You want to start a company. Over 5 million people start businesses every year. Many fail within months because they ignore "compliance debt." Learning how to register a business involves legal steps beyond choosing a name.

It requires following business registration requirements by state and meeting federal deadlines. For instance, the Corporate Transparency Act (FinCEN) now requires a report within 30 days of formation. If you miss this, you face $500 daily fines.

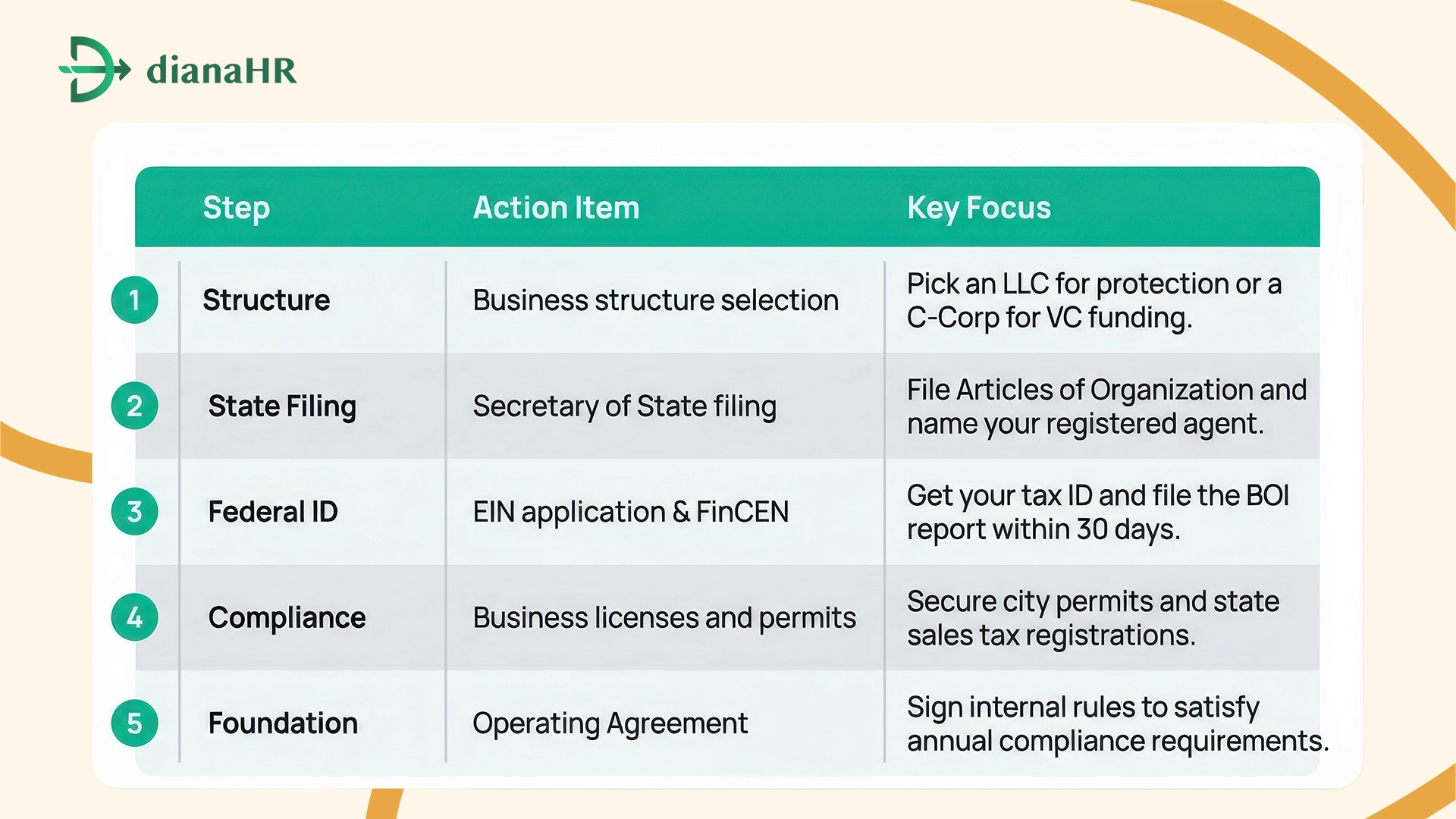

This guide shows you how to register a business in five steps. We make it easy to understand how to register your business so you can focus on growth. You need to know how to register a business to protect your future.

Step 1: Choosing Your "Legal Shield" (Business Structure)

Your first task involves business structure selection. This choice defines your personal liability and tax obligations. Most owners choose an LLC formation process because it protects personal assets.

This "legal shield" keeps your house and savings safe if the company faces a lawsuit. Learning how to register a business requires picking the right entity first.

Common choices include:

LLC: Ideal for most startups. It offers protection without complex rules.

S-Corp: A tax status for LLCs making over $60k in profit.

C-Corp: Best if you want venture capital or an IPO.

Knowing how to register a business starts here. Different business registration requirements by state apply, but the structure remains the foundation. Once you pick, you can move toward your EIN application. Understanding how to register your business ensures you avoid paying unnecessary self-employment taxes. Follow these steps to learn how to register a business effectively.

Step 2: The State Filing (Articles of Organization)

To establish your company, you must submit Articles of Organization to the government. This Secretary of State filing legally creates your entity. Most founders file in their home state to avoid double fees.

A critical part of how to register a business is the business name registration. Check the state database and trademark records to ensure your name remains unique.

Follow these business registration requirements by state:

Pick a Registered Agent: You need a physical address for legal papers. Professional registered agent requirements protect your privacy.

Pay Fees: Costs range from $35 to over $500.

File Online: Most states offer instant approval portals in 2026.

Knowing how to register a business involves getting these details right. When you understand how to register your business, you avoid legal delays. Learn how to register a business correctly to stay in good standing with the state.

Step 3: Federal Identity (EIN & FinCEN)

After state filing, you need a federal identity. Start with an EIN application on the IRS website. This free number acts like a Social Security number for your company. It remains a mandatory part of how to register a business.

You need it to open a bank account and hire staff. Next, handle the FinCEN Beneficial Ownership Information (BOI) report.

The Deadline: You have 30 days after formation to finish.

The Goal: You must disclose who really runs the company.

The Risk: Missing this step of how to register a business leads to $500 daily fines.

Know that how to register your business includes these federal tasks. Business registration requirements by state mostly focus on local rules, but federal steps apply to everyone. Finish your business name registration, and then grab your tax ID to learn how to register a business.

Step 4: Local Compliance (Licenses & Permits)

Local permission is your next milestone. After finishing your state registration documents, you need city-level approval. Every town has different business license and permit rules.

This is a vital part of how to register a business correctly. You should contact your city hall or county clerk immediately to check zoning laws.

Common requirements include:

General License: Required by most cities to operate legally.

Professional License: Needed for hair salons, doctors, or plumbers.

Sales Tax Permit: Essential if you sell physical goods.

Meeting business registration requirements by state covers the big picture, but local permits keep you open. When you learn how to register a business, don't ignore these local rules. Knowing how to register your business at every level prevents sudden shutdowns. Finish these local tasks to complete how to register a business successfully.

Step 5: Setting the Foundation (Operating Agreement)

Once your Articles of Organization are filed, you need an Operating Agreement. This internal document remains the backbone of your "legal shield." Even if you are a solo founder, having this contract is part of how to register a business with a solid foundation. It proves the company is a separate entity. This prevents a legal crisis.

To protect yourself, follow these annual compliance requirements:

Draft the Agreement: Outline who owns the company and how you make decisions.

Open a Business Bank Account: Use your EIN to keep every dollar separate.

Follow Formalities: Document major decisions to satisfy business registration requirements by state.

Knowing how to register a business means more than just filing papers. You must learn how to register your business and then run it properly. Use this document to define your rules and keep your personal assets safe. Learning how to register a business correctly today prevents massive headaches tomorrow.

US Business Registration Quick Guide (2026)

How DianaHR Protects Your New Business

DianaHR is an AI-powered HR platform that simplifies business registration for small teams. It automates your annual compliance requirements and handles filings across 40+ states. By combining smart tech with HR experts, it reduces your workload and saves 15+ hours weekly on how to register your business tasks.

AI Compliance: Automates payroll taxes and state registration documents.

Expert Support: You get a dedicated specialist to register business policies.

Easy Integration: Works with Gusto and ADP to streamline HR operations.

Explore how DianaHR simplifies how to register a business and helps your business scale faster → DianaHR

Conclusion: Start Clean to Grow Fast

Learning how to register a business is a foundational step for every founder. It is a one-time task that prevents legal issues later. In 2026, the speed of commerce requires you to get your state registration documents right the first time. Following the correct business registration requirements by state ensures your company acts as a "legal shield" rather than a liability.

Once you master how to register a business, DianaHR simplifies your annual compliance requirements. We handle state registrations as you scale so you can focus on your vision.

Let's connect with DianaHR and automate your annual compliance requirements so you can focus on scaling your vision without the paperwork.

FAQs

1. Is a home-state Secretary of State filing always the best option?

Yes. For most, a local Secretary of State filing avoids double fees. While some choose Delaware, home-state Articles of Organization simplify your business registration requirements by state. This ensures your business name registration remains valid without paying extra out-of-state "foreign qualification" costs.

2. What federal documents are required after my LLC formation process?

Once you finish the LLC formation process, submit your EIN application to the IRS immediately. Afterward, you must file your Beneficial Ownership Information report with FinCEN. This step is a vital part of how to register a business to avoid penalties.

3. How do local business licenses and permits differ from state registration?

Your state registration documents create the legal entity, but local business licenses and permits grant the right to operate. Learning how to register your business means checking city zoning laws and professional requirements to ensure you stay fully compliant everywhere.

4. How do I avoid fines for missing annual compliance requirements?

Maintaining your "legal shield" requires meeting all annual compliance requirements and registered agent requirements. Missing these deadlines leads to dissolution. DianaHR automates these workflows, handling how to register business tasks so you never face expensive government fines or shutdowns.

Share the Blog on: