Payroll errors cost you more than just money; they destroy team trust and trigger expensive fines. In 2026, over half of all companies face payroll penalties from simple data mistakes. If you mess up a paycheck twice, half your staff will look for a new job.

That is a high price for a manual error. Today, smart businesses use tax compliance automation and tools like DianaHR to catch issues before they happen. You need payroll fixes that work fast.

This guide shows you how to handle overpayments, underpayments, and tax errors using a payroll audit to keep your business safe.

The Reclaim Strategy: 3 Payroll Fixes for Accidental Overpayments

Paying an employee too much creates a messy situation for your books and your culture. You want your money back, but you also want to keep your staff happy.

These three payroll fixes help you recover funds without breaking the law or losing your best people.

Fix 1: The Standardized Recovery Agreement

When you find an overpayment, talk to the employee immediately. Do not just take the money back from their next check. Instead, use a written recovery agreement.

This document lists the error and sets a fair schedule for a payroll reconciliation. By letting them pay it back over time, you follow wage and hour laws and keep their trust.

Fix 2: Real-Time Anomaly Detection

Stop errors before they leave your bank account. Use payroll software updates that include anomaly detection. These tools flag a payment if it looks weird, like a check that is double the usual amount.

This payroll audit step catches manual entry errors during the "maker-checker" process so you never send the wrong amount in the first place.

Fix 3: Tax Adjustment Reconciliation

An overpayment often means you paid too much in taxes too. To fix this, you must adjust the current year’s wage totals. Do not just ask for the net amount. Use tax compliance automation to fix the withholding.

This prevents tax withholding correction issues later and ensures the employee’s W-2 stays accurate.

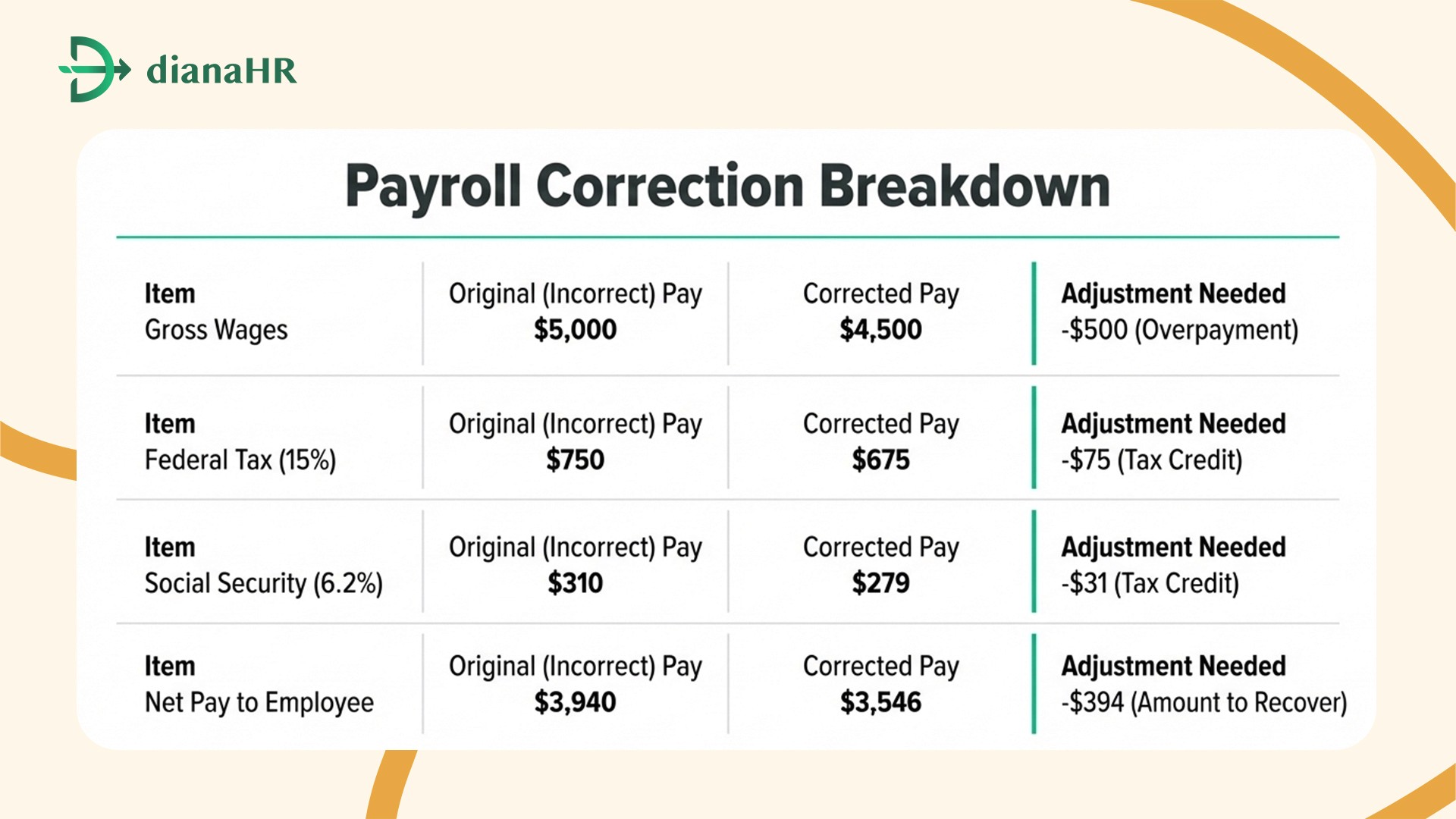

Here is how a typical underpayment adjustment or recovery looks when you factor in taxes:

By using this table, you show the employee exactly why you are asking for $394 back instead of the full $500. This payroll reconciliation keeps your records clean and avoids "phantom income" problems.

Fixing overpayments is about balance, but handling underpayments requires even more speed to keep your team motivated.

Restoring the Balance: 3 Essential Payroll Fixes for Underpaid Teams

Underpayments hurt your team’s morale faster than almost anything else. When someone works hard and gets a light paycheck, they feel undervalued. You need to act fast. These three payroll fixes help you settle the score and prove you value your employees' time.

Fix 4: Automated Retroactive Pay Calculations

Calculating retroactive pay by hand leads to more mistakes. If an employee gets a raise that starts three weeks late, they are owed a "catch-up" payment. Use a system that handles these payroll software updates automatically.

This ensures you pay the right rate for every hour worked, including overtime. It also keeps you in line with wage and hour laws without the headache of manual math.

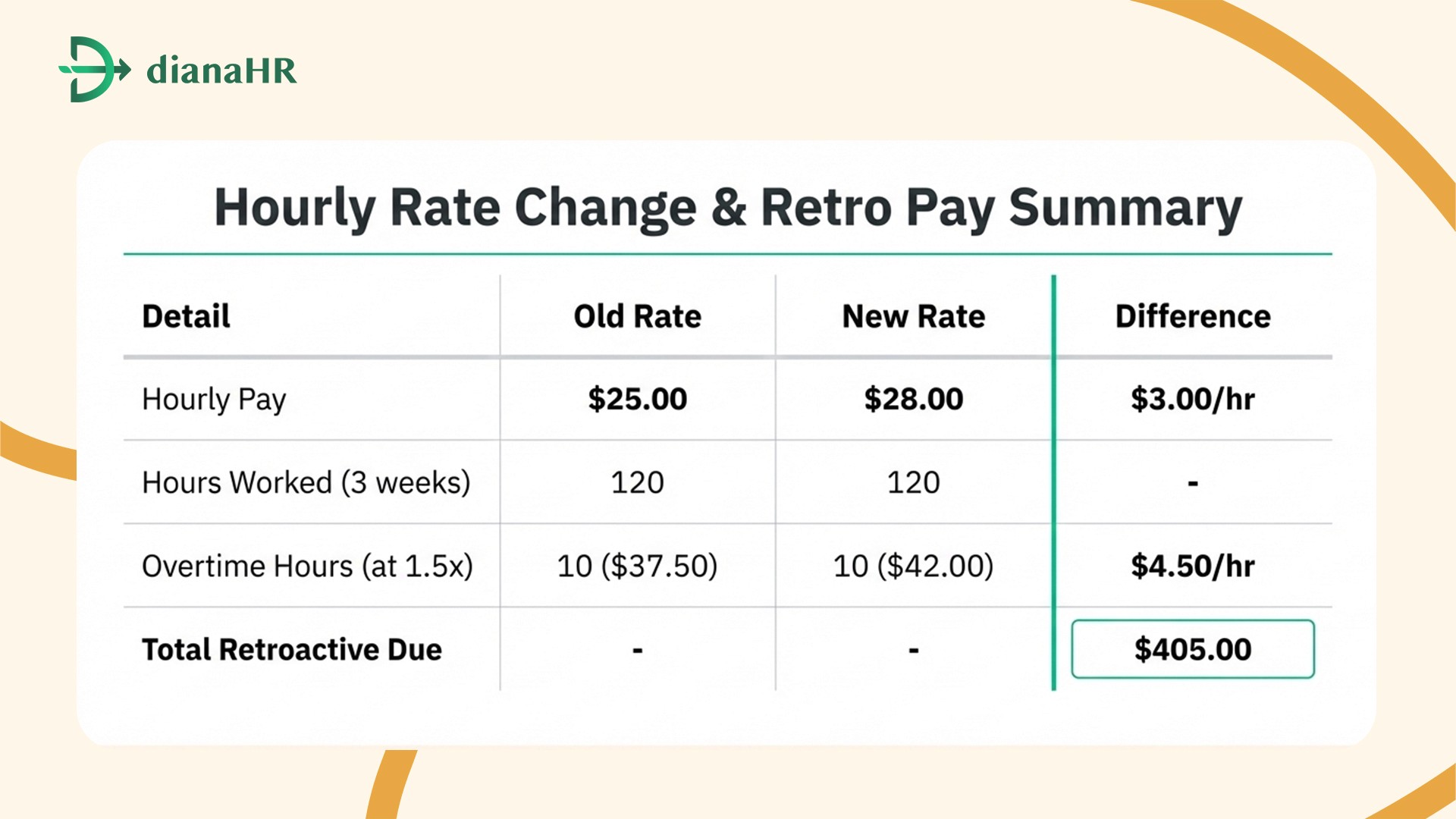

Here is how an automated system calculates retroactive pay for a missed raise:

This automated underpayment adjustment ensures you pay the exact amount owed, including the complex overtime math that often triggers payroll penalties if done incorrectly

.

Fix 5: Off-Cycle "Faster Payment" Integration

In 2026, telling an employee to "wait until next payday" for their missing money is a mistake. Integrate cloud-based payroll with "Faster Payments" or on-demand pay options.

This allows you to send an underpayment adjustment within 24 hours. Moving quickly stops payroll penalties from state labor boards and shows your team that you respect their bank accounts.

Fix 6: The Time-Tracking Synchronization Audit

Many underpayments happen because your time-clock and your payroll ledger do not talk to each other. You need a regular payroll reconciliation that syncs these two systems.

Check your digital timesheets against your pay runs twice a month. This helps you catch "ghost hours" or missed shift differentials before they become a legal problem.

Correcting paychecks is vital for morale, but fixing tax and filing errors is what keeps the government away from your door.

The Compliance Shield: 4 Critical Payroll Fixes for Tax and Filing Blunders

Tax errors are the most dangerous because they invite external scrutiny. With the One Big Beautiful Bill Act (OBBBA) ending transition relief in 2026, the IRS is increasing enforcement on reporting.

Use these four payroll fixes to build a wall of protection around your business and avoid a costly payroll audit.

Fix 7: Automated Tax Table Updates

With regional tax slabs and social security thresholds shifting, like California’s $70,304 exempt salary threshold for 2026, manual entry errors are a major liability. The primary fix is tax compliance automation via cloud software.

These systems update tax tables the moment new legislation is gazetted. This ensures every tax withholding correction is accurate to the cent, especially with the 2026 Social Security wage base hitting $184,500.

Fix 8: Worker Reclassification Remediation

The 2026 focus is on preventing misclassification. If you discover a contractor should be an employee, initiate a voluntary reclassification program. This is urgent as the IRS has increased the 1099 reporting threshold to $2,000.

Failing to fix this triggers payroll penalties that often exceed $25,000 per individual plus back-taxes. Smart payroll software updates now include classification wizards to help you follow wage and hour laws.

Fix 9: The "Maker-Checker" Approval Workflow

Implement a dual-verification process for any changes to tax withholding or banking details. This payroll audit layer involves one administrator entering data (the "maker") and another approving it (the "checker").

This simple workflow eliminates 90% of manual entry errors. It also prevents unauthorized changes to retroactive pay or overpayment recovery settings, keeping your funds secure.

Fix 10: Digital Chain of Custody for Records

In 2026, "I lost the spreadsheet" is not a valid legal defense. Transition to a system that creates a permanent, digital audit trail for every change. This cloud-based payroll history provides a "Digital Chain of Custody."

It shows exactly who made an underpayment adjustment or a payroll reconciliation entry, acting as your ultimate shield during a government inspection.

Managing these technical steps alone is tough, but you can leverage modern tools to handle the heavy lifting for you.

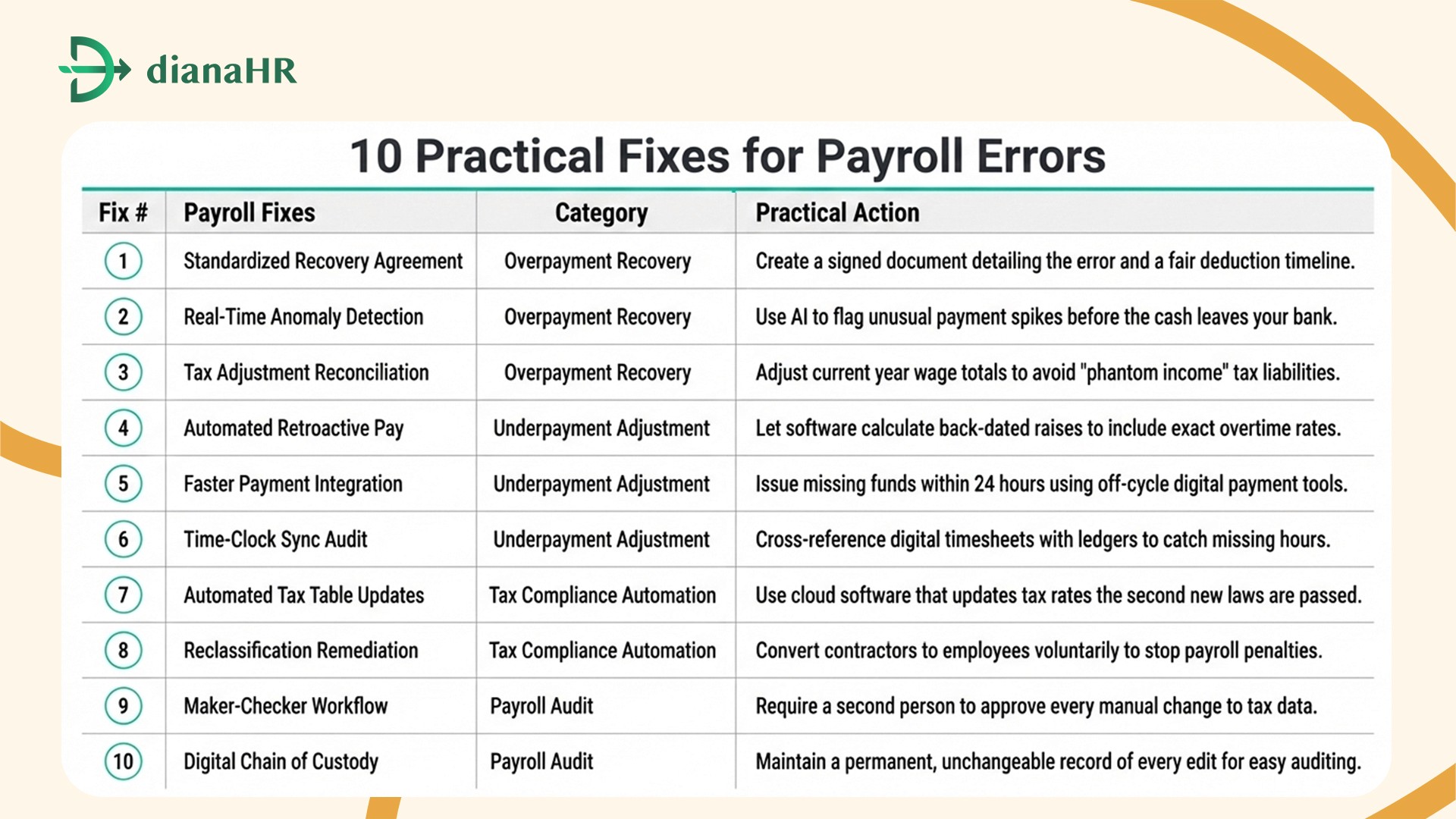

Quick Reference: 10 Essential Payroll Fixes for 2026

How DianaHR Automates Your 10 Payroll Fixes to Prevent Future Errors

Fixing payroll alone is hard. DianaHR simplifies your payroll fixes by acting as an AI-powered HR-as-a-Service platform. It cuts HR costs by 60% and saves you 15 hours every week.

Our tool integrates with Gusto, ADP, or Rippling to run a constant payroll audit on your records. You get 24/7 protection and expert support to keep your back-office running perfectly.

AI-Driven Compliance Management: Automates tax compliance automation and benefits across 40+ states.

Human-in-the-Loop Expertise: Pairs you with a dedicated HR specialist to manage complex policies.

Smart Task Automation: Eliminates manual work to stop errors before they happen.

Scalable People Operations: Ensures consistent workflows as your team grows.

Explore how DianaHR simplifies payroll fixes and helps your business scale faster at DianaHR.

Conclusion

Mastering payroll fixes in 2026 requires more than just a quick check. Ignoring overpayments leads to unrecoverable cash loss, while underpayments destroy employee trust and spark high turnover.

Even one small mistake in tax withholding correction can invite a brutal payroll audit and massive IRS penalties. These errors are not just administrative; they are financial traps that threaten your business survival.

DianaHR provides the tax compliance automation you need to stop these risks. By combining AI with human expertise, we catch manual entry errors early, ensuring your payroll remains a reliable asset instead of a legal liability.

Connect with DianaHR today and transform your back-office into a reliable, automated engine that scales alongside your business.

FAQs

1. How do I legally recover an overpayment?

Legally recovering funds requires a clear written agreement for overpayment recovery. Use payroll fixes that follow state wage and hour laws to avoid payroll penalties. Schedule deductions that keep pay above minimum wage, ensuring your payroll reconciliation remains accurate and transparent.

2. What is retroactive pay?

Retroactive pay is "catch-up" money for a back-dated raise or error. An automated underpayment adjustment ensures you pay the correct rate. Use tax compliance automation to handle the math, avoiding manual entry errors and ensuring your payroll fixes stay compliant.

3. How often should I perform a payroll audit?

Conduct a monthly payroll audit for spot-checks and a deeper payroll reconciliation every quarter. Regular reviews catch manual entry errors before they trigger payroll penalties. Using cloud-based payroll makes this process faster, ensuring your payroll fixes keep you audit-ready.

4. Can automation fix tax filing errors?

Yes. Tax compliance automation handles complex tax withholding correction tasks by updating tax tables instantly. This ensures your payroll fixes align with the 2026 Social Security base, reducing manual entry errors and preventing expensive legal scrutiny or missed filing deadlines.

5. What happens if I misclassify a worker?

Misclassification leads to severe payroll penalties, often exceeding $25,000 per individual. You must pay back-taxes and fulfill wage and hour laws. Use tax compliance automation to voluntarily reclassify staff, protecting your business from a brutal and expensive government-led payroll audit.

Share the Blog on: