Hidden payroll errors drain money and time. Studies show each correction costs about 291 dollars. You sit fixing problems instead of growing revenue. Remote work tax rules make it harder. That’s why many small businesses now look for the best payroll service for small company needs.

More than half of owners use payroll outsourcing companies to reduce stress. The right tool handles tax filing, direct deposit, employee self-service and deductions without spreadsheets. You get reliable payments and fewer surprises.

This guide helps you pick a small business payroll solution that protects cash flow and keeps you focused on customers, not paperwork.

Top 5 Payroll Service Companies (By Use Case)

You want the best payroll service for small company needs, not a generic tool. Each option below solves a specific problem. I’ll give you one company at a time so you can review features, pricing notes, and fit.

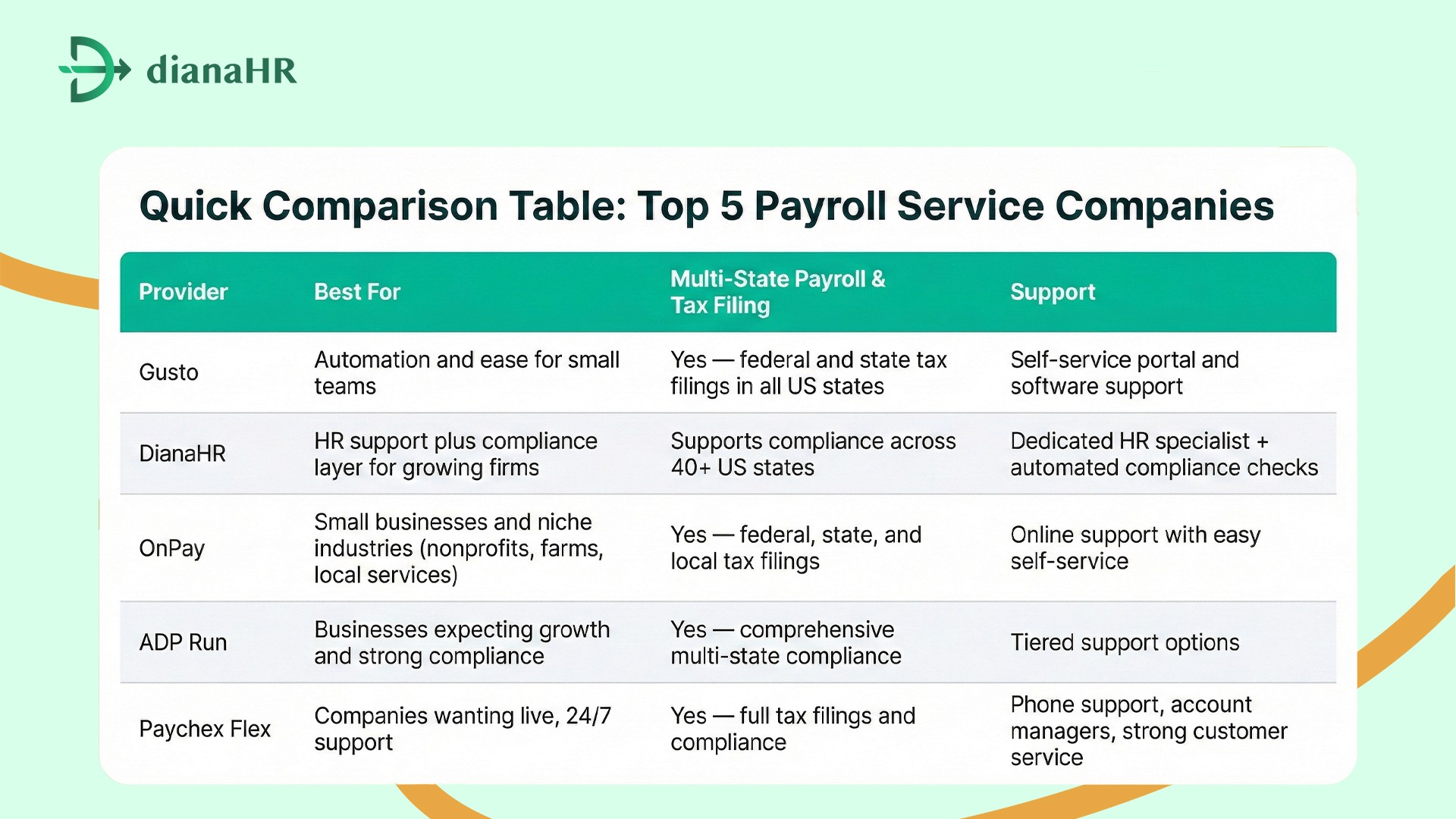

Quick Comparison Table: Top 5 Payroll Service Companies

These tools reduce admin tasks, avoid tax mistakes, and keep payroll moving without drama.

1. Gusto

Gusto makes payroll simple for small teams. It offers automated tax filing, direct deposit, and employee self-service tools that cut manual work. Many owners call it the best payroll service for small company needs because setup is quick and pricing is easy to understand. It keeps payroll accurate and steady.

Key Features:

Automated payroll processing with direct deposit

Time and attendance sync

Benefits administration and workers' compensation support

Clear deductions management

Services Offered: Payroll processing, tax filing, contractor payments, employee self-service, HRIS integration, compliance monitoring, mobile app access

Best For: Owners who want automation without extra admin effort.

Client Reviews: 4.7/5 Stars

2. DianaHR

DianaHR cuts HR costs by up to 60% and saves 15 to 20 hours each week through hands-on payroll support. It maintains compliance across 40+ U.S. states and acts as the best payroll service for small company workflows that involve multi-state hiring, tax notices, and messy deductions.

Key Features:

AI-based payroll audits

Real-time risk alerts on errors

Specialist support for state tax setup

Tax notice investigation and response

Services Offered: Payroll support, compliance monitoring, direct deposit setup, contractor payments, time and attendance validation, deductions management, benefits administration, workers' compensation guidance

Best For: Founders who need expert help with complex payroll and compliance tasks.

Client Reviews: 4.8/5 Stars

3. OnPay

OnPay works well for small teams that want simple pricing and reliable service. It ranks high for the best payroll service for small company needs in farming, nonprofits, and local shops. Many payroll outsourcing companies miss niche tax rules, but OnPay handles contractor payments, tax filing, and deduction management with ease.

Key Features:

Automatic tax filing

Clear pricing with no hidden fees

Support for niche industry forms

Fast setup for employee self-service

Services Offered: Payroll processing, compliance monitoring, direct deposit, contractor payments, time and attendance tracking, employee self-service, benefits administration, workers' compensation, deductions management

Best For: Small companies that need strong support for specialized filings and niche industries.

Client Reviews: 4.6/5 Stars

4. ADP Run

ADP Run delivers steady payroll support for growing teams. Many owners pick it as the best payroll service for small company growth plans because it handles complex deduction management, retirement plans, and multi-state tax filing with confidence. It competes with leading payroll outsourcing companies and offers strong security for payroll data.

Key Features:

Automatic payroll runs

Full-service tax filing

Secure employee records with employee self-service

Services Offered: Payroll processing, compliance monitoring, direct deposit, contractor payments, time and attendance tracking, HRIS data sync, employee self-service, benefits administration, workers' compensation

Best For: Teams planning to scale and add new payroll features over time.

Client Reviews: 4.5/5 Stars

5. Paychex Flex

Paychex Flex supports owners who want real help and clear answers. Many choose it as the best payroll service for small company needs because it offers 24/7 support, easy direct deposit, and clean tax filing tools. It stands next to other payroll outsourcing companies with strong service and reliable employee self-service features.

Key Features:

Round-the-clock phone support

Quick payroll setup and runs

Secure document access

Built-in alerts for compliance issues

Services Offered: Payroll processing, compliance monitoring, direct deposit, contractor payments, time and attendance tracking, employee self-service, benefits administration, workers' compensation, deductions management

Best For: Owners who want human support instead of chat-only help.

Client Reviews: 4.6/5 Stars

How DianaHR Adds the Service Layer Your HR Tech Stack Is Missing

DianaHR is an AI-powered HR-as-a-service platform built to simplify the best payroll service for small company needs for growing teams in technology, healthcare, nonprofits, retail, and professional services.

By mixing automation with expert support, DianaHR reduces HR costs by up to 60 percent and saves 15 to 20 hours each week. It helps founders remove repetitive admin work, maintain compliance across 40-plus US states, and focus on growth without dealing with payroll outsourcing companies or confusing paperwork.

Special Features:

AI-driven compliance checks for tax filing, benefits, and registrations in multi-state payroll operations

Dedicated HR specialist for onboarding, policy setup, and repeat payroll tasks

Works with Gusto, ADP, and other top systems without changing tools

Smart automations that reduce manual hours and improve deductions management

Scalable service for startups hiring in different states

These capabilities turn payroll from a slow back-office task into a streamlined, reliable process backed by AI and real HR experts.

Book a quick call with DianaHR and remove payroll tasks from your week.

Conclusion

Payroll service works best when payments run clean, tax filing happens on time, and records stay accurate. Trouble starts with messy spreadsheets, missed deduction management, late contractor payments, and outdated time and attendance data.

Errors waste money and break trust with employees. Notices from agencies, delayed deposits, and back-and-forth support tickets add even more stress.

DianaHR improves daily operations with automation and expert help, making it the best payroll service for small company teams. We monitor data before each run, support multi-state compliance, and give fast access to employee self-service.

Switch to DianaHR and make payroll simple every week. Let’s connect today.

FAQ

1. How much does the best payroll service for a small company cost?

Most payroll outsourcing companies charge a base fee plus a per-employee amount. Typical plans for the best payroll service for small company needs range from 40 to 75 dollars per month with direct deposit, tax filing, and deductions management included.

2. Do these services handle contractor payments?

Yes. Leading providers manage contractor payments, employee self-service, and year-end forms. This keeps 1099 records clean and makes the best payroll service for small company teams confident about payments and tax filing for contractors in any state.

3. Can I switch payroll providers midyear?

Mid-year transfers are common. Good providers move time and attendance data, direct deposit details, and deduction management records to keep the best payroll service for small company payroll cycles consistent without delays in tax filing or payments.

4. What is the difference between payroll services and PEO?

Payroll services handle pay runs, tax filing, and employee self-service. A PEO takes on HR duties like benefits and workers' compensation. Small teams often start with the best payroll service for small company solutions and add PEO support later if needed.

5. Do payroll services support benefits administration?

Yes, most providers include benefits administration, deductions management, and time and attendance syncing. This helps the best payroll service for small company users keep health plans, PTO, and direct deposit records accurate without juggling different tools or payroll outsourcing companies.

6. Can payroll services help with multi-state compliance?

Many tools support tax filing in multiple states and include employee self-service features for remote workers. The best payroll service for small company solutions tracks registrations, updates contractor payments, and manages state rules so payroll stays clean across locations.

Share the Blog on: