Small errors in your payroll management lead to massive penalties. Last year, 80% of small business owners reported payroll errors. The IRS collected billions in late fees. Despite these risks, few companies run regular payroll audits.

Relying on manual data entry fails in 2026 because tax laws change fast. You need strong payroll controls to protect your cash. This guide shows you how to use segregation of duties and automated payroll internal controls.

These steps improve your payroll management and stop payroll fraud prevention before it starts. You can build a better system today.

Closing the Gaps: Why Payroll Controls Are Your Best Defense

Weak systems invite trouble. You need payroll controls to protect your company from internal leaks and external fines. Without these payroll internal controls, you leave your bank account open to simple mistakes that turn into legal nightmares.

A) The True Cost of Payroll Mistakes

Errors do more than just annoy your team. They attract federal regulators. In 2026, the Department of Labor checks for employee misclassification with more intensity than ever. If you label an employee as a contractor, you face fines of $1,000 per person and back taxes.

A single mistake in your payroll management often leads to a three-year audit. This costs you millions in interest and back wages. Beyond the money, payroll errors kill morale. When people don't get paid the right amount on time, they quit. Payroll accuracy is your best tool to keep your best workers.

B) Spotting Your Business’s Vulnerabilities

Most gaps happen when one person manages everything. If one employee handles hours, checks, and taxes, your payroll compliance is at risk. Manual spreadsheets often hide payroll errors for months. You also need to look for "shadow payroll" where people make manual tweaks outside your software.

These hidden changes usually lead to wage compliance failures. Check your timesheet approval process for digital timestamps. If you see manual overrides, you found a hole in your payroll management.

Fixing these gaps starts with changing how you assign tasks to your team.

Segregation of Duties: Splitting Tasks to Stop Fraud

You cannot let one person hold the keys to your entire bank account. Effective payroll management requires you to split tasks among different team members. This creates a "human firewall" that makes payroll fraud prevention a built-in part of your daily routine.

A) Making Fraud Impossible

The core of payroll internal controls is the "Segregation of Duties" (SoD) principle. It means no single employee should manage a transaction from start to finish. If the same person who adds new hires also clicks "pay," they can create "ghost employees."

These are fake profiles used to steal company funds. In 2026, payroll-related fraud remains a top threat to business cash flow. When you use segregation of duties, you force a second set of eyes on every dollar.

This makes it nearly impossible for a single bad actor to manipulate your payroll management without getting caught.

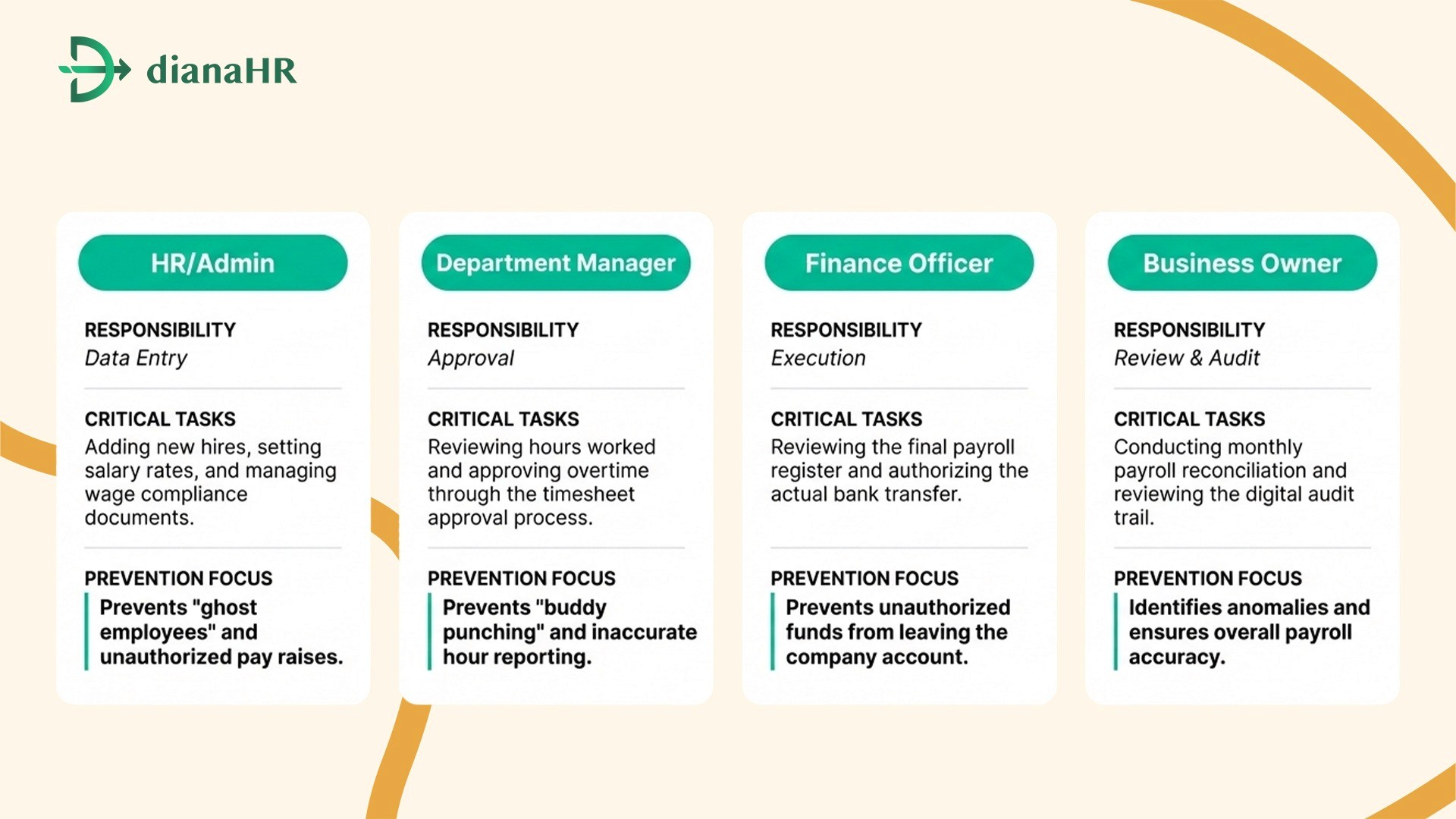

B) Essential Roles to Separate

To build a secure system, assign these payroll controls to different people:

Data Entry: Your HR lead adds employees, sets salary rates, and manages wage compliance files.

Approval: A department manager reviews the work hours and overtime through a formal timesheet approval process.

Execution: A finance officer or the owner authorizes the bank transfer after a final review.

Segregation of Duties: Role Allocation Table

By spreading these responsibilities, you ensure that every check is earned and every tax is paid. With your team roles set, you can now use tech to make these steps even faster and more secure.

Automation: Using Technology to Eliminate Human Error

Manual math is a recipe for disaster. Using software for payroll management takes the guesswork out of tax math and overtime laws. Modern tools enforce your payroll controls automatically so you don't have to worry about every single decimal point.

A) How Systems Prevent Fraud

Automated tools remove the human element that causes payroll errors. In 2026, AI-driven payroll internal controls flag "buddy punching" or fake receipts before you ever see them. These systems create a digital audit trail. You can see exactly who changed a bank account number or modified a salary rate.

This transparency is a key part of payroll fraud prevention. Software also handles payroll compliance by updating tax tables for every state instantly. You no longer have to track new labor laws by hand.

B) Choosing the Right Payroll Tech

Your tech should do more than just cut checks. You need a system that ensures payroll accuracy through direct integrations.

Real-time Anomaly Detection: Your software should flag duplicate deposits or sudden pay spikes immediately.

Integrated Time-Tracking: Hours should flow from the clock to the system. This prevents manual typing and stops wage compliance issues.

Biometric Syncing: This ensures the right person is at work, which improves your payroll fraud prevention efforts.

When your software handles the heavy lifting, checking your work becomes much easier.

Reconciliation and Audits: Catching Mistakes Early

Even with great software, you still need to check your work. Regular checks ensure your payroll management stays on track. By looking at your data often, you catch payroll errors before they turn into big problems with the IRS or your staff.

A) The Monthly Defense Strategy

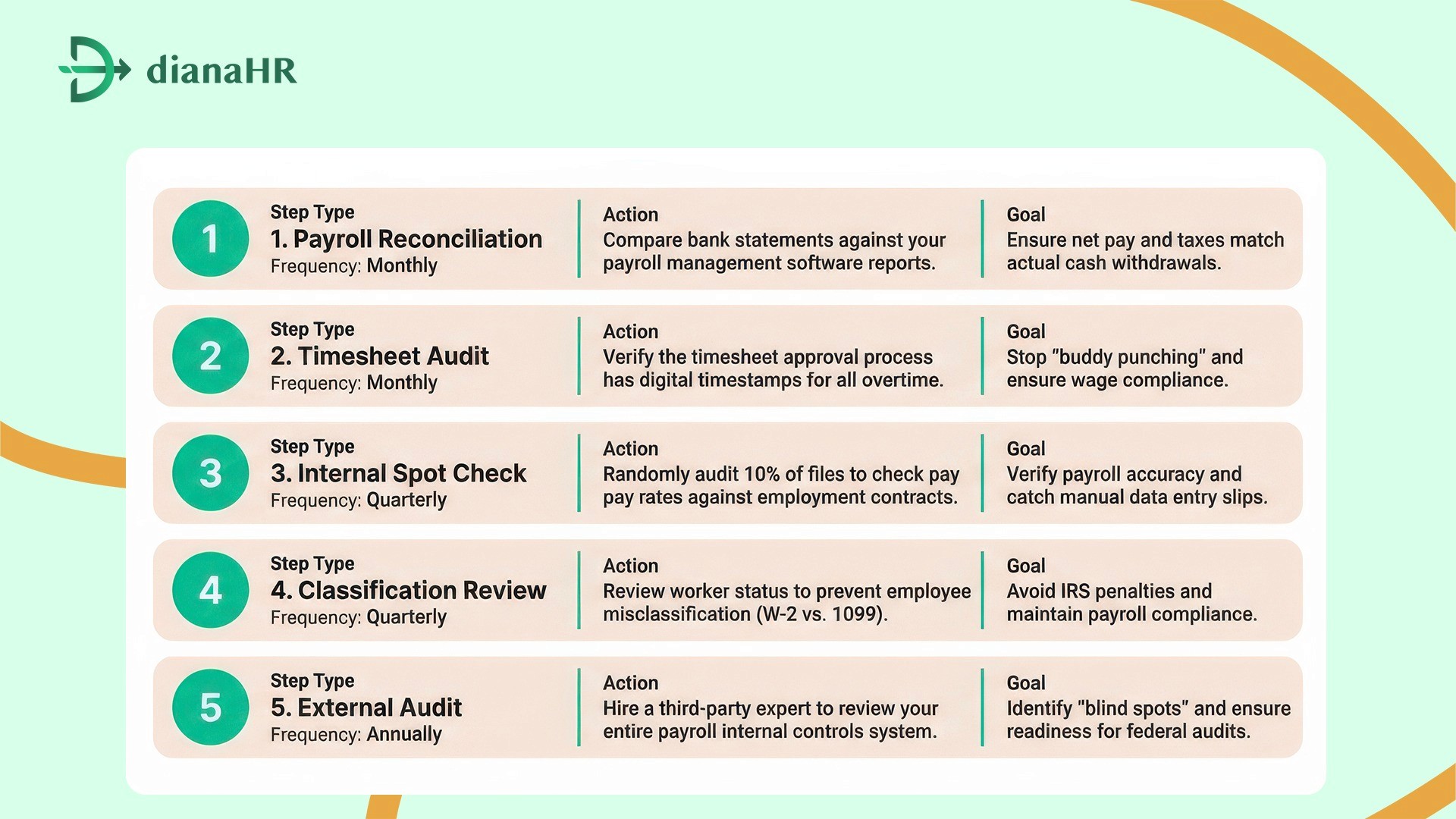

Payroll reconciliation is the process of matching your payroll records against your bank statements. Do this every month. If you wait for a quarterly review, you might miss a failed transfer or a duplicate payment.

In 2026, a top best practice for payroll accuracy is "Zero-Balance Accounting." You verify that the net pay and taxes match the exact amount taken from your bank. This monthly habit acts as a health check for your payroll controls. It stops small slip-ups from turning into permanent losses.

B) Internal vs. External Audits

You need two types of checks to maintain payroll compliance:

1. Quarterly Internal Audits: Pick 10% of your staff at random. Check that their pay matches their contract. Ensure their wage compliance documents are current and their classification is correct.

2. Annual External Payroll Audits: Hire a third party to find your blind spots. They look for shifts in state laws or new 2026 tax requirements that your team might miss. These payroll audits prove to regulators that you take payroll internal controls seriously.

Reconciliation and Audits: At a Glance

A solid audit plan keeps your records clean. Now, see how a partner can handle these tasks for you.

How DianaHR Protects Your Payroll Compliance

DianaHR builds these payroll controls directly into your operations. Our platform enforces segregation of duties by requiring multiple approval levels for every change.

We handle the complex math to ensure payroll accuracy across 40+ U.S. states. By combining AI with human experts, we reduce payroll errors and cut your admin workload by 15–20 hours a week.

Our Special Capabilities Include:

AI-Driven Compliance Management: We automate taxes and registrations for multi-state payroll management.

Human-in-the-Loop Expertise: Your dedicated specialist manages onboarding and policies tailored to your payroll internal controls.

Seamless Integrations: We work with Gusto, ADP, and Rippling so you don’t have to switch tools.

Smart Task Automation: This feature saves you 15+ hours weekly on repetitive payroll management tasks.

DianaHR turns a risky back-office job into a secure, data-driven process. See how DianaHR simplifies your payroll management and helps you scale faster → Explore DianaHR

Conclusion

Strong payroll management controls act as the foundation for a stable business. Without them, you face constant friction from manual entry and disjointed approval chains. These often lead to "ghost employees" or missed tax deadlines that go unnoticed for months.

Ignoring these gaps triggers severe consequences: the IRS can levy massive fines, and legal battles over wage compliance can drain your capital overnight. The fear of a surprise audit is real when your data is messy.

You can fix this by partnering with DianaHR. Our platform automates your payroll internal controls and audit trails, removing the risk of payroll errors. You get peace of mind and more time to focus on your company's growth.

Ready to stop worrying about audits? Connect with DianaHR today to automate your payroll management and secure your business.

Frequently Asked Questions

1. What is Segregation of Duties?

Segregation of duties strengthens payroll fraud prevention by splitting tasks between different people. No one employee should handle the entire payroll management cycle. This creates strong payroll internal controls that ensure payroll accuracy and catch payroll errors before they hurt your budget.

2. How often should I reconcile?

You must perform payroll reconciliation every month to maintain payroll compliance. Regular checks prevent payroll errors and wage compliance issues from snowballing into legal problems. Frequent payroll audits ensure your payroll management stays accurate and secure against accidental or intentional losses.

3. What are the biggest fraud red flags?

Common red flags include sudden pay spikes, duplicate bank accounts, or employee misclassification. Watch for "ghost employees" or manual overrides in your timesheet approval process. These signs often point to weak payroll internal controls and threaten your overall payroll management security and accuracy.

4. Can a small team still have controls?

Yes. Small teams use payroll controls by outsourcing to partners like DianaHR. They provide built-in segregation of duties and automated payroll compliance tools. This setup ensures payroll accuracy and strong payroll fraud prevention without requiring you to hire a large in-house team.

5. Is automation worth the cost?

Automation is a vital part of payroll management that cuts costs by 49%. It replaces weak payroll controls and eliminates manual payroll errors. Modern software improves payroll compliance and provides reliable payroll audits, making it the best investment for business growth.

Share the Blog on: