Smart founders in 2025 face a specific growth paradox. The most successful teams spend almost zero time on payroll but get better results. They stopped hiring generalist admins and started using small business HR outsourcing.

The old model of hiring a reactive assistant is dead. Today, you need fractional HR support to handle risk properly.

Data shows that 57% of owners now use outsourced HR solutions to survive compliance complexity. Why? Because doing it yourself kills growth. Owners who switch report a 150% ROI.

This guide skips the fluff. We identify the top services that solve your problems and boost administrative efficiency. You need small business HR outsourcing that actually works.

The 3 Trends Defining HR in 2025

The market changed fast. You cannot just hire a payroll provider and ignore the rest. Small business HR outsourcing evolved to meet new demands. We see three specific shifts changing how companies operate in 2025.

Trend 1: "Fractional" > "Transactional"

Business owners settled for generic call centers in the past. You filed a ticket and waited days for a scripted reply. That model failed. Today, small business HR outsourcing demands a dedicated HR manager. You need someone who knows your company culture but costs less than a full-time hire.

This "Fractional" model brings high-level talent acquisition strategy and management coaching directly to your team. You get the expertise of a veteran leader without the six-figure salary.

Trend 2: Compliance is the New Strategy

Risk keeps founders awake at night more than costs do. Remote workforce management turned simple payroll into a legal minefield. Your startup might have tax obligations in ten different states.

Small business HR outsourcing now focuses primarily on risk management. You pay experts to handle strict labor law adherence because mistakes cost too much. Payroll compliance ensures you survive audits.

Trend 3: The "Integration" Requirement

Platform fatigue is real. You likely already use tools you like. The best outsourced HR solutions in 2025 respect your tech stack. They integrate directly with your existing HR technology platforms.

Traditional PEO services often demand you switch everything to their proprietary system. Modern small business HR outsourcing providers plug into Gusto or Rippling. They fix your administrative efficiency without disrupting your workflow.

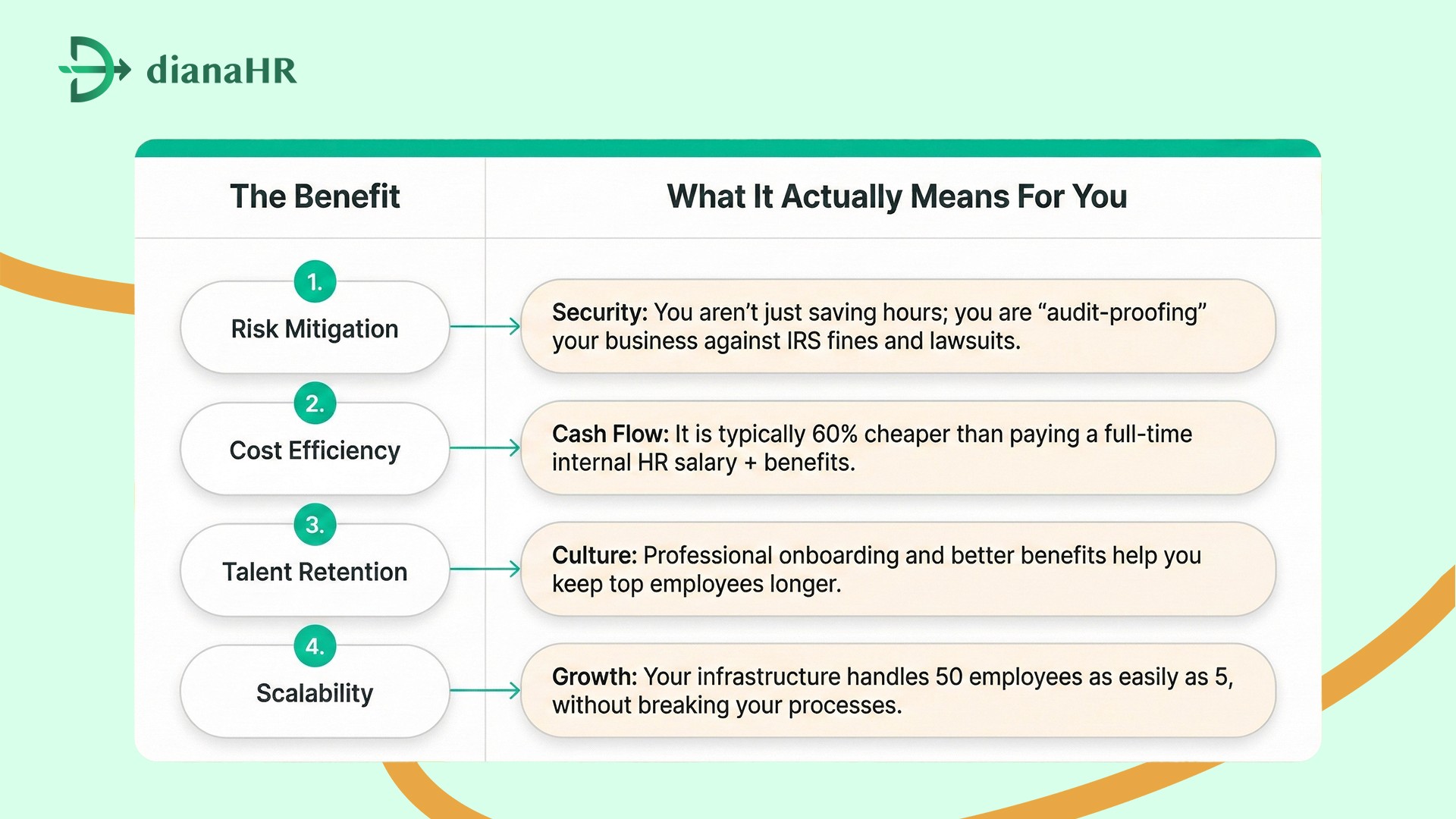

These trends explain the shift in small business HR outsourcing. Now consider the financial impact. We will break down the tangible benefits you get from outsourced HR solutions.

The Real Benefits of Outsourcing (Beyond "Time Saved")

You might worry about the price tag. But the math proves that small business HR outsourcing actually protects your bottom line. It stops being an expense and becomes a savings mechanism.

1. Cost Containment

Hiring an internal manager costs $80,000 or more. You also pay for their benefits and taxes. Small business HR outsourcing gives you a team of experts for a fraction of that cost. You typically pay a monthly fee between $1,500 and $3,000.

This arbitrage lets you reinvest capital into sales or product development. You get superior fractional HR support without the massive overhead. Small business HR outsourcing makes financial sense.

2. Audit-Proofing

The IRS does not care if you were busy. Payroll compliance requires precision. One mistake leads to massive fines. Small business HR outsourcing shifts this liability to the experts.

They handle risk management and tax filings daily. You avoid the stress of state audits. Your provider ensures strict labor law adherence so you focus on running the business. Small business HR outsourcing keeps you safe.

3. Talent Wins

Great candidates ignore messy companies. They want professional automated onboarding and clear answers about healthcare. Outsourced HR solutions level the playing field.

You can offer professional employee benefits administration that rivals large corporations. Your 10-person startup projects the stability of a 100-person organization. This professional polish helps you win top talent.

Now you understand the ROI. Small business HR outsourcing solves your money, risk, and talent problems. Next, we review the top five services available in 2025.

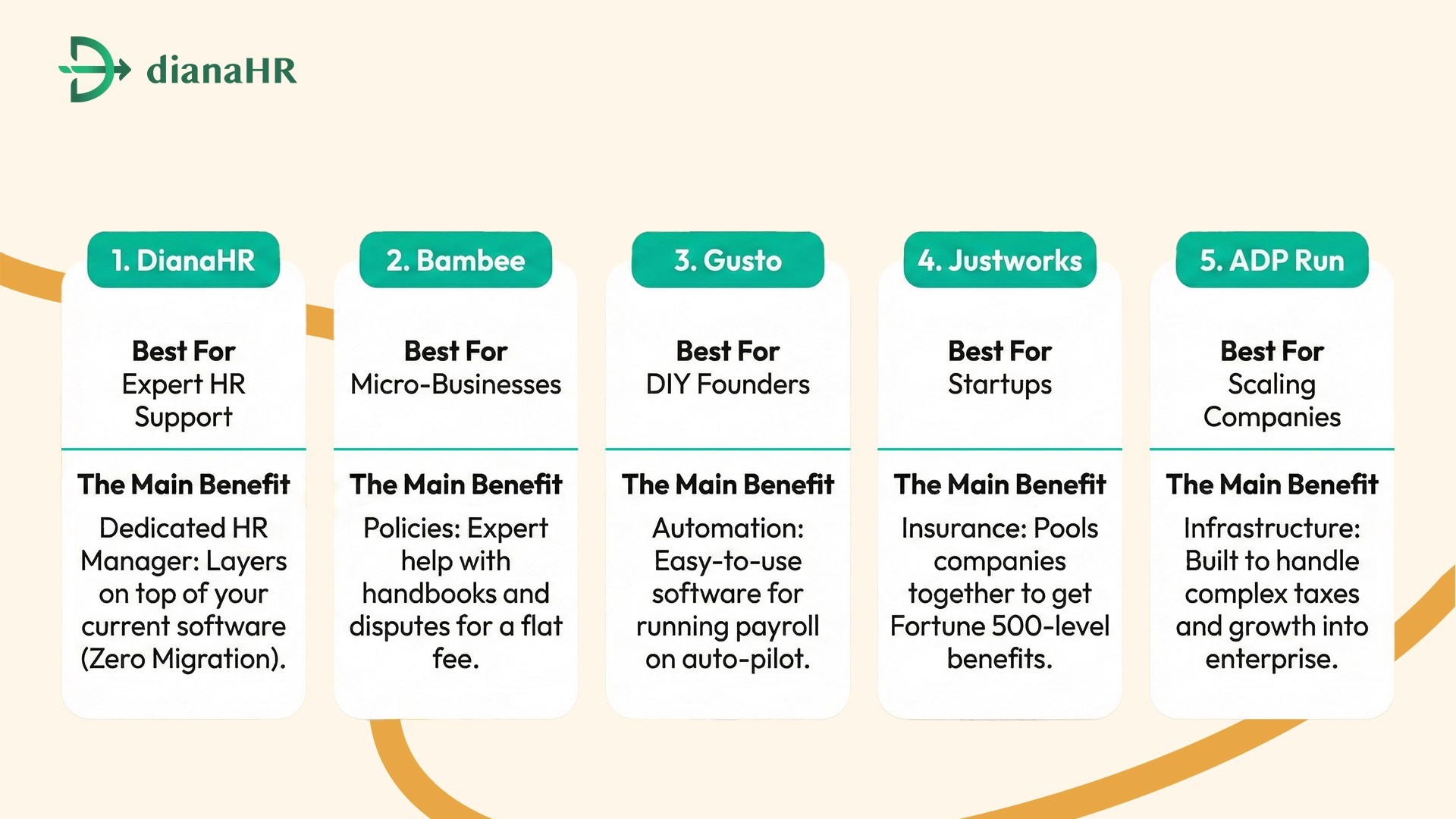

Top 5 HR Outsourcing Services

1. DianaHR

DianaHR leads small business HR outsourcing in 2025. They bridge the gap between software and consultants. You receive a dedicated HR manager supported by AI. This outsourced HR solutions model reduces costs by up to 60% and saves 15–20 hours per week.

Special Features:

Zero Migration Required: Layers on top of Gusto or Rippling so you never switch software.

National Compliance: Maintains strict risk management across 40+ U.S. states, ensuring you never face penalties for remote workforce management.

Services Offered: Compliance management, state tax registrations, automated onboarding, benefits administration, employee relations, payroll coordination.

Here is the next service, Bambee, formatted as requested.

2. Bambee

Bambee makes small business HR outsourcing accessible for micro-businesses. You get a dedicated manager to write policies and handle disputes for a flat monthly fee. This service is ideal if you need affordable fractional HR support to fix your employee handbook and solve basic compliance issues.

Special Features:

Transparent Pricing: A flat monthly rate makes budgeting easy for smaller teams needing outsourced HR solutions.

Policy Focus: Specializes in crafting compliant handbooks and managing terminations to ensure labor law adherence.

Services Offered: HR audits, policy crafting, termination guidance, risk management, employee training, performance tracking.

Here is the next service, Gusto, formatted as requested.

3. Gusto

Gusto acts as the default choice for HR outsourcing for small companies that prefer a DIY approach. If you value software over human advice, this HR technology platforms leader works best. It automates payroll compliance and tax filings to create administrative efficiency for tech-forward founders.

Special Features:

User Experience: The interface is intuitive, so employees actually enjoy using it for automated onboarding and accessing paystubs.

Auto-Pilot: Runs payroll automatically and handles federal and state tax filings to ensure basic risk management.

Services Offered: Full-service payroll, health benefits, time tracking, hiring tools, contractor payments, workers comp.

4. Justworks

Justworks defines the PEO model for small business HR outsourcing. They pool your team with thousands of others to unlock Fortune 500-level health insurance. This bundling makes them a top choice among outsourced HR solutions for startups needing robust employee benefits administration.

Special Features:

Group Buying Power: Gives you access to enterprise-grade medical, dental, and vision insurance at rates usually reserved for large corporations.

All-in-One Model: Combines payroll compliance, benefits, and HR tools into a single per-employee price.

Services Offered: PEO services, health insurance, 401(k), workers' comp, harassment training, tax filing.

5. ADP Run

ADP Run serves as the traditional powerhouse in small business HR outsourcing. It suits companies planning to grow into large enterprises. While less agile than modern HR technology platforms, it provides unmatched infrastructure for complex payroll compliance and risk management needs.

Special Features:

Scalability: Built to handle growth from startup to enterprise without forcing you to switch outsourced HR solutions.

Complex Handling: Easily manages garnishments and difficult tax situations that break smaller systems, ensuring labor law adherence.

Services Offered: Payroll, tax filing, retirement plans, insurance, time and attendance, compliance support.

Conclusion

Managing HR in a small business is a relentless cycle of complex compliance requirements and tight payroll deadlines. The pressure to be perfect is immense, yet resources are often limited.

The cost of mismanagement here is severe. A single compliance oversight or payroll discrepancy can spiral into federal audits and devastating fines that threaten the very viability of your company. These operational risks are too dangerous to leave to chance.

DianaHR serves as your safeguard. We provide the expert-backed infrastructure and automated precision needed to guarantee accuracy. Secure your business against these liabilities and scale confidently with DianaHR.

Get expert HR support with DianaHR.

Frequently Asked Questions

1. Why should small businesses outsource HR instead of hiring internally?

Outsourcing small business HR to DianaHR significantly cuts overhead costs while boosting compliance management. Instead of hiring expensive internal staff, you gain a dedicated HR manager and automated payroll services. This proactive approach helps reduce payroll errors and avoids costly tax penalties, ensuring your growing company remains audit-ready and operationally efficient.

2. How does DianaHR help prevent costly payroll mistakes?

Manual data entry causes financial discrepancies. DianaHR combines advanced automated payroll technology with expert oversight to eliminate errors. By streamlining tax filings and wage calculations, our comprehensive payroll services protect your business from unexpected IRS fines, ensuring accurate, on-time payments. We handle the complexity so you can trust your financial data.

3. Can DianaHR handle complex state and federal regulations?

Navigating labor laws is critical. DianaHR acts as your shield by managing shifting federal and state regulations. From workers' compensation to employee handbook updates, our full-service compliance management solutions ensure your small business stays legal. We mitigate risk, allowing you to focus on revenue growth rather than researching legal loopholes.

4. How does DianaHR support employee benefits administration?

Attracting top talent requires competitive perks. DianaHR simplifies employee benefits administration, offering access to affordable health insurance, 401(k)s, and wellness plans. By managing these HR solutions, we help you improve employee retention and satisfaction without the administrative burden. Give your team the support they deserve while keeping your HR costs controlled.

5. Does DianaHR assist with new hire onboarding and scaling?

Scaling requires seamless processes. DianaHR optimizes new hire onboarding with digital paperwork and efficient workflows. Our HR software manages the entire lifecycle, from offer letters to background checks, ensuring a professional experience. As you grow, our scalable HR infrastructure adapts, providing the strategic HR support needed for rapid business expansion.

Share the Blog on: