One misclassified employee costs you up to $50,000 in back pay. Most small businesses have a major compliance error right now. You need to move from guessing to being ready. Using a checklist for an HR audit helps you find gaps before regulators do.

This guide gives you a framework to organize your HR compliance documentation. A clear HR compliance audit template stops $30,000 violations per worker. Use this checklist for HR audits to keep your business safe and your team happy.

You don't need to fear the government. You just need a solid plan. DianaHR provides that plan for you. We help you stay legal so you can grow. Follow this checklist for an HR audit to protect your company today.

Why an HR Audit Is Your Best Insurance Policy

Non-compliance costs companies $14.8 million on average. You avoid these fees by using a checklist for HR audits to find errors early. A regular review acts as a shield for your bank account. It also helps your team work better.

When you follow an HR audit process checklist, you fix slow onboarding and messy records. Compliance also helps you keep your best people. Employees trust you when you pay them correctly and follow the law.

Use a checklist for the HR audit to check these areas:

Smooth Operations: Find and fix blocks in your hiring flow.

Team Trust: Show your staff you value fairness and legal standards.

A checklist for an HR audit ensures your business stays healthy. You build a stronger culture by being professional. Setting up your defense is the first step, so now let’s look at how to organize the work using a clear HR audit process checklist.

The 3-Phase HR Audit Workflow

To get results, you must follow a clear HR audit process checklist. Breaking the work into stages makes it manageable.

Phase 1: Scoping

First, decide what to check. You might choose a full system review or a targeted look at high-risk areas. Many companies start with a payroll compliance verification to ensure pay is accurate.

Phase 2: The Documentation Hunt

Next, gather your files. Collect I-9s, contracts, and handbooks in one place. Using a checklist for an HR audit ensures you don't miss HR compliance documentation like signed offer letters.

Phase 3: Risk Scoring

Finally, use a "traffic light" system to rank your findings:

Red: Immediate threats like missed overtime pay.

Yellow: Issues like an outdated handbook.

Green: Small improvements for HR audit best practices.

Organizing your workflow this way keeps your HR compliance audit template effective and easy to follow. Once you have your workflow ready, you can dive into the specific items on your checklist for the HR audit.

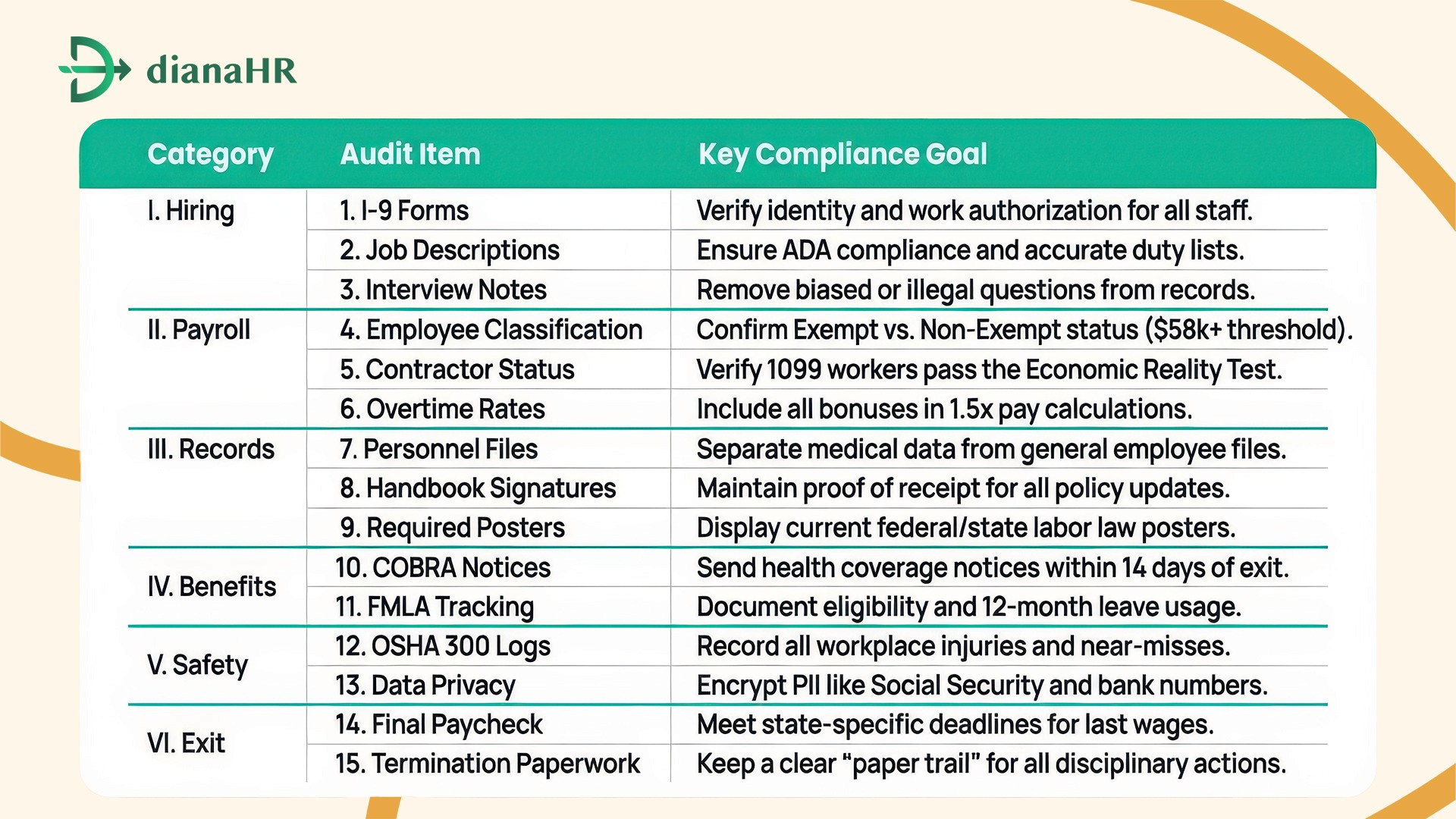

The 15-Point HR Audit Checklist

A solid checklist for an HR audit covers every stage of the employee lifecycle. You need to look at specific documents to ensure you meet labor law audit requirements. By checking these points, you turn your HR compliance audit template into a powerful tool for your business.

Let’s look at the first category to get you started.

A) Hiring & Onboarding

Your checklist for the HR audit must start with how people enter your company. Errors here often lead to discrimination claims or fines.

Focus on these three areas to maintain high HR documentation standards:

1. I-9 Verification: This is the most audited document. Ensure you use the latest version and verify documents within three days of hire.

2. Interview Notes: Audit your recruiters' notes. Ensure they only contain job-related information. This protects you against claims of bias or unfair hiring.

3. Handbook Acknowledgments: Every new hire must sign a form saying they received the employee handbook. Keep these in your employee records audit files to prove they know your rules.

Using a checklist for an HR audit for onboarding ensures every new team member starts on the right legal footing.

B) Wages, Hours & Classification

This part of your checklist for the HR audit protects your cash flow from wage-and-hour lawsuits. Payroll errors are expensive and easy for regulators to spot. You must verify that your pay practices follow current federal and state rules.

4. Exempt vs. Non-Exempt: Check that your salaried staff meet the new 2025 pay levels. If they earn less than the required amount, they must receive overtime. Misclassifying these workers is a top risk in any HR compliance audit template.

5. Contractor Audits: Review your 1099 workers. Use a payroll compliance verification to ensure they aren't actually employees based on how much control you have over their work.

6. Overtime Math: Ensure you pay 1.5x the regular rate for all hours over 40. This must include bonuses in the calculation. Use your checklist for the HR audit to confirm no one works "off-the-clock" without pay.

Correcting these pay issues keeps your business safe and fair for everyone.

C) Benefits & Leave

The next part of your checklist for the HR audit covers how you manage time off and insurance. Errors in these areas often lead to high penalties and unhappy employees.

Use your HR compliance audit template to verify you meet these federal standards:

7. COBRA & HIPAA: Check that you send health insurance notices on time. You must give departing staff clear information about continuing their coverage within 14 days. This is a vital part of HR documentation standards.

8. FMLA Tracking: Audit how you handle family and medical leave. You must track hours correctly and keep medical files separate from general personnel folders.

9. Leave Eligibility: Use an employment audit checklist to ensure you offer leave to all qualified workers. This includes checking state-specific paid leave laws, which change often.

Keeping these records organized ensures your benefits stay compliant and your staff feels supported during life changes.

D) Safety & Data Security

Safety and data are top priorities for a workplace compliance review. You must protect both the physical well-being of your team and their private information. Use your checklist for the HR audit to verify these points:

10. OSHA Logs: Check that you record all work-related injuries and illnesses. You need to post your summary form every year so employees can see it.

11. Digital Privacy: Audit how you store sensitive HR compliance documentation. This includes Social Security numbers and bank details. You should limit access to only those who need it to do their jobs.

12. Hazard Assessments: Perform regular checks of your office or job site. Documenting these checks shows you take safety seriously and follow HR documentation standards.

A thorough checklist for an HR audit ensures your data and your people stay secure. High digital standards also prevent identity theft and legal trouble.

E) Performance & Offboarding

The final part of your checklist for the HR audit covers the end of the employee lifecycle. Proper documentation here is your best defense against wrongful termination lawsuits. You must show that you treated every departing worker fairly and followed the law.

13. Progressive Discipline Records: Check your files for a clear "paper trail." Ensure every firing follows a documented process of warnings and coaching. This is a core part of an employee records audit.

14. Final Pay Compliance: Verify that your final paychecks meet state deadlines. Some states require pay immediately, while others allow it by the next payday. Use your checklist for the HR audit to confirm you never miss these dates.

15. Exit Interviews: While not always a law, documenting why people leave helps you spot trends. Store these notes safely as part of your HR compliance documentation.

Following these steps ensures that even when people leave, your business remains protected.

Common "Pitfalls": Where Most Audits Fail

Even with a checklist for HR audits, many businesses trip over new regulations. Staying updated is the only way to avoid heavy fines. Watch out for these common mistakes that often show up during a compliance gap analysis:

The Remote Work Trap: You must follow the laws of the state where your employee actually sits. If they move, your payroll taxes and insurance must move too.

The "Zombie" Handbook: Using an old template is risky. Your handbook needs updates for 2025 AI privacy laws and new paid leave rules.

Missing Signatures: A policy doesn't protect you if you can't prove the worker saw it. Use your checklist for the HR audit to find every missing signature.

AI Bias: If you use software to screen resumes, you need an annual audit to prove the tool isn't biased.

Avoiding these traps keeps your HR compliance audit template effective and your business safe. Managing these details alone is difficult, so here is how DianaHR simplifies your HR audit process checklist to keep you safe.

How DianaHR Makes Audits Effortless

DianaHR simplifies every checklist for HR audits using AI-powered automation. Small businesses save 20 hours each week and cut costs by 60% with our platform. We turn messy paperwork into a streamlined process.

Automated Compliance: We manage payroll taxes and state registrations across 40+ states to keep you safe.

Expert Guidance: You get a dedicated HR specialist to oversee your HR compliance audit template.

Easy Integration: Our system works with Gusto, ADP, and Rippling so you don't have to switch tools.

DianaHR handles the heavy lifting so you can focus on scaling your company.

Explore how DianaHR simplifies your checklist for HR audit and helps your business scale faster → DianaHR

Conclusion: Audit Today, Sleep Tomorrow

An annual checklist for HR audits is the only way to track changing laws. Most managers struggle with "zombie" handbooks and messy HR compliance documentation, leaving the business vulnerable.

One small mistake in payroll compliance verification triggers massive DOL fines and lawsuits that can bankrupt your company. Don't let a simple clerical error destroy your hard work.

DianaHR removes this risk by automating your HR audit process checklist across 40 states. Our platform identifies gaps and fixes them before regulators arrive. You get expert oversight and AI precision to ensure total safety. Stop worrying about hidden legal traps, and let DianaHR protect your future today.

FAQs

1. How often should I conduct an HR audit?

Perform a full workplace compliance review annually to keep your HR compliance audit template updated. However, conducting a quarterly payroll compliance verification and a quick employee records audit is recommended to catch documentation gaps before they lead to expensive legal penalties.

2. Internal vs. External: When should you hire a professional?

Use a professional when your business scales or enters new states with complex labor law audit requirements. While internal teams handle a basic checklist for HR audit, external experts provide an objective compliance gap analysis that identifies hidden risks and high-level audit findings remediation.

3. What is the #1 audit finding and the fix?

Missing signatures on handbooks is the top finding. Fix this by digitizing your HR documentation standards. Use an automated employment audit checklist to track receipt logs and ensure every worker signs updated policies within 48 hours to prevent serious compliance failures.

Share the Blog on: