Jul 31, 2025

Penalties for Hiring Undocumented Workers - Employer's Guide

Upeka Bee

As a startup founder or small business owner, juggling multiple roles can make it easy to overlook HR compliance. But missing critical steps—especially around employment eligibility—can lead to costly mistakes.

One of the most serious is hiring individuals not authorized to work in the U.S. The penalties for hiring undocumented workers aren’t just expensive—they can damage your business and personal reputation.

Let’s explore how to avoid these issues—and what to do if you're already facing one.

The Real Cost: Penalties for Hiring Undocumented Workers

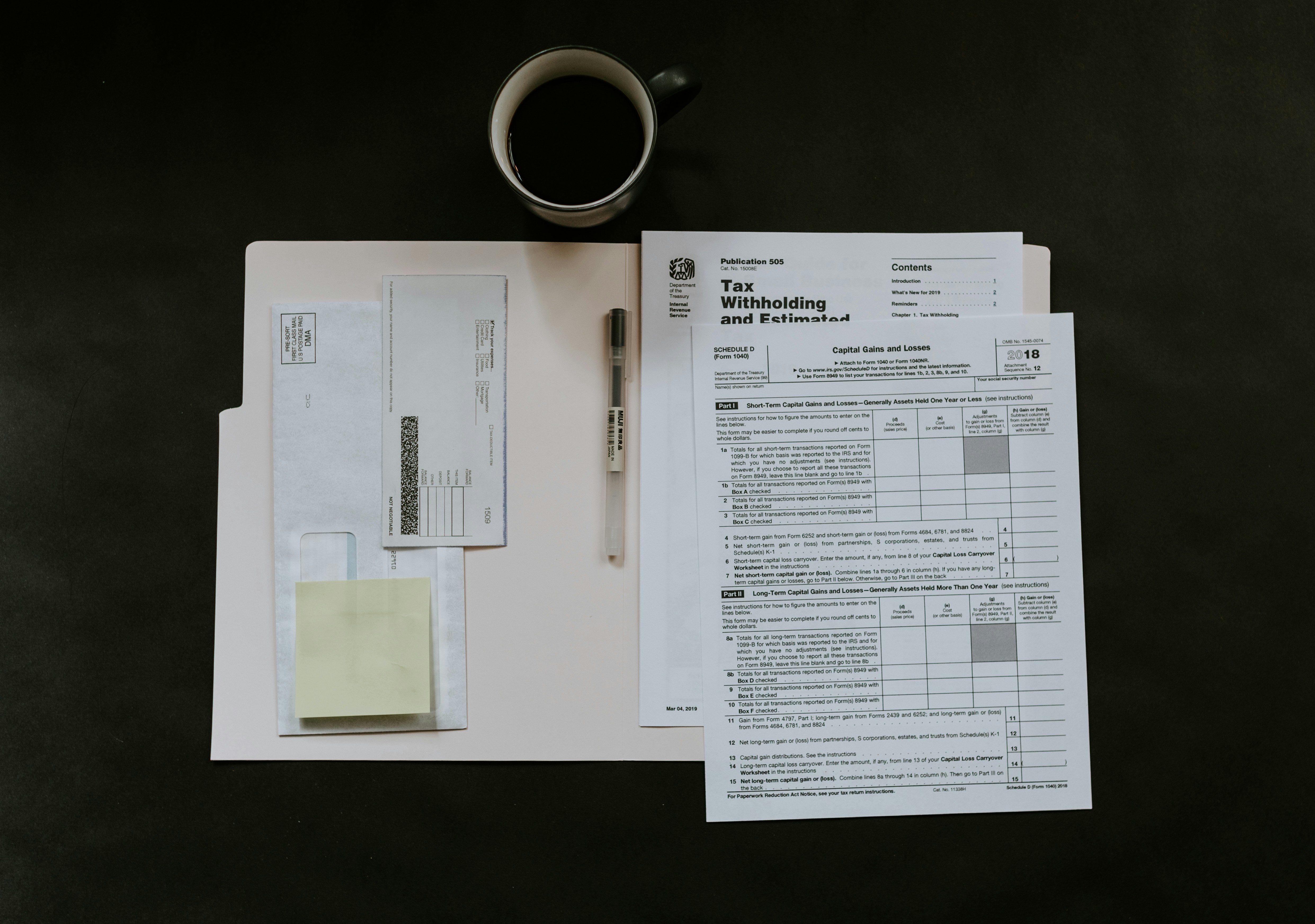

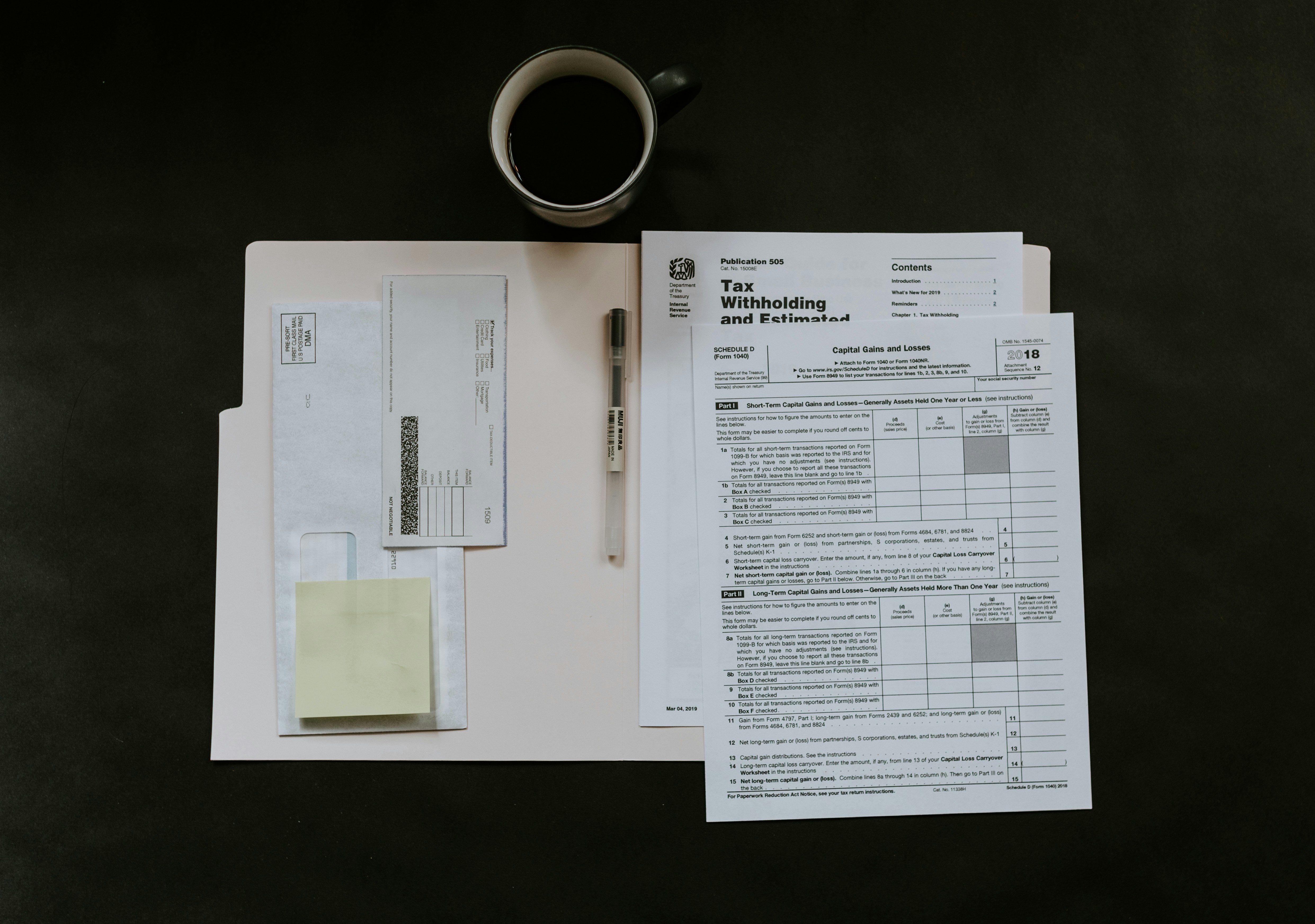

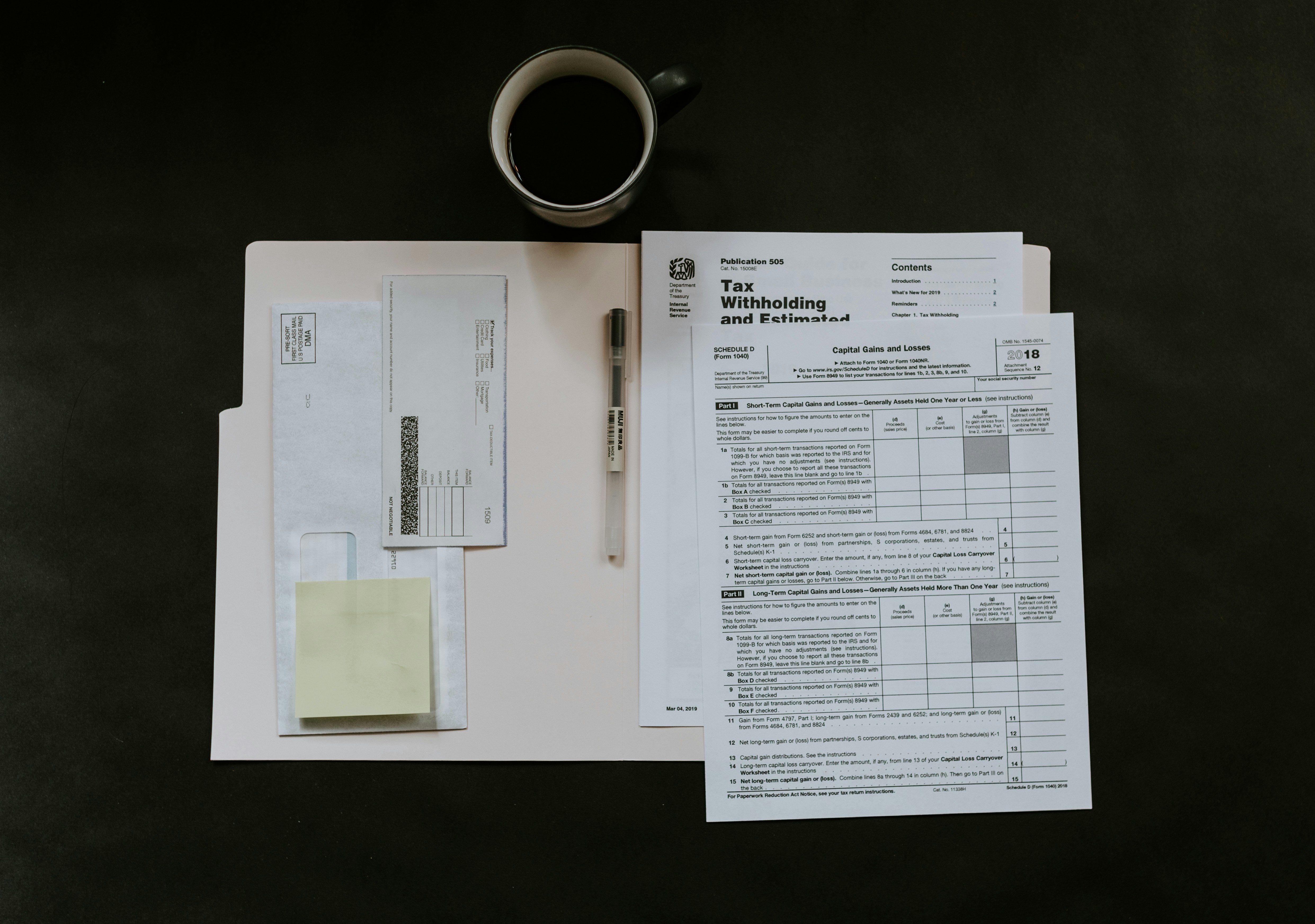

Under the Immigration Reform and Control Act (IRCA), all employers must verify new hires’ employment eligibility through Form I-9. Failing to do so—or knowingly hiring unauthorized workers—can bring civil fines, criminal penalties, and more.

Here’s what’s at stake:

Form I-9 Violations: Errors on the form—even minor ones—can result in $281 to $2,789 per mistake.

Knowingly Hiring Unauthorized Workers:

First offense: $698 – $5,579 per worker

Second: $5,579 – $13,946

Third or more: $8,369 – $27,894

Criminal Charges: For repeated violations, executives could face fines up to $3,000 per person and even prison sentences.

Government Debarment: Violations can disqualify you from federal contracts.

Reputational Damage: Public violations can shatter trust with clients and future hires.

In short, the risks are too high to ignore.

Smart HR Compliance = Risk Reduction

Staying compliant isn’t just smart—it’s essential. Here's how to build a bulletproof foundation:

Thorough I-9 Verification

Complete I-9s within required timelines. Examine original documents closely—no photocopies, no shortcuts. A ‘good faith’ effort goes a long way in audits.

Stay Legally Informed

Employment laws change. Keep up with evolving requirements around wages, discrimination, and documentation.

Policies & Handbooks

Create an employee handbook outlining clear policies for hiring, conduct, and terminations.

Track Everything

Keep organized records of I-9s, payroll services, and disciplinary actions. These become vital during audits.

Train Your Team

Educate hiring managers on legal hiring practices. Mistakes can happen when there’s a knowledge gap.

Managing all of this in-house is tough, especially for lean teams. That’s where outsourced HR for startups makes a difference.

Why More Startups Use Outsourced HR

Trying to stay compliant while growing your business can feel like an impossible balancing act. That's why many founders turn to the best HR outsourcing for small business support.

Platforms like DianaHR offer affordable, scalable solutions that handle HR compliance, onboarding, payroll, and more—without the cost of a full in-house team.

With DianaHR, you get:

State Compliance Support

I-9 & Onboarding Oversight

Payroll and Benefits Management

When you weigh the hr outsourcing pricing against the risks and costs of compliance failures, the value becomes clear.

Got a Penalty? Here’s What to Do

Even with precautions, errors happen. If your business receives a penalty:

Don’t Ignore It: Respond quickly to notices from USCIS, DOL, or EEOC.

Assess the Violation: Determine what went wrong and who’s affected.

Get Legal Help: Consult an employment attorney or compliance expert immediately.

Correct the Issue: Update your policies, fix paperwork, and train your team. Showing effort can reduce penalties.

Communicate Smartly: Be honest but cautious in communication with employees. Don’t admit fault unnecessarily.

Fix the Root Cause: Strengthen your HR processes to prevent repeat issues and consider outsourced HR for startups if you haven’t already.

Your HR Safety Net: DianaHR

Avoiding penalties for hiring undocumented workers is about preparation, documentation, and the right support. DianaHR delivers the expert guidance and operational support startups need to stay compliant and confident, at a cost that scales with your business.

With our fractional HR model, you access real professionals (not bots), who help you:

Navigate I-9s and audits

Streamline onboarding and exits

Manage benefits and payroll seamlessly

Let DianaHR handle compliance while you focus on growth. Visit DianaHR to see how we help startups stay penalty-free.

FAQs

What are the biggest HR risks for small businesses?

Failing I-9 compliance, misclassifying workers, and not keeping proper records can all lead to legal trouble for small businesses.

How does outsourced HR reduce the risk of penalties?

HR experts help you manage I-9s and stay current on employment law, preventing mistakes that lead to fines.

Is outsourcing HR expensive?

Not at all. Most HR outsourcing pricing models are cost-effective, especially compared to full-time HR hires or penalty costs.

What if an I-9 document looks fake?

You’re not expected to be an expert. Accept documents that appear genuine, but if something seems off, consult HR or legal counsel.

How is DianaHR better than an AI chatbot?

DianaHR offers real, experienced HR professionals—not generic, automated replies—giving you tailored solutions and strategic support.

As a startup founder or small business owner, juggling multiple roles can make it easy to overlook HR compliance. But missing critical steps—especially around employment eligibility—can lead to costly mistakes.

One of the most serious is hiring individuals not authorized to work in the U.S. The penalties for hiring undocumented workers aren’t just expensive—they can damage your business and personal reputation.

Let’s explore how to avoid these issues—and what to do if you're already facing one.

The Real Cost: Penalties for Hiring Undocumented Workers

Under the Immigration Reform and Control Act (IRCA), all employers must verify new hires’ employment eligibility through Form I-9. Failing to do so—or knowingly hiring unauthorized workers—can bring civil fines, criminal penalties, and more.

Here’s what’s at stake:

Form I-9 Violations: Errors on the form—even minor ones—can result in $281 to $2,789 per mistake.

Knowingly Hiring Unauthorized Workers:

First offense: $698 – $5,579 per worker

Second: $5,579 – $13,946

Third or more: $8,369 – $27,894

Criminal Charges: For repeated violations, executives could face fines up to $3,000 per person and even prison sentences.

Government Debarment: Violations can disqualify you from federal contracts.

Reputational Damage: Public violations can shatter trust with clients and future hires.

In short, the risks are too high to ignore.

Smart HR Compliance = Risk Reduction

Staying compliant isn’t just smart—it’s essential. Here's how to build a bulletproof foundation:

Thorough I-9 Verification

Complete I-9s within required timelines. Examine original documents closely—no photocopies, no shortcuts. A ‘good faith’ effort goes a long way in audits.

Stay Legally Informed

Employment laws change. Keep up with evolving requirements around wages, discrimination, and documentation.

Policies & Handbooks

Create an employee handbook outlining clear policies for hiring, conduct, and terminations.

Track Everything

Keep organized records of I-9s, payroll services, and disciplinary actions. These become vital during audits.

Train Your Team

Educate hiring managers on legal hiring practices. Mistakes can happen when there’s a knowledge gap.

Managing all of this in-house is tough, especially for lean teams. That’s where outsourced HR for startups makes a difference.

Why More Startups Use Outsourced HR

Trying to stay compliant while growing your business can feel like an impossible balancing act. That's why many founders turn to the best HR outsourcing for small business support.

Platforms like DianaHR offer affordable, scalable solutions that handle HR compliance, onboarding, payroll, and more—without the cost of a full in-house team.

With DianaHR, you get:

State Compliance Support

I-9 & Onboarding Oversight

Payroll and Benefits Management

When you weigh the hr outsourcing pricing against the risks and costs of compliance failures, the value becomes clear.

Got a Penalty? Here’s What to Do

Even with precautions, errors happen. If your business receives a penalty:

Don’t Ignore It: Respond quickly to notices from USCIS, DOL, or EEOC.

Assess the Violation: Determine what went wrong and who’s affected.

Get Legal Help: Consult an employment attorney or compliance expert immediately.

Correct the Issue: Update your policies, fix paperwork, and train your team. Showing effort can reduce penalties.

Communicate Smartly: Be honest but cautious in communication with employees. Don’t admit fault unnecessarily.

Fix the Root Cause: Strengthen your HR processes to prevent repeat issues and consider outsourced HR for startups if you haven’t already.

Your HR Safety Net: DianaHR

Avoiding penalties for hiring undocumented workers is about preparation, documentation, and the right support. DianaHR delivers the expert guidance and operational support startups need to stay compliant and confident, at a cost that scales with your business.

With our fractional HR model, you access real professionals (not bots), who help you:

Navigate I-9s and audits

Streamline onboarding and exits

Manage benefits and payroll seamlessly

Let DianaHR handle compliance while you focus on growth. Visit DianaHR to see how we help startups stay penalty-free.

FAQs

What are the biggest HR risks for small businesses?

Failing I-9 compliance, misclassifying workers, and not keeping proper records can all lead to legal trouble for small businesses.

How does outsourced HR reduce the risk of penalties?

HR experts help you manage I-9s and stay current on employment law, preventing mistakes that lead to fines.

Is outsourcing HR expensive?

Not at all. Most HR outsourcing pricing models are cost-effective, especially compared to full-time HR hires or penalty costs.

What if an I-9 document looks fake?

You’re not expected to be an expert. Accept documents that appear genuine, but if something seems off, consult HR or legal counsel.

How is DianaHR better than an AI chatbot?

DianaHR offers real, experienced HR professionals—not generic, automated replies—giving you tailored solutions and strategic support.

Title

Title

Title

HR Compliance: What Auditors Check and How to Prepare

Breaking Down Your Startup Budget: HR Outsourcing Costs

How to Automate Leave Management for Remote Teams

A Legal Guide on How to Fire Someone Across State Lines

Payroll Survival Guide: Mastering Taxes & Compliance

Lean Team Benefits That Actually Matter to Employees

Payroll Audits: Key Things Every Employer Should Know

Probationary Termination: A Legal Guide for US Small Businesses

Exit Interviews That Actually Save You Money (and Morale)

2025 California Minimum Wage: Employers Guide