Managing employee benefits internally drains your productivity. You chase enrollment forms, reconcile invoices, and fix carrier errors. This manual work steals hours you should spend on strategy.

That is why smart leaders turn to benefits administration outsourcing. Small teams actually see 150% ROI when they replace internal hires with a partner.

The right benefits administration companies combine health insurance management tech with human support. Effective benefits administration outsourcing reduces manual work and keeps costs predictable.

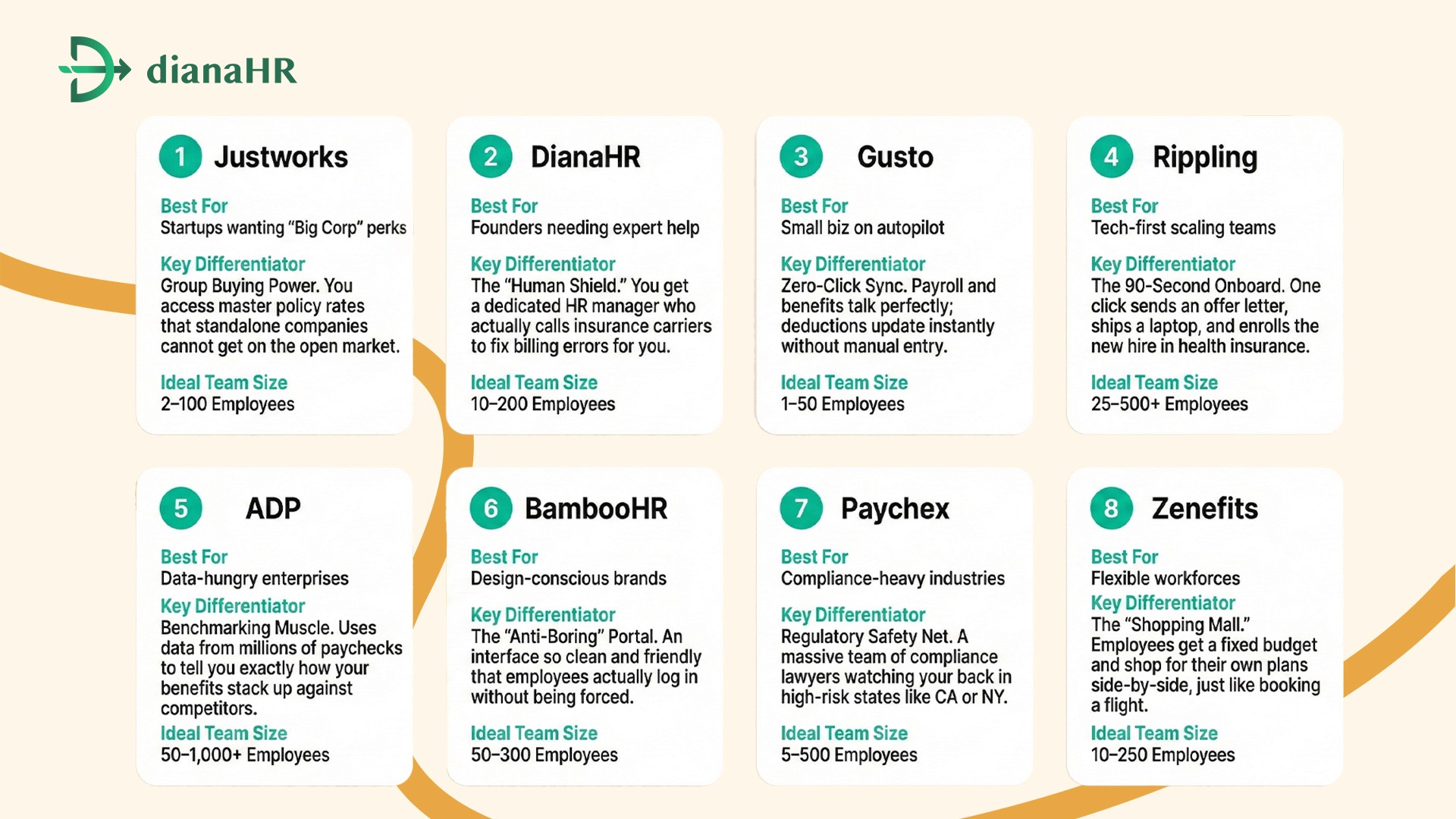

Top 8 Benefits Administration Companies

We analyzed the market to find reliable partners for your business. These top benefits administration companies combine strong open enrollment support with easy-to-use software. Here are the best options for 2025.

1. Justworks

Justworks is a PEO that bundles payroll, compliance, and benefits. It simplifies outsourced benefits management for small businesses by handling everything from carrier negotiation to tax filings in one centralized hub.

Key features:

Access to large-group medical, dental, and vision rates.

Automated compliance monitoring for state and federal laws.

24/7 human support for health insurance management.

Simple employee self-service portal for easy access.

Best for: Small businesses and startups needing access to high-quality insurance without high costs. It fits teams that want to offload liability and focus strictly on their core business goals.

Why teams Choose Justworks: Teams pick Justworks for its user-friendly interface and comprehensive PEO services. The platform manages COBRA administration and payroll sync automatically. Their strong carrier negotiation secures better rates than open market options, making benefits administration outsourcing seamless.

2. DianaHR

DianaHR combines modern software with a dedicated fractional HR manager. They handle day-to-day health insurance management tasks and answer employee questions directly, so you don't have to. By handling these tasks, they help clients reduce HR costs by up to 60% and manual HR workloads by up to 60%.

Key features:

Works seamlessly with Gusto, ADP, and Rippling for HRIS integration.

Maintains strict compliance monitoring across 40+ U.S. states.

AI-powered benefits enrollment platform for rapid onboarding.

Dedicated expert for carrier negotiation and claims support.

Best for: Startups needing rapid benefits administration outsourcing without hiring full-time staff. It fits founders who want to eliminate repetitive admin work and focus on business growth while ensuring compliance.

Why teams choose DianaHR: Founders choose DianaHR because it layers expert service over your benefits enrollment platform. It integrates with your current payroll tools without migration. This combination saves teams 15–20 hours per week and secures outsourced benefits management efficiency.

3. Gusto

Gusto simplifies benefits administration outsourcing by syncing everything directly with payroll. It acts as your broker for medical, dental, and vision plans. The software automates calculations, ensuring your health insurance management data stays accurate without manual entry.

Key features:

Automatic sync between benefits and payroll deductions.

Digital employee self-service portal for signing forms.

Built-in compliance monitoring for state and federal laws.

Integrated FSA/HSA administration options.

Best for: Small businesses that want a modern, automated experience. It works best for teams that value a strong user interface and need outsourced benefits management that runs on autopilot.

Why teams choose Gusto: Teams love Gusto for its clean design. It combines HRIS integration with payroll, meaning you update data once, and it changes everywhere. The benefits enrollment platform handles ACA reporting and new hire onboarding automatically, making it a favorite for tech-forward companies.

4. Rippling

Rippling stands out among benefits administration companies by merging HR, IT, and finance. It allows you to manage health insurance management and company devices in one place. You hire someone, and the system sets up their benefits and apps instantly.

Key features:

Unified HRIS integration for benefits, payroll, and IT.

Flexible "bring your own broker" or use their carrier network.

Global outsourced benefits management for international hires.

Automated ACA reporting and compliance alerts.

Best for: Fast-growing companies that need to manage equipment and insurance together. It fits teams that want to centralize benefits administration outsourcing with their IT workflows to save administrative time.

Why Teams Choose Rippling: Companies select Rippling to eliminate data silos. The platform automates the entire employee lifecycle. It grants app access and completes open enrollment support in seconds, making it a powerful, all-in-one solution.

5. ADP

ADP uses its massive data network to refine outsourced benefits management. It supports mid-sized and large teams by integrating health insurance management with payroll. Their tools help employees navigate complex plan options with confidence and clarity.

Key features:

"Nayaa" AI assistant for personalized open enrollment support.

Deep benchmarking data for competitive plan design.

Automated ACA reporting and regulatory compliance alerts.

Comprehensive employee self-service portal on mobile.

Best for: Mid-sized or enterprise companies. It suits organizations that need deep analytics and third-party administrator (TPA) compatibility to manage complex, multi-state workforces effectively.

Why Teams Choose ADP: Leaders pick ADP for stability and scale. The platform offers both PEO services and standalone software options. Their data-driven approach allows for smarter carrier negotiation and plan selection, ensuring your benefits package remains competitive in the talent market.

6. BambooHR

BambooHR transforms outsourced benefits management by connecting directly with your own carriers. It is not a broker, so you keep your existing relationships. The platform visualizes health insurance management data, making it easy for HR to track enrollment status.

Key features:

Intuitive open enrollment support wizard for employees.

Automatic carrier negotiation data updates via Carrier Connect.

Visual reports for analyzing participation rates.

Mobile-ready employee self-service portal.

Best for: Teams that love their current broker but hate the paperwork. It works perfectly for companies wanting a cleaner benefits enrollment platform without switching their insurance providers or losing current plans.

Why teams choose BambooHR: Teams choose it for the interface. It simplifies benefits administration outsourcing by making data easy to read. The HRIS integration ensures that when an employee updates a life event, the changes reflect instantly in your records, reducing administrative errors.

7. Paychex

Paychex leads in compliance monitoring for businesses that fear regulatory risks. It combines outsourced benefits management with a massive team of legal experts. The "Paychex Flex" platform centralizes health insurance management, payroll, and tax filings to keep your data accurate.

Key features:

Dedicated specialists for ACA reporting and state-specific mandates.

Integrated PEO services for risk mitigation and group rates.

Mobile-first employee self-service portal for 24/7 access.

Automated COBRA administration to prevent coverage gaps.

Best for: Companies in states with complex labor laws, like California or New York. It suits risk-averse leaders who need benefits administration outsourcing that guarantees regulatory accuracy and protects them from government penalties.

Why teams choose Paychex: Leaders choose Paychex for peace of mind. The tech stack includes the "Paychex Flex" dashboard, which tracks every deduction and law change. Their carrier negotiation power reduces premiums, while their focus on legal defense makes them the safest choice for benefits administration companies.

8. Zenefits (TriNet)

Now part of TriNet, Zenefits (TriNet HR Plus) brings a modern "shopping cart" experience to benefit administration outsourcing. It empowers employees to compare plans side-by-side while you control the budget, simplifying the complexity of health insurance management.

Key features:

"Defined contribution" tools for predictable employer costs.

Visual benefits enrollment platform for easy plan comparison.

Automated COBRA administration and compliance filings.

Flexible options to bring your own broker.

Best for: Startups and small businesses that prioritize employee choice. It fits teams wanting to set a fixed dollar amount for benefits and let staff shop for the coverage that matches their personal needs.

Why teams Choose Zenefits (TriNet): Teams love the flexibility. The platform removes the guesswork from selecting plans. Its intuitive design and ability to scale into full PEO services make it a versatile choice among benefits administration companies for dynamic workforces.

Top 8 Benefits Administration Companies at a Glance:

Key Features to Look For

Before you commit to a contract, audit the potential partner for these three capabilities. The right technology mix will save you from manual data entry and legal headaches.

Feature #1. Carrier Connections (EDI and API)

Your benefits platform must talk directly to your insurance carriers. Look for providers that use carrier negotiation power to build direct EDI (Electronic Data Interchange) or API feeds.

What it does: When you hire an employee or they change their plan, the system automatically sends that data to the insurer (e.g., Aetna, BlueCross).

Why it matters: It prevents "coverage leakage." Without this, you might pay premiums for terminated employees for months simply because someone forgot to fax a form.

Feature #2. Employee Portal

In 2025, a mobile-first employee self-service portal is non-negotiable. Employees expect to manage their health just like they manage their bank accounts—from their phones.

Must-have tools: Look for decision-support tools (calculators that estimate out-of-pocket costs), digital ID card access, and one-click renewal buttons.

Real-world impact: When employees can answer their own questions about deductibles or network doctors, HR ticket volume drops significantly.

Feature #3. Compliance Tracking

Federal and state regulations change constantly. Your partner should automate compliance monitoring so you never miss a deadline.

Essential automation: The system should automatically track hours for ACA reporting eligibility, generate 1095-C forms, and trigger COBRA administration notices the moment an employee leaves.

Risk reduction: Automated alerts should notify you immediately if your plan fails non-discrimination testing, keeping you audit-ready at all times.

These features build the technical foundation for success, but the real value lies in the long-term impact on your business.

Conclusion

Handling benefits yourself creates a cycle of "manual marathons." You are stuck juggling enrollment forms, cross-referencing payroll, and chasing employees for signatures. This data deluge pulls you away from building your business.

The cost of a mistake is terrifying. A single missed COBRA administration notice can trigger lawsuits with daily penalties. Failing ACA reporting in 2025 invites massive IRS fines. These aren't just clerical errors; they are financial time bombs that threaten your stability.

DianaHR neutralizes these threats. We combine AI-powered software with a dedicated HR expert to handle the grunt work. We fix carrier errors, ensure compliance monitoring across many states, and save you lots of hours per week.

Stop the administrative chaos. Book a demo with DianaHR today to secure your compliance.

FAQs

1. What does benefits administration outsourcing cost?

PEO services typically charge 2–12 percent of payroll or $40–$160 per employee monthly. Standalone benefits administration companies offer lower rates, often $6–$15. While PEOs cover comprehensive health insurance management, software-only tools reduce outsourced benefits management costs but provide less hands-on open enrollment support for your team.

2. Can I keep my current broker?

Yes, you can often keep your trusted advisor. Flexible benefits enrollment platforms like BambooHR allow "bring your own broker" models. However, opting for full benefits administration outsourcing through PEO services usually requires adopting their master policies and internal teams for carrier negotiation and health insurance management.

3. Do these services handle ACA reporting?

Absolutely. Top providers like ADP automate ACA reporting for teams with over 50 employees. They track hours to ensure strict compliance monitoring, flagging eligibility issues early. This essential feature of outsourced benefits management prevents costly IRS penalties and simplifies complex filing requirements for your health insurance management.

4. What is the difference between a PEO and a TPA?

A PEO co-employs your staff to unlock better health insurance management rates. Conversely, a third-party administrator (TPA) handles specific tasks like claims or COBRA administration for existing plans without co-employment. Choose PEO services for total liability protection or a TPA for focused open enrollment support and control.

5. How is data security handled?

Reputable benefits administration companies prioritize security using SOC 2 Type II compliance. They protect sensitive data during HRIS integration with banking-grade encryption. This ensures your outsourced benefits management process remains safe from breaches, protecting employee privacy while maintaining secure access to your employee self-service portal 24/7.

Share the Blog on: