The staffing market moves fast. Managing money for temporary workers gets messy without help. You need professional staffing payroll services to stay organized. Many agencies switch to payroll outsourcing for staffing agencies to automate payroll processing and ensure payroll compliance.

Reliable temporary staffing payroll solutions let you pay staff weekly even when clients pay late. These staffing payroll services help you handle workforce management without the stress.

Here are the top five providers for your growing team.

Top 5 Staffing Payroll Services for Enterprises and Growing Teams

Finding the best staffing payroll services is vital for agencies that want to grow. These temporary staffing payroll solutions streamline your payroll processing and payroll compliance in 2026. Reliable staffing payroll services allow you to focus on recruiting instead of manual data entry.

1. DianaHR – AI-Powered "Hands-Off" People Operations

DianaHR offers an AI-driven, hands-off approach to staffing payroll services. It acts as an overlay for your existing tools, using AI agents to handle payroll processing and state registrations. This platform simplifies payroll administration by managing paperwork through Slack and email requests.

Key Features:

Agentic Onboarding: Automatically moves new hires from signed offers into your payroll software.

Payroll Compliance: Manages complex multi-state tax filings and legal registrations via AI-powered agents.

Contractor Payments: Facilitates fast payments for both 1099 contractors and W-2 temporary employee payroll.

Human-in-the-Loop: Pairs high-tech automation with a dedicated human expert for your staffing payroll services.

Why Choose DianaHR: Choose this for modern payroll outsourcing for staffing agencies that integrates with your current software stack.

Industry Served: Tech Startups, IT, Healthcare, Professional Services, Nonprofits.

Client Reviews: 4.9/5 stars.

2. ADP TotalSource — Enterprise-Grade PEO with Comprehensive Payroll Solutions

ADP TotalSource is a professional employer organization that handles your entire workforce management and payroll processing needs. It acts as a co-employer to manage payroll tax filing and benefits administration at scale. This service provides a robust infrastructure for high-volume staffing payroll services.

Key Features:

Co-Employment Model: Shares legal and tax liabilities to improve your payroll compliance across 50 states.

DataCloud Analytics: Uses AI to give predictive insights into labor costs and temporary employee payroll trends.

Full-Service Tax Filing: Automatically handles all federal, state, and local payroll tax filing for your agency.

Integrated Benefits: Provides enterprise-level health and retirement plans to your staff through benefits administration.

Why Choose ADP TotalSource: Use this for enterprise-level staffing and payroll services that need deep legal backing and powerful analytics.

Industry Served: Manufacturing, Hospitality, Construction, Retail, Healthcare, and Professional Services.

Client Reviews: 4.3/5 stars.

3. Paychex – Scalable Payroll and HR Platform for Staffing Firms

Paychex Flex provides scalable staffing and payroll services that grow with your agency. It automates payroll processing and payroll tax filing for both W-2 and 1099 staff. The platform simplifies workforce management by bundling hiring, benefits administration, and payroll software into one unified system.

Key Features:

Recruiting Copilot: Uses AI to source talent and manage contractor payments faster during high-growth periods.

Compliance Experts: Offers 24/7 access to specialists who ensure your payroll compliance meets 2026 labor laws.

Flexible Funding: Provides access to working capital to cover your temporary employee payroll while waiting for client payments.

Mobile Workforce App: Allows staff to view pay stubs and manage schedules, improving your overall payroll administration.

Why Choose Paychex: It is the ideal choice for payroll outsourcing for staffing agencies looking for a long-term, scalable HR and payroll partner.

Industry Served: Healthcare, IT, Retail, Manufacturing, Professional Services.

Client Reviews: 4.3/5 stars.

4. QuickBooks Payroll — Integrated Accounting and Payroll for Growing Agencies

QuickBooks Payroll is a fast, integrated choice for agencies already using QuickBooks for accounting. In 2026, its new AI "Payroll Agent" helps identify pay errors before they happen. This platform provides seamless payroll processing and same-day direct deposit for your team.

Key Features:

AI Payroll Agent: Proactively identifies hour anomalies and misses to prevent payroll administration errors.

Geofencing Time Tracking: Uses GPS to ensure staff clock in only when at the job site, reducing temporary employee payroll costs.

Auto-Tax Filing: Automatically calculates and files federal and state taxes to maintain strict payroll compliance.

Same-Day Direct Deposit: Offers the fastest payment cycles in the industry, which is essential for contractor payments.

Why Choose QuickBooks Payroll: It is the best choice for agencies that need to sync payroll software with their accounting books in seconds.

Industry Served: Small Staffing Agencies, Professional Services, Retail, Construction, Tech.

Client Reviews: 4.5/5 stars.

5. TempWorks Financial – Specialized Payroll Funding for Staffing Companies

TempWorks is built specifically for the recruiting industry, offering a combined ATS and back-office solution. It stands out by providing integrated payroll funding through its sister company, Lone Oak Payroll. This ensures your agency has the cash flow to handle temporary employee payroll without waiting for client payments.

Key Features:

Integrated Payroll Funding: Advances up to 97% of your invoice value to cover contractor payments and taxes immediately.

Buzz Mobile App: Provides a native mobile experience for workers to enter time and view payroll processing details.

Enterprise Infinity: A robust system that manages high-volume payroll administration and complex billing for large agencies.

Compliance Integrity Checks: Features built-in tools to verify payroll compliance and tax accuracy across different states.

Why Choose TempWorks Financial: It is the best all-in-one choice for agencies that need both staffing payroll services and a built-in funding lifeline.

Industry Served: Light Industrial, Clerical, IT, Professional Services, Healthcare.

Client Reviews: 4.1/5 stars.

Top 2026 Staffing Payroll Services Comparison

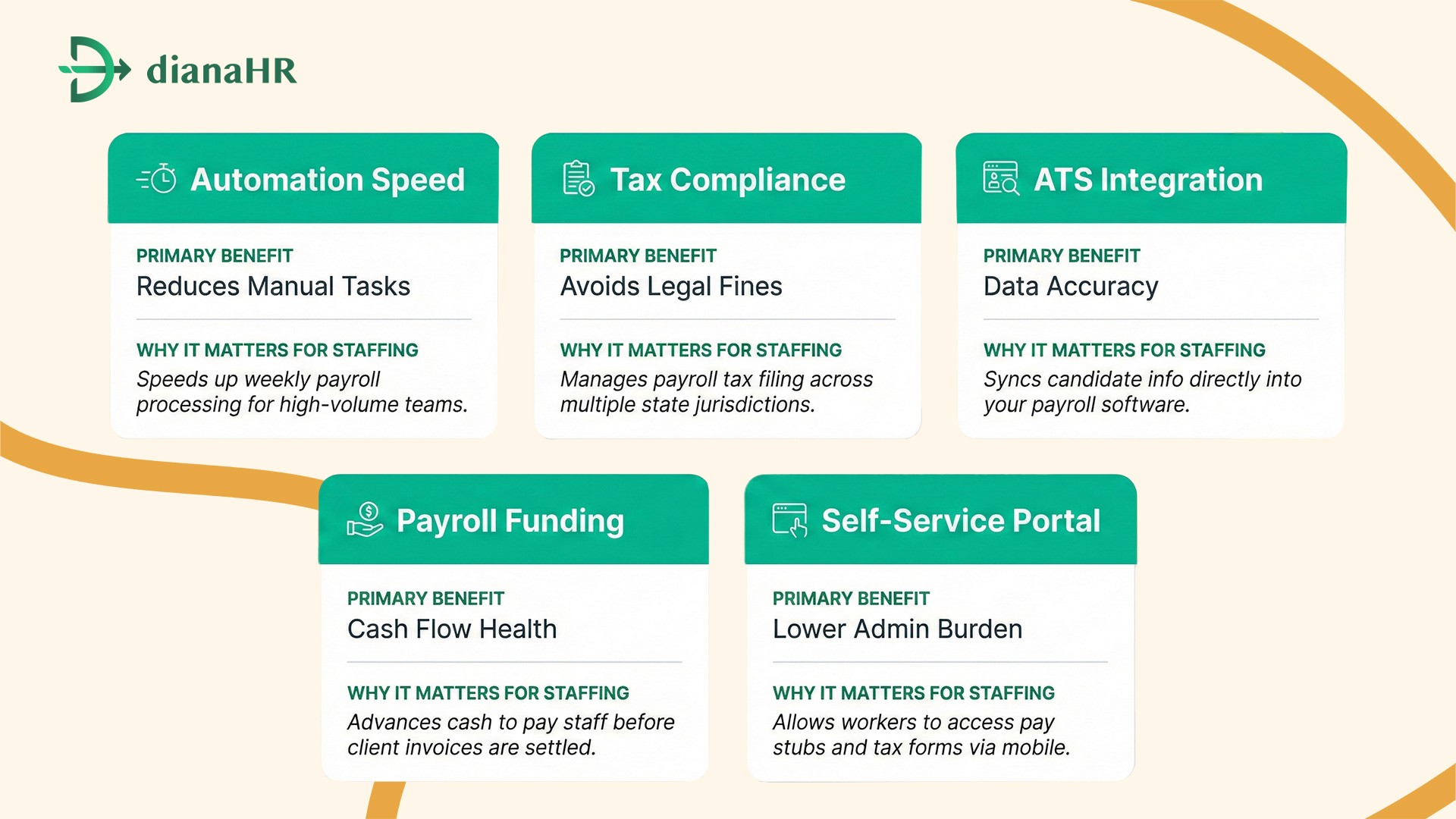

Key Features to Compare in Staffing Payroll Services

Comparing staffing payroll services requires a focus on practical tools that solve daily agency headaches. You need temporary staffing payroll solutions that handle the unique math of recruiting. Look for these core features when evaluating payroll outsourcing for staffing agencies.

1. Payroll Processing Speed and Automation Capabilities

In 2026, manual entry is a liability. Your payroll software must automate at least 90% of your recurring tasks. High-quality staffing payroll services use AI to calculate variable pay rates and overtime across different client sites. Faster payroll processing means your staff gets paid on time, even with complex weekly cycles.

2. Tax Compliance and Multi-Jurisdiction Management

Staffing often involves placing workers across state lines. This makes payroll compliance and payroll tax filing difficult. Good staffing payroll services automatically register your business in new tax jurisdictions as you hire. They also track local labor law changes to keep your payroll administration legal and penalty-free.

3. Integration with Applicant Tracking and Time-Tracking Systems

Efficiency breaks down when systems do not talk to each other. Your staffing payroll services should sync directly with your ATS. This ensures that when a candidate starts a job, their data flows into payroll processing without extra typing. Integrated time tracking also stops "time theft" and makes contractor payments more accurate.

4. Payroll Funding Options and Working Capital Solutions

Growth takes cash. Often, you must pay temporary employee payroll weekly, but clients take 60 days to pay you. Look for staffing payroll services that offer payroll funding. These working capital tools advance your money based on your open invoices, so you never miss a pay cycle while scaling your agency.

Comparison of Key Staffing Payroll Features

Conclusion

Managing staffing payroll services involves balancing worker needs with complex tax rules. Many agencies struggle with slow payroll processing and the burden of payroll compliance. If your system fails, you face angry workers, tax penalties, and lost clients. High turnover and legal fines can quickly drain your bank account. Avoid these risks by choosing temporary staffing payroll solutions that actually work.

DianaHR streamlines your workforce management and payroll administration through smart automation. We handle the technical details of payroll outsourcing for staffing agencies so you can focus on hiring.

Connect with DianaHR today to automate your staffing payroll services and reclaim your time.

FAQs

1. What is the difference between staffing payroll services and traditional payroll providers?

Staffing payroll services handle the high-volume, weekly cycles of a flexible workforce. Unlike traditional tools, these temporary staffing payroll solutions manage complex payroll processing for shifting schedules. They also offer payroll funding to bridge gaps in your payroll administration and cash flow.

2. How much do staffing payroll services typically cost for growing agencies?

Prices for staffing payroll services vary based on your agency size. Basic payroll software starts around $29, while PEO payroll outsourcing for staffing agencies can cost $150 per head. Investing in automation improves payroll compliance and reduces manual payroll processing costs significantly.

3. What are the biggest compliance risks for staffing agencies managing payroll?

The main risks include worker misclassification and multi-state tax errors. Reliable staffing payroll services automate your payroll tax filing to avoid IRS penalties. Using smart payroll software ensures your payroll compliance stays current with 2026 labor laws across all local jurisdictions.

4. How does payroll funding work for staffing companies?

Payroll funding provides immediate cash based on your outstanding invoices. This tool ensures you can handle temporary employee payroll even when clients pay slowly. Most staffing payroll services integrate this to provide the working capital needed for consistent payroll administration and growth.

5. Can staffing payroll services integrate with applicant tracking systems?

Yes, top-tier staffing payroll services sync directly with your ATS. This connection ensures candidate data flows into payroll processing without manual entry. These integrations streamline workforce management and make contractor payments faster by linking time-tracking data to your primary payroll software.

Share the Blog on: