Today, 40% of small businesses carry over $100,000 in debt. Large banks only approve 13% of loan applications. Average credit card interest rates now hit 25%. This makes carrying a balance impossible. You need small business debt restructuring.

Proper small business financial restructuring fixes your cash flow issues. Modern tools like Subchapter V bankruptcy help local shops stay open. This guide explores six debt restructuring options to stabilize your company.

Effective small business debt restructuring saves your bottom line. Partners like DianaHR support this business's financial recovery by streamlining your operations to save cash. Use small business debt restructuring to achieve business financial recovery and protect your assets.

What Does Small Business Debt Restructuring (SBR) Actually Mean?

Small business debt restructuring involves changing your loan terms to match your actual cash flow. It is a proactive choice to fix your balance sheet before a crisis hits. You want to align your monthly payments with what your business actually earns.

Waiting for a default makes everything more expensive. Proactive small business debt restructuring is often ten times cheaper than fighting a lawsuit. You gain more leverage when you act before a bank freezes your accounts.

Watch for these signs that you need small business financial restructuring:

Your debt-to-income ratio stays above 40%.

You have less than 30 days of cash left.

Interest payments eat most of your monthly profit.

Using debt restructuring options helps you transition from reactive stress to a plan for business financial recovery. It changes your focus from surviving the week to growing the company.

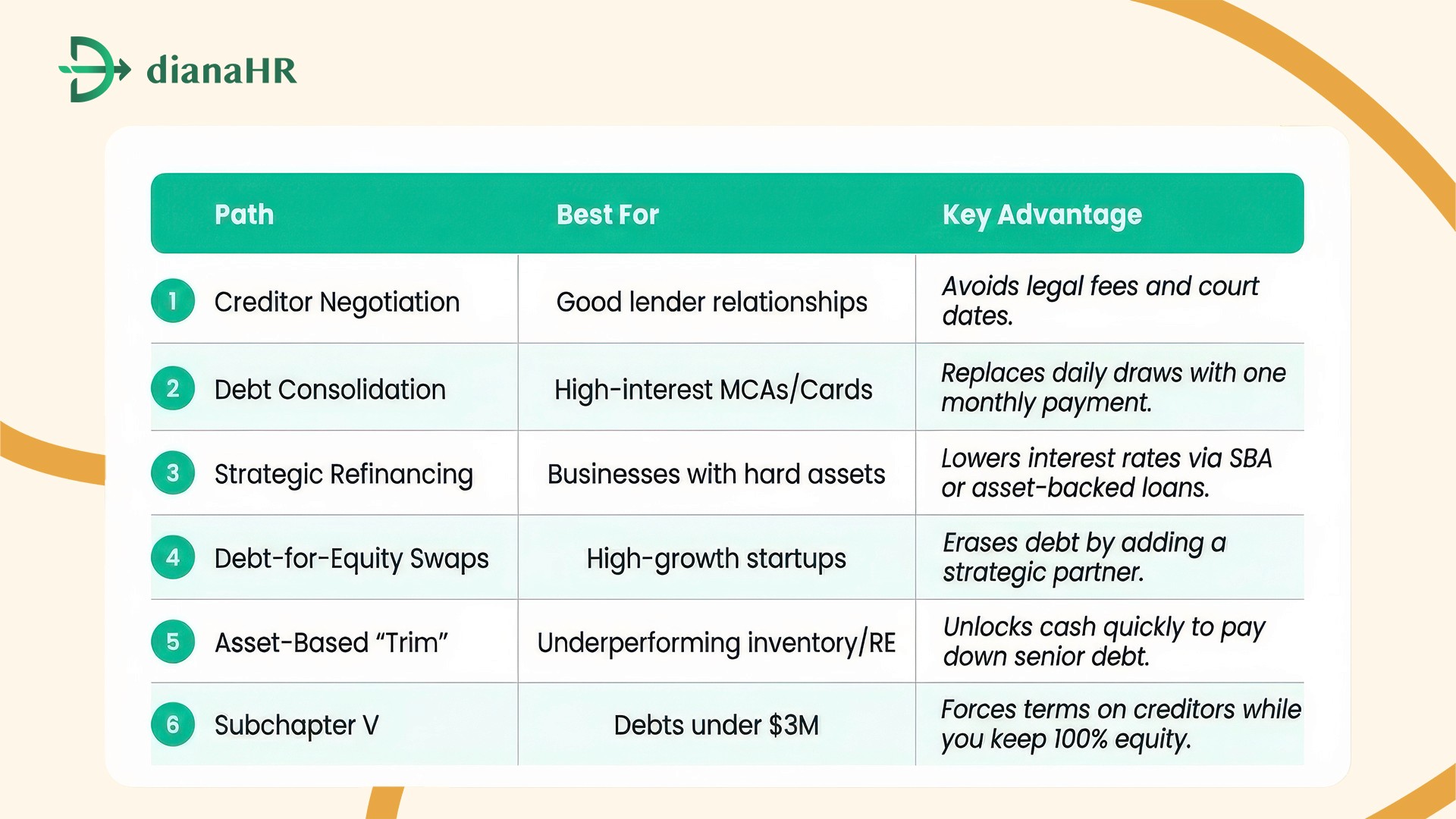

Choosing the right path makes your small business debt restructuring successful, so here are six proven debt restructuring options for your small business financial restructuring.

The 6 Paths to Financial Restructuring

Every company faces unique hurdles. Pick the specific small business debt restructuring strategy that fits your current cash flow.

These six debt restructuring options offer clear ways to handle your liabilities.

Path 1: Direct Creditor Negotiation (The "Workout"):

Talk to lenders to change terms without a judge. Banks prefer a 70% recovery over time rather than losing everything in liquidation. Use this leverage to negotiate an interest rate "haircut" or a payment pause.

At a Glance: 6 Paths to Small Business Debt Restructuring

This small business financial restructuring move keeps you operational. Secure a 120-day forbearance or stretch loan lengths to lower monthly bills.

Path 2: Debt Consolidation & Installment Transition:

Fold high-interest credit cards and merchant cash advances into one loan. This small business debt restructuring strategy replaces daily withdrawals with one predictable payment.

Fintech firms provide these debt restructuring options based on your revenue. Consolidating high-cost debt protects your daily operations and speeds up your business's financial recovery.

Path 3: Strategic Debt Refinancing:

Replace expensive old debt with a lower-interest loan. Use company assets like real estate or machinery as leverage to secure better terms. This small business financial restructuring path works best with a 12-month track record of stable earnings.

Use SBA 7(a) or 504 programs to drop rates and add direct profit to your bottom line.

Path 4: Debt-for-Equity Swaps:

Trade a portion of ownership to cancel debts. This small business debt restructuring choice works well for businesses with high debt but no cash. Your creditor becomes a partner invested in your growth.

It removes the pressure of monthly interest and helps you achieve business financial recovery while preserving cash for hiring.

Path 5: Asset-Based Restructuring (The "Trim"):

Sell underperforming assets to pay down expensive loans. Offload extra equipment or inventory to clear senior debt. A sale-leaseback is a smart small business financial restructuring tactic where you sell your building but rent it back.

These debt restructuring options turn idle assets into active relief and remove unproductive weight from your balance sheet.

Path 6: Subchapter V (Small Business Reorganization):

This is a faster, cheaper version of Chapter 11 for debts under $3,024,725. You stay in control while a trustee helps create a repayment plan. This small business debt restructuring option forces stubborn creditors to accept new terms.

It ensures business financial recovery happens under court protection while you keep 100% of your equity. Once you select your preferred debt restructuring options, you need a clear plan to execute your small business debt restructuring.

This roadmap provides the exact steps for your small business financial restructuring success.

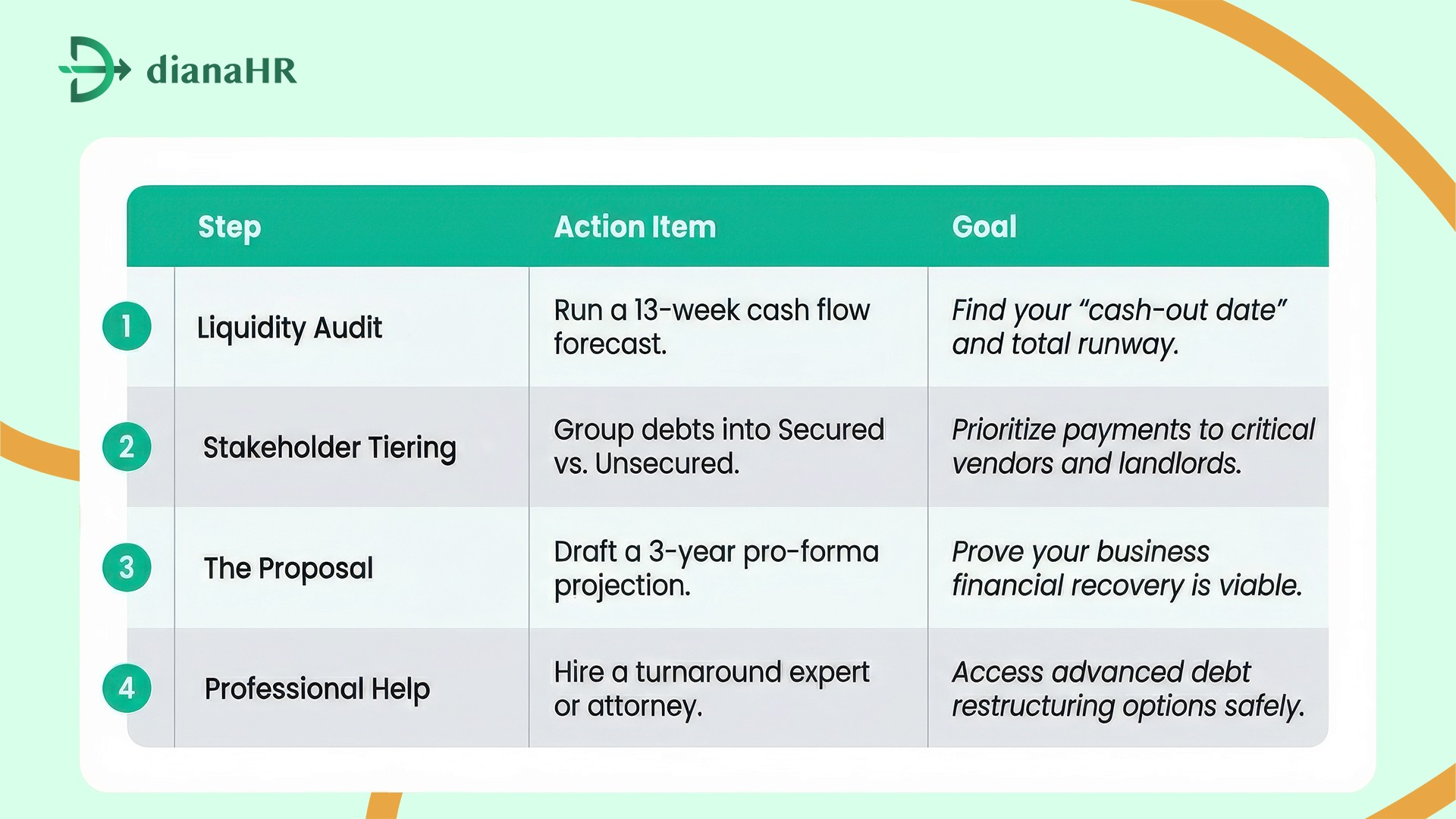

The 2026 Implementation Roadmap

Executing a small business debt restructuring plan requires a disciplined approach. You must follow a clear sequence to ensure your business financial recovery stays on track.

Step 1: Liquidity Audit. Determine exactly how many days of cash you have left. Use your accounting software to find your "cash-out date," where your reserves hit zero.

Step 2: Stakeholder Tiering. Rank your creditors. Prioritize "critical" secured lenders like your landlord before dealing with unsecured credit card companies.

Step 3: The Proposal. Create a three-year financial projection. You must prove to lenders that small business financial restructuring makes your company viable again.

Step 4: Professional Oversight. Hire a turnaround consultant or attorney. They help you avoid legal traps and negotiate better debt restructuring options.

This roadmap simplifies the small business debt restructuring process. It gives you the structure needed to protect your assets and employees. By following these steps, you build a stronger foundation for business financial recovery.

At a Glance: 2026 Implementation Roadmap

How DianaHR Supports Restructuring Businesses

Efficiency is everything during small business debt restructuring. DianaHR helps you achieve business financial recovery by cutting HR costs by up to 60%.

Our platform automates repetitive admin work, saving you 15–20 hours per week to focus on your small business financial restructuring plan.

Compliance Management: Maintain legal safety across 40+ states while adjusting your workforce.

Smart Automation: Reduce manual workloads so your team focuses on growth, not paperwork.

Expert Guidance: Work with a dedicated specialist to handle sensitive policy changes during your small business debt restructuring.

DianaHR simplifies your operations so you can scale faster.

Conclusion

Small business debt restructuring is a tool for survival. However, many owners ignore the warning signs of high interest and low reserves. Delaying your small business financial restructuring leads to aggressive lawsuits, frozen bank accounts, and total asset seizure.

If you wait until a bank levy occurs, you lose 80% of your debt restructuring options. This financial collapse ruins your credit and forces permanent closure. Avoid this disaster by acting while you still have control.

DianaHR helps you secure a business financial recovery by stripping away operational waste. Our platform slashes overhead costs and automates compliance, freeing up the cash you need to settle debts.

Start your small business debt restructuring today with DianaHR to protect your company's future.

FAQs

1. How much does a typical restructuring cost?

Out-of-court small business financial restructuring costs $15k–$40k. However, Subchapter V bankruptcy fees often exceed $60k. Investing in these debt restructuring options protects your assets from total loss. Proactive small business debt restructuring saves money by avoiding expensive, reactive litigation.

2. Will restructuring ruin my business credit?

You will see a temporary dip, but successful small business debt restructuring is better than default. It proves you chose business financial recovery over failure. Most owners regain credit health faster by using structured debt restructuring options than through liquidation.

3. What is the "New Value Rule" in Subchapter V?

This rule allows owners to keep 100% equity without injecting fresh cash. It is a powerful part of small business debt restructuring. By committing future income to business financial recovery, you satisfy creditors while maintaining control of your company.

4. How do I handle Merchant Cash Advances (MCAs)?

MCAs are high-risk, but small business debt restructuring can lower their impact. You can negotiate a "reverse consolidation" or use legal recharacterization. These debt restructuring options turn daily drains into manageable payments to support your business's financial recovery.

Share the Blog on: