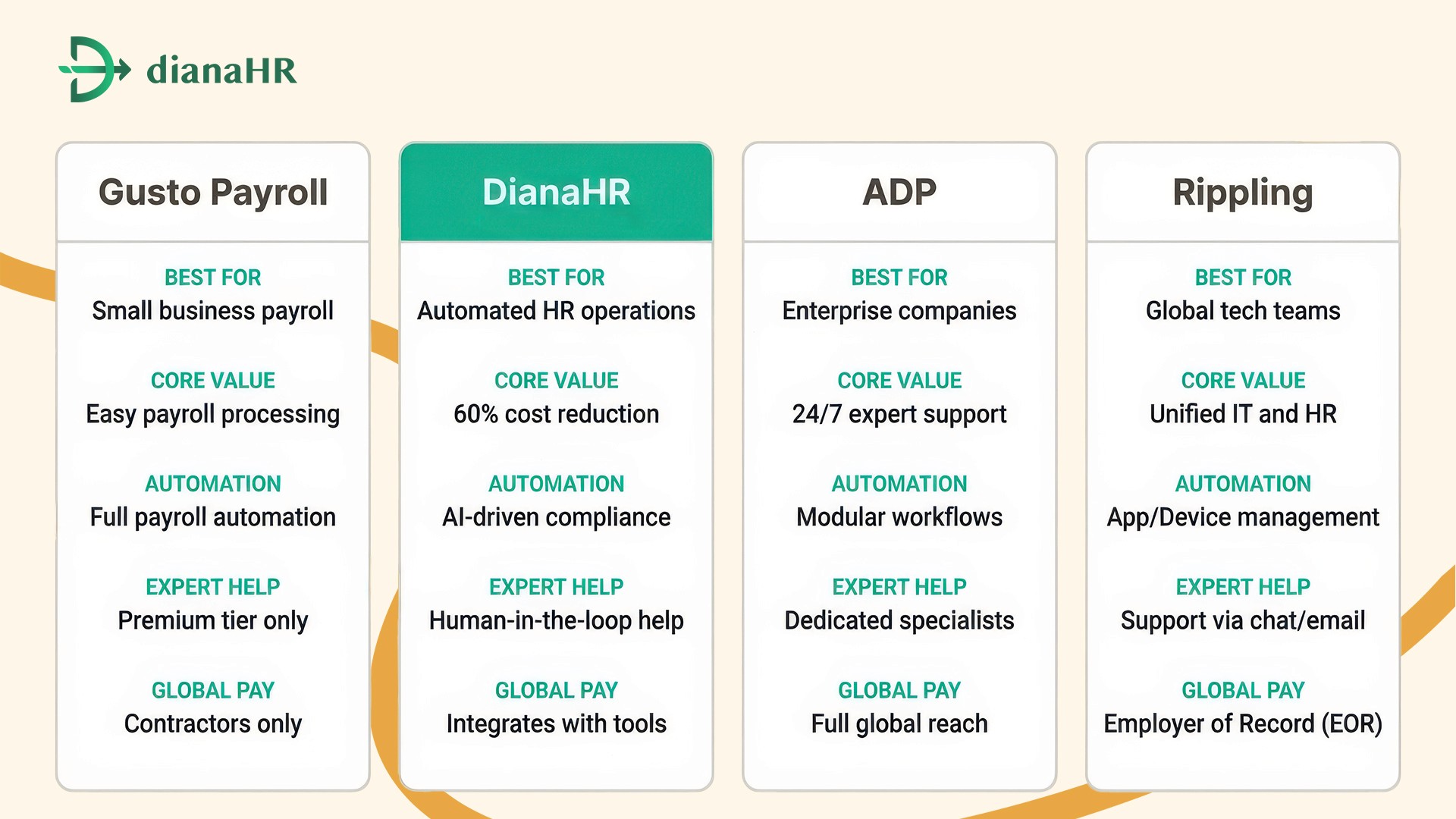

Here is how some top competitors compare to the core gusto payroll experience.

1. DianaHR: AI Powered Human-in-the-Loop

DianaHR is an AI powered service that simplifies payroll processing for many industries. By combining automation with expert guidance, it helps you reduce costs by 60 percent. You save 15 to 20 hours per week on small business payroll tasks across 40 states. It works perfectly with gusto payroll.

2. ADP The Enterprise Legacy Choice

ADP works well for companies that grow beyond simple HR tools. It offers 24/7 support and deeper reports than most platforms. Gusto payroll focuses on easy design. ADP handles complex labor rules instead. This choice is better if you need a huge system that scales into a global enterprise.

3. Rippling Unified IT and Global HR

Rippling connects your payroll automation with IT tasks like shipping laptops to remote workers. It handles payments in 185 countries, making it a powerful HR management platform. Rippling manages hardware and software access. Gusto payroll focuses solely on people. It is the best choice for tech heavy startups.

Limitations and Market Alternatives: Platform Comparison

Read our final thoughts to see if this platform is right for you.

Conclusion

Gusto payroll remains a top choice for owners who want to spend less time on paperwork. This payroll software small business solution makes tax filing and managing employee benefits simple.

Most users save over 150 hours every year by using these automated tools. Pairing gusto payroll with a service like DianaHR ensures your small business payroll stays compliant while you focus on growth.

Let DianaHR take the wheel. You focus on growing your business while experts manage your payroll operations behind the scenes.

FAQs

1. Does Gusto handle multi-state taxes?

Gusto payroll makes tax filing simple across every state. This payroll software small business solution automates complex payroll processing for remote teams. You stay compliant without manual work because the system handles every local requirement automatically using built-in payroll automation tools for you today.

2. How does the direct deposit work?

Your team receives funds quickly through direct deposit on this HR management platform. You can set up payroll automation to run on a schedule. This ensures employee benefits and pay reach bank accounts on time every single pay period without any manual errors.

3. Can employees manage their own data?

Yes, employee self-service is a core feature of gusto payroll. Workers use the app for time tracking and viewing their pay stubs. These HR tools reduce your admin work while giving your staff total control over their own small business payroll information.

4. Is Gusto a good value for startups?

As an affordable payroll software, gusto payroll provides enterprise level power for a low price. It combines tax filing, hiring, and payroll processing into one dashboard. You get all the essential HR tools needed to grow your company without hidden monthly costs.

5. Does it sync with accounting apps?

This HR management platform connects with tools like QuickBooks and Xero. It uses payroll automation to sync your payroll processing data instantly. You can track employee benefits costs and taxes without manual entry, keeping your books accurate and your office team very happy.

Share the Blog on: