California changed the rules for employee time off. For years, you could force workers to use two weeks of accrued vacation before they received state money. That practice ends now. On January 1, 2025, AB 2123 California went into effect.

This law stops the mandatory vacation burn. AB 2123 California works with other California employment law changes to protect worker benefits. Keeping your 2024 policies leads to expensive fines.

Update your employee handbook today with DianaHR. This guide covers paid family leave requirements, Assembly Bill 2123, and necessary PFL policy updates. We help you manage California paid family leave 2025 changes to stay compliant.

AB 2123 Explained: No More Vacation Prerequisites

The old law let you force workers to use two weeks of vacation before they got state money. Assembly Bill 2123 changes this by making PFL accessible from day one.

Now, AB 2123 in California ensures that using vacation time is an employee choice, not a mandate. You cannot make vacation a prerequisite for state benefits anymore. AB 2123 California simplifies the process for families.

Key updates include:

Mandatory "vacation burn" periods are prohibited for PFL claims.

AB 2123 California gives workers full control over their accrued leave usage.

Employers must follow new paid family leave requirements starting January 1, 2025.

PFL policy updates should focus on voluntary "topping off" options.

These California employment law changes require immediate action. Understanding these PFL changes is only half of the story, as AB 2123 California works alongside new safety protections to redefine employee rights.

The Safe Leave Expansion (AB 2499 Context)

While AB 2123 in California handles PFL, you must also prepare for AB 2499. This law expands protections for victims of a qualifying act of violence. These changes to California employment law move victim leave from the Labor Code to the Fair Employment and Housing Act (FEHA).

Now, AB 2123 California and AB 2499 create a broader safety net for your team. You must recognize these updated paid family leave requirements:

Broader Definitions: Protection now covers any act involving bodily injury, weapons, or threats, even without an arrest.

Family Protections: Employees can take leave to assist family members who are victims.

Reasonable Accommodations: You must provide safety measures like changed phone numbers or locks if requested.

Notice Mandates: You must provide a written notice of these rights to all new hires and current staff annually.

Managing violence victim leave requires a delicate touch. DianaHR provides the specific PFL policy updates and manager scripts you need to handle these sensitive situations correctly.

Compliance is moving fast, but simple system updates can prevent major legal headaches before they start.

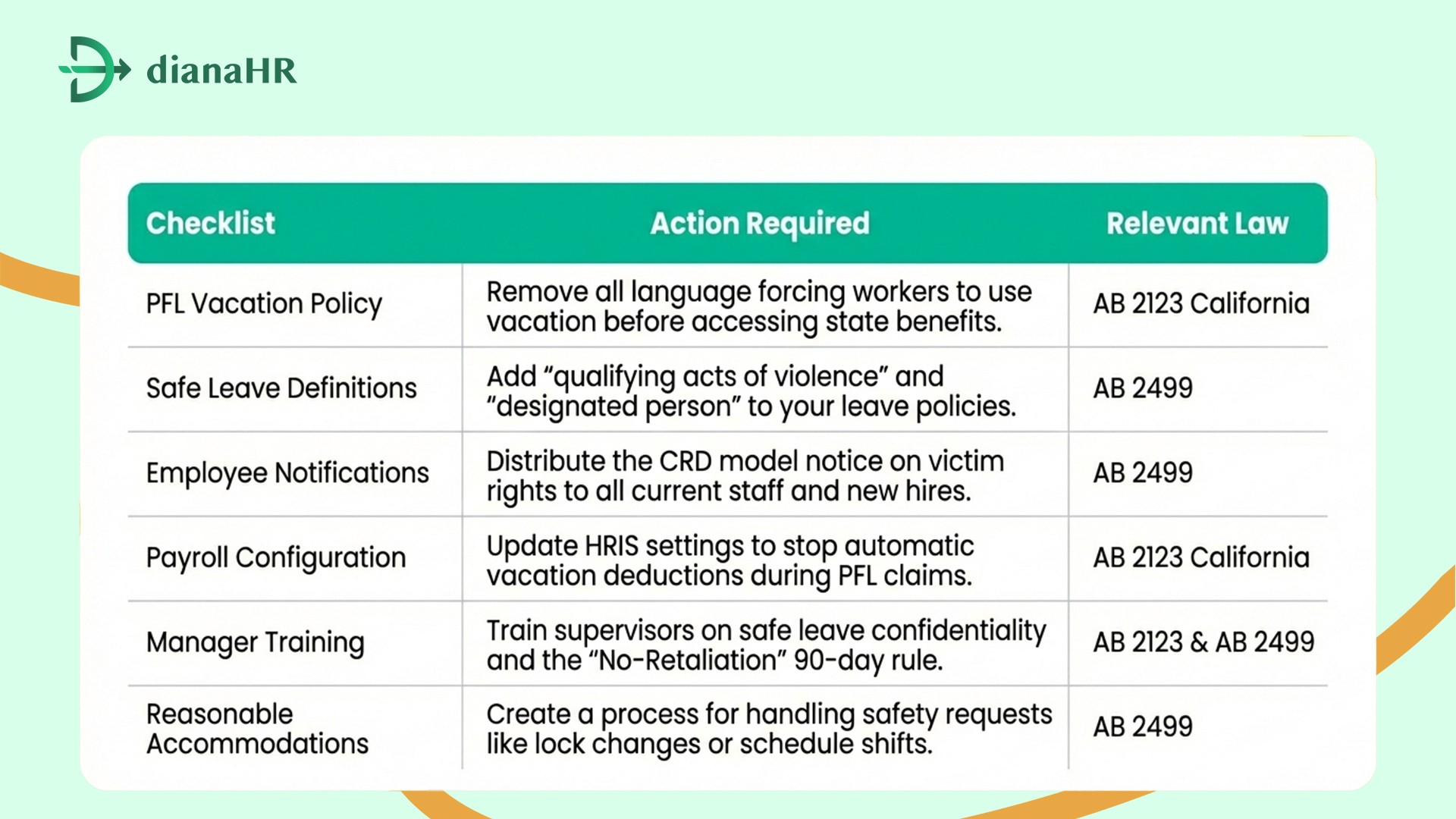

The 2025 HR Compliance Checklist

You cannot wait to update your operations. Staying compliant with AB 2123 California and related laws requires a systematic review of your current documents.

These California employment law changes are already active, so your team must act fast to avoid legal risks. Use this checklist to align your business with California paid family leave 2025 standards.

Phase #1: Policy Revisions (The Handbook Update)

Your employee handbook is the first place a regulator looks. To meet employer compliance with AB 2123, you must strip out old language that forces workers to use vacation time.

Most 2024 handbooks contain a "vacation burn" clause that is now illegal under Assembly Bill 2123. Review these specific areas:

1. Remove Vacation Prerequisites: Delete sections requiring a two-week vacation deduction before state benefits start.

2. Update Victim Leave Definitions: Include "qualifying acts of violence" to comply with sick leave expansion violence rules.

3. Redefine Family Members: Ensure your policy includes "designated persons" as per the new paid family leave requirements.

4. Distribute Notices: You must provide written notice of these new rights to all staff immediately.

This keeps your HR implementation of AB 2123 simple and accurate.

Phase #2: Payroll & HRIS Configuration

Your back-end systems must mirror your updated policies. AB 2123 in California requires you to decouple vacation accruals from state benefit claims. If your HRIS automatically triggers a two-week vacation deduction when a worker files for PFL, you are violating Assembly Bill 2123.

You must manually or digitally override these legacy settings to ensure compliance. Check these technical areas:

1. Disable Mandatory Deductions: Ensure your software does not force vacation usage for PFL applicants.

2. Enable Voluntary "Topping Off": Set up systems to allow workers to use vacation to cover the 30–40% pay gap left by state benefits.

3. Track Safe Leave Separately: Configure new pay codes for violence victim leave to distinguish it from standard sick time.

4. Audit Wage Statements: Verify that leave pay is clearly classified to meet paid family leave requirements.

This prevents automated errors from turning into legal liabilities.

Phase #3: Manager Sensitivity Training

Managers are your first line of defense against PFL policy updates going wrong. Under AB 2123 in California, a manager cannot ask an employee to use vacation before state benefits.

This requires a shift in how supervisors handle leave requests. Without proper training, a simple conversation can turn into a $30,000 liability per violation under California employment law changes. Focus on these training pillars:

1. The Non-Inquiry Rule: Train managers to accept PFL requests without pressuring workers to use PTO first.

2. Safe Leave Empathy: Under AB 2499, employees may disclose a qualifying act of violence. Managers must handle this with strict confidentiality and zero judgment.

3. The Retaliation Clock: Any negative action within 90 days of a leave request is legally presumed to be retaliation. Supervisors must document every performance issue to avoid this trap.

4. Spotting Accommodation Needs: Managers should know when a request for a "modified schedule" or "changed workstation" triggers violence victim leave protections.

DianaHR offers manager support tools that provide real-time guidance for these tough conversations. We help your leadership team understand paid family leave requirements so they remain supportive and compliant.

2025 Compliance Quick Glance:

How DianaHR Streamlines AB 2123 Compliance

Managing AB 2123, California, and California employment law is easier with an AI-powered partner. DianaHR simplifies California paid family leave 2025 by automating your policy updates and payroll tax registrations.

Our platform integrates with Gusto, ADP, and Rippling to ensure your system never forces a "vacation burn" against Assembly Bill 2123 rules.

With DianaHR, you get:

Compliance Management: Automated alerts for PFL policy updates across 40+ states.

Expert Guidance: A dedicated HR specialist to manage violence victim leave requests.

Efficiency: Save 15–20 hours per week on paid family leave requirements.

Explore how DianaHR simplifies AB 2123 California compliance and helps your business scale faster → DianaHR.

Conclusion

AB 2123 California ends the mandatory vacation deduction for state leave. Many employers struggle with these California employment law changes and outdated handbooks.

These paid family leave requirements are complex. Ignoring Assembly Bill 2123 leads to lawsuits, $30,000 fines, and back-pay penalties. This risk creates massive stress for small business owners. DianaHR is the solution for California paid family leave 2025 compliance. We automate PFL policy updates and fix payroll errors instantly.

Don't let compliance failures sink your business. Let DianaHR handle the technical work while you focus on growth. Secure your workplace today.

FAQs

1. How does AB 2123 in California change my current vacation policy?

Previously, you could mandate a two-week "vacation burn" before workers accessed state money. Under AB 2123 in California, this is illegal. You must remove mandatory deduction language to stay compliant with paid family leave requirements and Assembly Bill 2123 standards.

2. What specific notice must I give under AB 2499 and AB 2123?

You must provide a written notice regarding violence victim leave and California paid family leave 2025 rights. This notice is required for new hires, annually for all staff, and whenever an employee discloses a qualifying act of violence.

3. Can I still allow workers to "top off" PFL with vacation?

Yes. While AB 2123 in California stops mandatory deductions, workers can voluntarily use PTO to reach 100% pay. Ensure your PFL policy updates clearly distinguish between voluntary usage and illegal prerequisites to maintain wage and hour compliance.

4. What are the consequences of failing an AB 2123 audit?

Non-compliance with AB 2123 in California leads to civil litigation under FEHA. Penalties include back pay, attorney fees, and damages for retaliation. DianaHR protects you from these risks by automating employer compliance with AB 2123 and updating your digital handbook.

Share the Blog on: