A tiny typo on a paycheck costs your business thousands. Data shows 53% of companies face penalties for payroll errors lately. You lose 5% of your labor budget to leakage. Fixing one overtime miscalculation costs $300 on average.

Your automated payroll system must work perfectly because many workers quit after one mistake. Avoid common payroll errors to protect your cash.

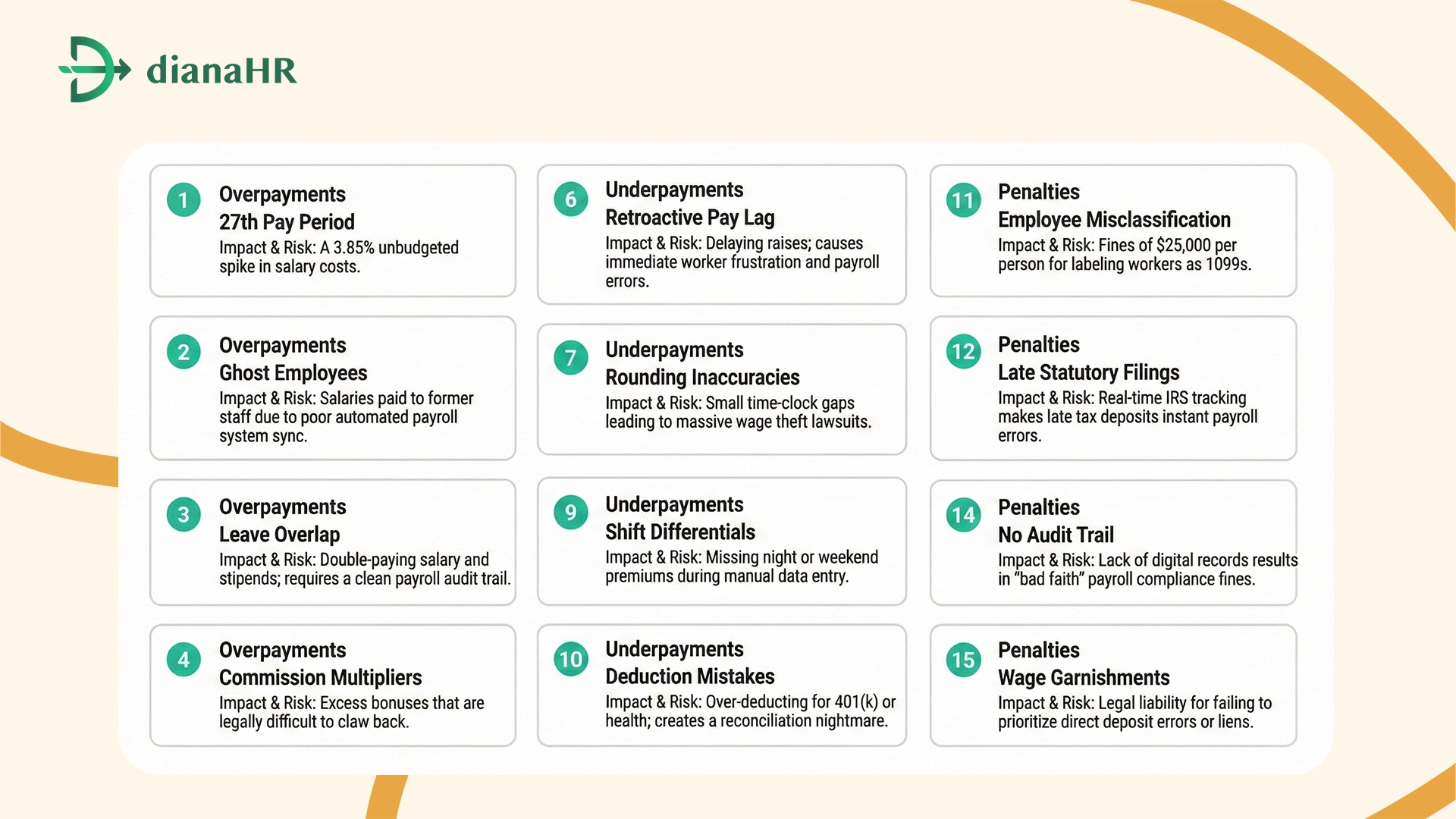

This guide helps you spot 15 mistakes that cause overpayments and high fines. Start protecting your bottom line today.

The Invisible Leak: 5 Payroll Errors Triggering Overpayments

You might think overpaying staff is a rare gift, but it drains your bank account and creates massive tax headaches. Most payroll errors happen when your checks and balances fail. If you don't maintain payroll compliance, you lose money fast.

Here are five ways payroll errors lead to cash leaks.

1. The "27th Pay Period" Calendar Anomaly: Most systems assume a standard 26-week cycle. However, 2026 presents a calendar quirk where bi-weekly pay dates fall on both the first and last day of the year. If you don't adjust your math, you will trigger payroll errors and pay an extra 3.85% in annual salaries by accident. Your automated payroll system needs a "divide-by-27" rule to stay accurate.

2. Ghost Employees and "Shadow" Onboarding: People who leave the company sometimes stay on the digital ledger. Without a sharp automated payroll system, you might send checks to people who no longer work for you. These "phantom" salaries often hide in large departments until a deep payroll audit trail reveals the truth.

3. Overlapping Leave and Double-Dipping: Managers often struggle to track when a worker moves from parental leave to standard PTO. When data doesn't sync, you might pay a full salary plus a benefit stipend at the same time. This lack of payroll compliance causes thousands in losses due to direct deposit errors.

4. Miscalculated Commission Multipliers: Sales teams often have complex bonus structures. If you fail to update a "draw-against-commission" rate, you might send out too much money. Once paid, it is legally difficult to claw back these payroll errors.

5. The Fringe Benefit Tax Oversight: Perks like gym memberships or transit passes carry a cash value. If you don't track the fringe benefit tax, you end up overpaying the gross-up amount on taxes. These payroll errors bleed your budget dry without you even noticing.

Stop these leaks now before they sink your ROI. Next, we look at the opposite problem: how payroll errors can actually rob your employees of their hard-earned money.

The Talent Killer: 5 Underpayment Flaws in Your Automated Payroll System

Underpaying your team destroys trust faster than anything else. When payroll errors hit a worker's pocket, they start looking for a new job.

An automated payroll system should prevent these slips, but poor setup still leads to disaster. Watch out for these five flaws that cause payroll errors and hurt your staff.

6. The Retroactive Pay Lag: Promotions often happen in the middle of a month. If your automated payroll system isn't set for effective-dating, the worker misses out on their new rate. This retroactive pay delay feels like a broken promise. It leads to payroll errors that frustrate your best talent immediately.

7. Rounded Time-Clock Inaccuracies: Many managers round hours to the nearest 15 minutes to save time. In 2026, this is a dangerous game. Even a five-minute gap every day adds up to wage theft claims. You must ensure your payroll compliance standards account for every second worked to avoid lawsuits.

8. Misaligned Shift Differentials: Night shifts and weekend work usually pay more. These premiums often vanish during manual data entry when moving info between apps. These payroll errors mean your hardest workers take home less than they earned.

9. Incorrect Benefit Deductions: Taking too much for healthcare or retirement plans is a huge mess. These deduction mistakes lower an employee's take-home pay and create a mountain of paperwork for you to fix later. Keeping your automated payroll system updated with 2026 contribution limits is vital for payroll compliance.

10. Tax Jurisdiction "Drift": With remote work, people move states without telling HR. If you use the wrong tax withholding rules, your employee gets a massive bill from the IRS at the end of the year. These payroll errors ruin lives and lead to high staff turnover.

Fixing these underpayments keeps your team happy and focused. Next, we examine the legal traps that trigger massive government audits and fines.

The Audit Nightmare: 5 Traps Threatening Payroll Compliance

Ignoring laws leads to massive fines and federal scrutiny. You might think your records are fine, but payroll compliance requires constant vigilance. One small slip triggers payroll errors that invite auditors to your door.

Avoid these five traps to keep your business safe from government penalties and costly payroll errors.

11. The "Contractor Cloak" Misclassification: Labeling a full-time worker as a contractor saves money on benefits, but it is illegal. In 2026, employee misclassification penalties reach $25,000 per person. Federal agencies use AI to spot these payroll errors faster than ever. If you treat a freelancer like an employee, you face a huge audit.

12. Late Statutory Filings and "Deposit Borrowing": Never "borrow" from tax deposits when cash is tight. The IRS now validates data in real-time, making late filings instantly visible. These payroll errors lead to automatic fines. Your automated payroll system must handle these deadlines without delay to ensure payroll compliance.

13. Failure to Maintain a Digital Audit Trail: Paper records no longer satisfy modern auditors. You need a verifiable payroll audit trail for every change made to staff data. If you cannot prove who changed a pay rate, you lose the benefit of the doubt. Digital proof helps you avoid many payroll errors.

14. Ignoring State-Specific "Final Pay" Laws: Many states now require a final check within 48 hours of an employee leaving. If you rely on manual data entry that takes two weeks, you violate the law. These payroll errors trigger daily penalties that double the amount you owe.

15. Non-Compliant Wage Garnishments: Handling child support and tax liens is tricky. If you mess up the priority of court orders, you become liable for the unpaid debt. A strong automated payroll system manages these limits correctly. This stops the payroll errors that lead to expensive legal disputes with state agencies.

Protecting your business means staying ahead of these legal traps. Next, learn how the right tools can simplify this complex work for you.

2026 Snapshot: 15 Critical Payroll Errors & Their Risks

How DianaHR Helps You Maintain Zero-Error Payroll Compliance

Managing fifteen types of payroll errors manually is a recipe for disaster. DianaHR acts as your compliance co-pilot, integrating with your automated payroll system to stop leaks.

By combining AI with human experts, we ensure payroll compliance across 40+ states while saving you 20 hours weekly.

Special Capabilities:

AI-Driven Compliance: Automates taxes and benefits to prevent payroll errors in multi-state operations.

Human Expertise: You get a dedicated specialist to handle onboarding and complex payroll compliance tasks.

Seamless Sync: Works with Gusto, ADP, or Rippling to fix manual data entry issues without switching tools.

Smart Automation: Cuts admin workloads by 60%, reducing the risk of deduction mistakes.

Explore how DianaHR simplifies your workflows today.

Conclusion

Payroll errors are not just simple math mistakes; they are significant financial liabilities. From overtime miscalculation to deduction mistakes, the pain points of inaccurate pay cycles drain your bottom line and ruin employee trust.

If you fail to maintain payroll compliance, the consequences are severe. Federal audits, class-action lawsuits for wage theft, and "Error Tax" fees can bankrupt a growing business. These payroll errors create a culture of fear and high turnover. You cannot afford to wait for a disaster.

DianaHR provides the automated payroll system support you need to catch anomalies before they happen. Our platform ensures your payroll audit trail stays perfect, protecting your capital and your team from preventable financial ruin.

Let's connect with DianaHR and protect your business from payroll errors while ensuring total payroll compliance for your growing team.

FAQs

1. What is the "27th pay period" error?

The 2026 calendar creates an extra bi-weekly payday, triggering payroll errors that cause unbudgeted salary overpayments. Without an automated payroll system to recalibrate annual math, you fail payroll compliance and lose 3.85% of your labor budget to this "silent" leak.

2. Can an employer legally claw back an overpayment?

Yes, but you must avoid direct deposit errors during the fix. Most states allow recovery of payroll errors, provided you follow strict payroll compliance rules. Use a digital payroll audit trail to document the mistake before adjusting future employee paychecks.

3. What is the penalty for misclassifying an employee?

Employee misclassification is a major trap. In 2026, the IRS tracks payroll errors in real-time, with fines reaching $25,000 per worker. Failing to maintain payroll compliance also forces you to pay back-taxes, unpaid overtime, and steep legal settlement fees.

4. How does automation prevent underpayments?

An automated payroll system eliminates manual data entry slips like overtime miscalculation or deduction mistakes. By syncing time-tracking directly, you ensure payroll compliance and prevent wage theft claims, keeping your workers happy and your payroll audit trail perfectly clean.

5. Is an audit trail mandatory in 2026?

Absolutely. To ensure payroll compliance, you must have a verifiable digital history of all changes. Without a clear payroll audit trail, your business cannot defend against payroll errors or government inspections. Modern systems make this record-keeping automatic and instant.

Share the Blog on: