More U.S. companies are hiring across multiple states to expand their talent reach and maintain flexibility. A 2024 SHRM report found that 75% of employers still struggle to hire qualified people.

As remote work spreads, HR teams deal with complex payroll laws, compliance standards, and varying tax obligations. Every state adds new layers of regulations for wages, unemployment insurance, and benefits. These factors make multi state hiring one of the toughest HR challenges in 2025.

Managing remote employees, maintaining accurate records, and ensuring compliance across jurisdictions all require a smarter approach. This blog explains how companies can handle multi-state operations, reduce compliance risk, and create smoother hiring systems across the U.S.

Why Multi-State Hiring Introduces New HR Challenges

Hiring across states creates added responsibilities for HR teams. Each state comes with unique payroll laws, benefits regulations, and tax rules that make multi state hiring complex.

Remote work has pushed this trend even further, as more employees live and work in different states. Below are the core areas where HR challenges begin to multiply.

A) Talent Acquisition Across State Lines

Recruiting talent in multiple states changes the entire talent acquisition process. Compensation standards, benefits, and job expectations vary widely. Some regions have strong labor pools, while others face talent shortages.

HR must adapt job listings to match local pay norms, manage state-specific job posting regulations, and handle workforce mobility efficiently. Without consistent strategy and tools, companies risk overpaying or missing top candidates. Technology-driven sourcing helps simplify hiring across state lines and keeps compliance intact.

B) Compliance Burdens Grow with Geography

Every state enforces different labor codes, wage limits, and multi-state employment tax rules. As a result, HR must manage multiple registrations and reporting processes.

Key problem areas:

Tracking state unemployment insurance differences

Filing local tax registrations

Meeting state-specific record-keeping requirements

Using centralized HR technology for multi-state operations ensures consistency and minimizes missed filings.

C) Payroll Laws and Tax Implications Vary Significantly

Running payroll across different states demands precision. State income tax, local withholding rates, and disability insurance programs all differ. A single oversight can create financial or legal issues.

For instance, some states require payroll processing reports monthly, while others demand quarterly filings. To stay compliant, companies must use systems that automatically update tax tables and track multi-state onboarding requirements. Consistent payroll accuracy protects both compliance and employee trust.

D) Managing Distributed Remote Teams

Remote work spreads employees across time zones and regulatory frameworks, creating remote team compliance issues. HR must maintain engagement and manage compliance simultaneously.

Best practices:

Set clear policies for work hours and documentation

Offer digital onboarding and training tools

Conduct regular virtual check-ins to align performance goals

Well-structured HR frameworks help maintain culture and compliance across distributed teams.

When multi state hiring expands, the pressure on HR systems and compliance frameworks intensifies. The next section explains the key HR challenges that companies face when managing operations across multiple states and how they can address them effectively.

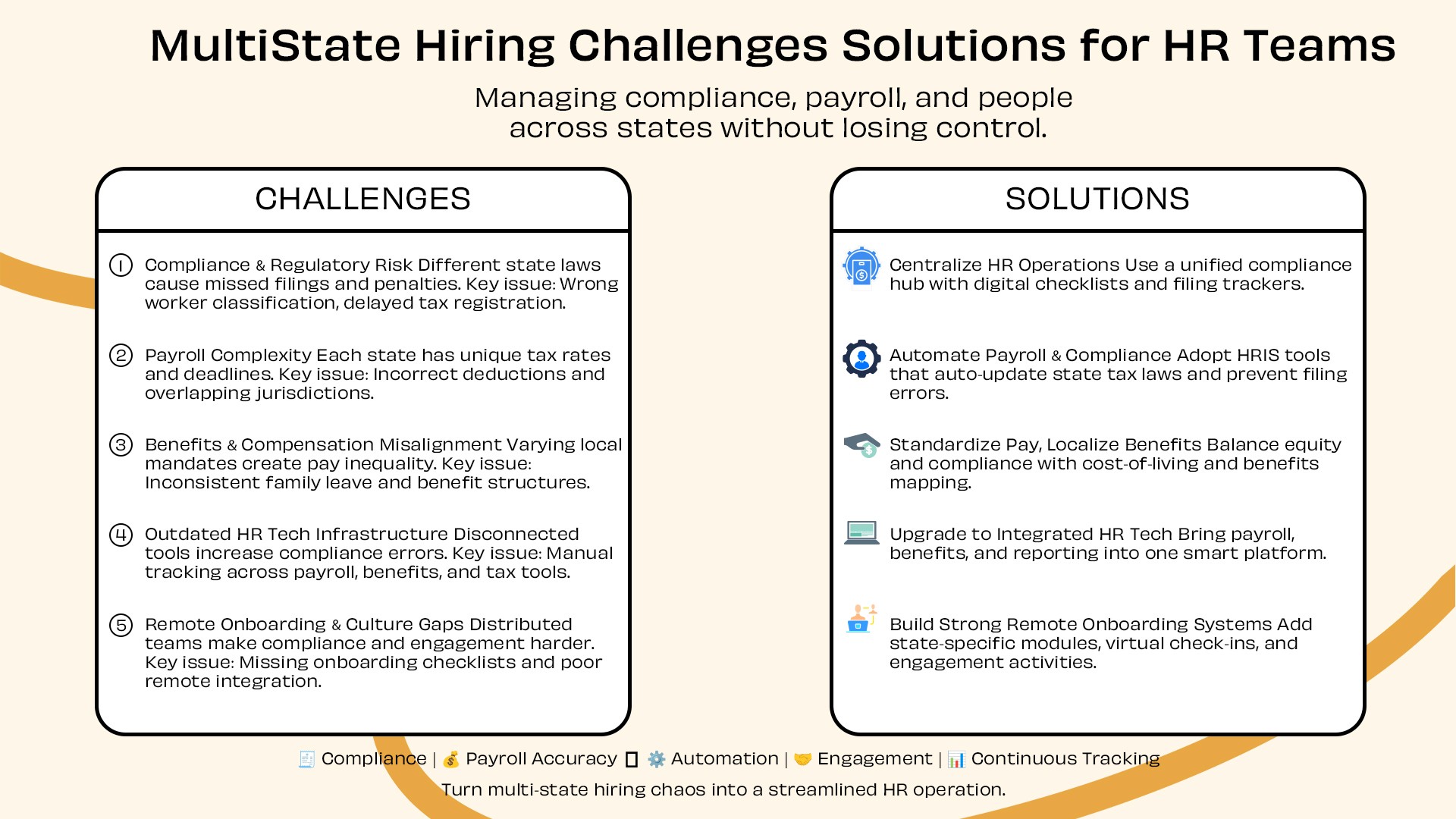

Key HR Challenges in Multi-State Hiring

A Table of Overview of Major HR Challenges in Multi-State Hiring:

Challenge | Description | Risk Level | Common Impact | Recommended Solution |

Compliance Risk | Managing state-specific labor laws, wage regulations, and registration filings across multiple jurisdictions. | High | Penalties, audits, delayed state approvals. | Use centralized compliance tools and expert monitoring to maintain accurate filings across states. |

Payroll Complexity | Handling varying payroll laws, tax rates, and multi-state employment tax requirements. | High | Payroll errors, delayed payments, inaccurate deductions. | Automate payroll processing with integrated HR technology for multi-state operations. |

Benefits Alignment | Adjusting compensation and benefits packages according to each state’s mandates and cost-of-living. | Medium | Unequal pay perception, compliance gaps, low retention. | Apply standardized compensation with localized benefits and periodic pay structure reviews. |

Remote Compliance | Overseeing remote team compliance issues across states with distinct HR documentation rules. | Medium | Inconsistent onboarding, compliance breaches, disengaged teams. | Implement multi-state onboarding systems and remote compliance checklists. |

When companies expand hiring beyond a single location, HR teams face compliance, payroll, and technology obstacles. The complexity grows with every new state added to the system. Below are the main challenges that affect multi state hiring operations today.

Challenge #1. Compliance and Regulatory Risk

Each state enforces distinct labor codes, wage laws, and multi-state employment tax rules. Failing to register for state unemployment insurance or report new hires properly can result in costly penalties.

Key compliance risks:

Delayed state tax registration

Misclassified workers or wrong wage calculation

Missing filings for unemployment or disability insurance

Using centralized HR operations and compliance software helps track every state’s requirements, reducing legal exposure and manual errors.

Challenge #2. Payroll Processing Complexity

Multi-state payroll demands precise handling of taxes, deductions, and pay schedules. Each state sets its own wage thresholds, tax rates, and reporting intervals.

Common payroll issues:

Overlapping tax jurisdictions

Incorrect withholding or deductions

Outdated state tax tables

Automating payroll processing through a multi-state HRIS ensures accuracy, timely submissions, and consistent updates on state-specific tax laws.

Challenge #3. Benefits and Compensation Alignment

Employees across states expect fair pay and benefits, yet regulations differ. States like California mandate paid family leave, while others do not. HR must balance internal equity with compliance and local expectations.

To manage this effectively, companies use compensation benchmarking tools that adjust for cost of living and state regulations. Routine pay audits help maintain fairness without overspending.

Challenge #4. Technology and HR Infrastructure Limitations

Outdated systems often fail to support multi-state onboarding and compliance tracking. Many teams rely on separate tools for payroll, benefits, and tax reporting, increasing error risks.

Investing in unified HR technology for multi-state operations brings automation, analytics, and audit trails under one platform—reducing manual oversight and improving compliance visibility.

Challenge #5.Onboarding and Culture for Remote/Distributed Teams

Distributed teams create new remote team compliance issues. HR must follow state-specific onboarding requirements and maintain engagement without physical presence.

Effective practices:

Include state compliance checklists in onboarding

Use digital verification and training tools

Conduct periodic virtual sessions to align remote teams with company culture

As multi state hiring expands, these HR hurdles can multiply quickly. The next section outlines practical solutions that help simplify compliance, payroll, and onboarding across states while keeping operations scalable and secure.

Practical Solutions for Multi-State Hiring Success

Tackling multi state hiring challenges requires structure, automation, and ongoing compliance oversight. With different payroll laws, tax codes, and labor rules across the U.S., HR teams need practical systems that simplify processes without losing control. Below are proven strategies to make hiring and managing employees across states efficient and compliant.

Solution #1. Centralize Your HR Operations with Regional Compliance Frameworks

Creating a hybrid HR model helps balance consistency and flexibility. A centralized HR hub supported by regional compliance partners ensures smooth coordination between states.

Key actions:

Develop a “state-entry checklist” for new registrations

Track state unemployment insurance differences and filing deadlines

Maintain digital records of tax and labor compliance

Centralized oversight gives HR visibility into every state while preventing duplication of effort or compliance gaps.

Solution #2. Leverage Technology for Payroll and Compliance Automation

Automation is vital when handling complex multi-state employment tax systems. Modern HRIS tools can update tax tables automatically, manage filings, and issue error alerts before deadlines.

Benefits of automation:

Accurate deductions for multi-state payroll

Reduced manual data entry

Real-time updates on regulatory changes

The right HR technology for multi-state operations minimizes risk, cuts processing time, and improves compliance reliability.

Solution #3. Standardize Compensation Practices but Localize Benefits

Equity in pay builds trust across distributed teams. A consistent compensation structure, paired with state-specific benefits, keeps your organization compliant and competitive.

Best practices:

Define core pay ranges and apply cost-of-living adjustments

Match benefits to state mandates like paid family leave or disability coverage

Review tax impacts for local benefits annually

This balance supports fairness and meets both legal and employee expectations.

Solution #4. Adopt Best Practices for Onboarding and Remote Culture

Effective onboarding helps new hires integrate quickly regardless of location. Clear communication, structured workflows, and state compliance training should be built into the process.

Add compliance modules by state

Use interactive onboarding tools

Schedule periodic virtual check-ins

Engaged employees are more productive and less likely to face compliance issues.

Solution #5. Monitor and Evaluate Continuously

Tracking the success of multi state hiring is as important as execution. Measure performance across all HR processes and refine them regularly.

Key metrics to monitor:

Payroll accuracy by state

Time-to-fill positions

Compliance incidents and error rates

Remote engagement and retention data

Data-driven evaluation allows HR to identify weak areas and improve efficiency.

How DianaHR Can Help with Multi-State Hiring

DianaHR is an AI-powered HR-as-a-Service platform designed to simplify multi state hiring for small and mid-sized businesses. It supports industries such as technology, healthcare, nonprofits, retail, and professional services.

By combining automation with human expertise, DianaHR helps companies reduce HR challenges, cut costs by up to 60%, and save nearly 15–20 hours weekly. It enables business owners to manage compliance across 40+ states while focusing on growth instead of paperwork.

Key Features that Simplify Multi-State Hiring

AI-Driven Compliance Management: Automates payroll taxes, benefits, and state registrations for multi-state operations, ensuring smooth compliance under varying payroll laws and multi-state employment tax systems.

Human-in-the-Loop Expertise: Pairs each client with a dedicated HR expert who manages onboarding, policies, and people operations specific to multi state hiring workflows.

Seamless Integrations: Connects easily with major HR platforms like Gusto, ADP, and Rippling—no tool migration or downtime.

Smart Task Automation: Cuts repetitive HR work by up to 60%, saving 15+ hours every week on multi-state onboarding, payroll, and reporting.

Scalable People Operations; Built for startups and SMBs scaling across states, offering consistent HR technology for multi-state operations that stay compliant and efficient.

These features turn multi state hiring from a manual, error-prone process into a streamlined, automated system managed by AI and experienced HR professionals.

Explore how DianaHR simplifies multi state hiring and helps your HR operations and scale with confidence.→ DianaHR.

Conclusion

Managing multi state hiring without the right systems leads to rising compliance pressure, inconsistent payroll laws, and scattered HR operations. HR teams struggle to track multiple state registrations, handle different tax rules, and maintain engagement across remote teams.

These issues affect both employee and company growth. Businesses lose valuable time fixing filing mistakes, responding to audits, or recalculating benefits. Productivity drops, costs rise, and the risk of non-compliance expands with every new location added.

DianaHR solves these pain points with automated multi-state onboarding, real-time compliance tracking, and seamless payroll integration. Its AI-driven system manages registrations, filings, and HR workflows across all states, allowing teams to focus on scaling instead of fixing errors.

Connect to DianaHR today to simplify multi state hiring, stay compliant across all states, and scale your workforce with confidence.

FAQs

1. What is multi state hiring?

Multi state hiring involves recruiting and managing employees across different U.S. states. It includes handling payroll laws, multi-state employment tax, and compliance filings for each jurisdiction. Companies expanding nationwide rely on HR technology for multi-state operations to manage hiring, onboarding, and workforce documentation under varying state requirements effectively.

2. Why does compliance get harder in multi state hiring?

Compliance complexity grows as every state enforces distinct payroll laws, benefits mandates, and state unemployment insurance rules. HR must register separately, track filings, and ensure accuracy across all locations. Automated multi-state onboarding systems reduce errors and maintain consistent compliance reporting across jurisdictions, helping businesses stay audit-ready and penalty-free.

3. How do payroll laws affect multi state hiring?

Different states impose unique wage limits, income tax rates, and benefit deductions. Mismanaging these payroll laws can lead to penalties and loss of employee trust. Automated systems streamline payroll processing, tax filing, and multi-state employment tax compliance, ensuring accurate calculations and state-specific reporting within expanding multi state hiring operations.

4. What are the biggest remote team compliance issues?

Remote team compliance issues occur when employees work in states where the company isn’t registered. This affects payroll processing, tax withholdings, and local benefit laws. Using centralized HR technology for multi-state operations helps manage remote teams effectively by syncing state-specific data, automating filings, and ensuring uniform compliance standards.

5. How can businesses simplify multi state onboarding?

Businesses simplify multi-state onboarding by using automated HR platforms that handle documentation, tax registration, and policy sign-offs. Integrated systems manage compliance, streamline employee verification, and apply payroll laws uniformly. This approach reduces manual workload and supports efficient hiring across states while meeting every multi state hiring requirement.

6. How does DianaHR help with multi state hiring?

DianaHR automates multi-state onboarding, compliance tracking, and payroll processing across 40+ states. It handles state unemployment insurance, benefits registration, and multi-state employment tax filings under one dashboard. Combining automation with human HR expertise, DianaHR simplifies multi state hiring, reduces compliance risk, and supports consistent HR operations for growing businesses.

Share the Blog on: