One in five payroll runs hits a snag. That single error costs your business an average of $291. It adds up fast. With state laws changing weekly, basic software cannot keep up. You need stronger protection. That is why smart leaders turn to HR outsourcing solutions.

These tools do more than basic admin work. They act as a shield against costly IRS fines. Proper payroll compliance management stops mistakes before they happen. Don't let compliance fears slow you down. Using modern HR outsourcing solutions guarantees tax filing accuracy and turns a risky back-office task into a secure process.

Top 10 HR Outsourcing Solutions

We grouped these top HR outsourcing solutions by category. This helps you find the right fit for your specific business needs without wasting time.

Category A: The "Fractional" Partners

This group works best for SMBs needing human experts to manage their current software.

1. DianaHR

Overview: DianaHR pairs a dedicated expert with your tools to cut HR costs by up to 60%. They monitor your systems daily to catch mistakes. They handle your admin tasks so you save 15–20 hours per week while ensuring your human resource outsourcing services run smoothly.

Key Features:

Maintains compliance across 40+ U.S. states

Automates taxes and benefits for multi-state payroll processing operations

Works with Gusto, ADP, and Rippling

Real-time risk monitoring

Industries Served: Startups, SMBs, Retail, Tech, Remote Teams, Healthcare

Why pick DianaHR: You keep your current stack. They work seamlessly with platforms like Gusto and ADP without requiring tool migration. This lets you focus on growth while they handle payroll compliance management. It is the smart choice for HR outsourcing solutions that eliminate repetitive work.

2. Bambee

Overview: Bambee gives you a dedicated HR manager to handle sensitive employee issues. They craft policies and solve conflicts so you avoid lawsuits. This makes them one of the most accessible HR outsourcing solutions for businesses needing human resource outsourcing services.

Key Features:

Dedicated HR manager for workforce management

Labor law adherence and policy updates

Termination guidance and risk mitigation

Optional payroll processing add-on

Industries Served: Retail, Small Business, Service Industry, Healthcare

Why pick Bambee: Bambee excels at policy and culture. Unlike other HR outsourcing solutions that just count hours, Bambee ensures your handbooks and termination procedures remain compliant. Their experts guide you through worker classification and payroll compliance management, effectively shielding your business from costly wrongful termination claims.

Category B: The Automation Giants (Tech-First)

This category suits companies that trust robust software to handle the math automatically. These platforms use code to solve complex payroll processing problems.

3. Rippling

Overview: Rippling unifies your employee data into one single record. It automates almost every manual step, from onboarding to final payments. This automation positions it as a leader among HR outsourcing solutions for tech-forward teams.

Key Features:

Automated state tax registration triggers

Unified HRIS platforms for IT and HR

Automated timekeeping and device management

Global workforce management capabilities

Industries Served: Tech Startups, SaaS, Remote-First Companies, Media

Why pick Rippling: Rippling wins on speed. Its "Unity" platform connects IT, HR, and Finance. If an employee moves, it updates tax filing accuracy settings instantly. This automation removes administrative HR support bottlenecks, ensuring payroll compliance management happens in the background without manual data entry.

4. Gusto

Overview: Gusto makes payroll easy for small teams. It puts tax filings on auto-pilot so you never miss a deadline. This simplicity makes it a favorite among HR outsourcing solutions for business owners who want to avoid paperwork.

Key Features:

Unlimited payroll processing runs

Automated local, state, and federal tax filing

Integrated employee benefits administration

Contractor and worker classification support

Industries Served: Small Business, Creative Agencies, Retail, Cafes

Why pick Gusto: Gusto focuses on design and ease. The "Auto-pilot" feature guarantees tax filing accuracy automatically. It enhances human resource outsourcing services by syncing automated timekeeping directly to paychecks. If you need simple payroll compliance management without complex enterprise features, Gusto works perfectly.

5. Paycor

Overview: Paycor helps industries with complex scheduling needs. It prevents compliance gaps in manufacturing and healthcare. This focus makes it a reliable choice among HR outsourcing solutions for companies that need strict control over their shifts and hours.

Key Features:

Real-time labor law adherence alerts

Advanced workforce management and scheduling

Automated timekeeping for shift differentials

Tax filing accuracy notifications

Industries Served: Healthcare, Manufacturing, Logistics, Non-profits

Why pick Paycor: Paycor excels at scheduling compliance. It warns managers if a shift violates rules, ensuring labor law adherence before you run payroll. Its specialized tools handle complex local taxes, offering better payroll compliance management than generic human resource outsourcing services. It protects you from costly wage-and-hour lawsuits.

Category C: The Heavyweights (Enterprise/Complex)

This group handles large-scale operations. They offer HR outsourcing solutions designed for complex regulatory environments.

6. ADP

Overview: ADP handles payroll for massive organizations. They manage complex regulations that break smaller platforms. Their infrastructure makes them a top choice for HR outsourcing solutions when you need to handle garnishments and global pay across borders.

Key Features:

"SmartCompliance" for regulatory audits

Global payroll processing capabilities

Automated wage garnishment management

Robust HRIS platforms integration

Industries Served: Enterprise, Government, Retail Chains, Multinational Corporations

Why pick ADP: ADP brings massive scale. Their "SmartCompliance" module manages payroll compliance management by handling unemployment claims and garnishments automatically. This reduces administrative HR support loads significantly. If you need human resource outsourcing services that ensure tax filing accuracy across 50 states and multiple countries, ADP delivers.

7. Paychex

Overview: Paychex specializes in granular reporting for businesses with specific tracking needs. They track labor costs down to the project level. This capability makes them one of the preferred HR outsourcing solutions for industries requiring detailed job costing.

Key Features:

Deep job costing and payroll processing reports

Tip credit and union reporting

Support for regulatory audits

Employee benefits administration integration

Industries Served: Construction, Restaurants, Skilled Trades, Manufacturing

Why pick Paychex: Paychex wins on details. They handle tip credits and certified payroll for government contracts better than most. This ensures tax filing accuracy for complex labor models. Their tools simplify payroll compliance management for union dues and specialized human resource outsourcing services, making them ideal for regulated sectors.

Category D: The Risk-Transfer PEOs

For business owners wanting zero liability, PEO providers are the answer. They become the legal employer for tax purposes.

8. Insperity

Overview: Insperity operates as a PEO to absorb your employment risks. They act as the employer of record for your team. This structure makes them unique among HR outsourcing solutions because they take legal responsibility for your payroll accuracy.

Key Features:

Full risk mitigation and liability transfer

Fortune 500-level employee benefits administration

Dedicated administrative HR support teams

Comprehensive regulatory audits protection

Industries Served: Professional Services, Finance, White Collar, Engineering

Why pick Insperity: Insperity offers total peace of mind. As one of the top PEO providers, they handle payroll compliance management by taking the legal hit for errors. They provide premium human resource outsourcing services that give small teams access to big-company benefits. This boosts retention while ensuring tax filing accuracy.

9. Justworks

Overview: Justworks removes the mystery from PEO pricing. They bundle payroll, compliance, and benefits into one clear fee. This transparency makes them a favorite among HR outsourcing solutions for businesses valuing simplicity and speed.

Key Features:

Transparent bundled pricing model

Automated payroll compliance management

Integrated employee benefits administration

Built-in risk mitigation and insurance

Industries Served: Startups, Agencies, Non-profits, Tech

Why pick Justworks: Justworks makes human resource outsourcing services simple. They bundle payroll processing with workers' comp and EPLI automatically. This all-in-one approach ensures labor law adherence without hidden fees. It is the easiest way for founders to access PEO providers without navigating complex contracts.

Category E: The Global Specialist

This final category covers the complexities of international hiring.

10. Deel

Overview: Deel eliminates borders from your hiring strategy. You can onboard contractors and employees in 150+ countries without establishing local entities. This platform centralizes global workforce management, ensuring you obey diverse local laws without needing a massive legal team.

Key Features:

AI-powered worker classification assessments

Global payroll processing in 100+ currencies

Employer of Record (EOR) services

Automated timekeeping and expense syncing

Industries Served: Tech, Gaming, FinTech, SaaS

Why pick Deel: Deel is the engine for global growth. Its standout "Worker Classifier" tool uses AI to flag misclassification risks before they become fines. With seamless integrations for your tech stack, it guarantees labor law adherence and tax filing accuracy across international borders.

The "Hidden" Costs of Payroll Errors

Paying for HR outsourcing solutions often looks like a line item you can cut to save money. That is a dangerous assumption. The monthly fee for a service is predictable. The cost of a mistake is not.

1. Financial Penalties Bleed Profits

The IRS does not accept "honest mistakes" as a valid excuse. They penalize businesses up to 15% for failing to deposit taxes on time. Statistics show that one in five payroll runs contains an error.

On average, each single mistake costs a business $291 in direct penalties. That figure does not even include legal fees. Without tight payroll compliance management, a simple missed local tax registration triggers a cascade of fines.

Practical Example: You hire a remote worker in Ohio but forget to register for local municipal taxes (RITA). Years later, you receive a bill for thousands in back taxes plus interest. Regulatory audits like this turn small oversights into financial disasters.

2. The "Trust Tax" Destroys Retention

Your employees trade their time for your promise of payment. Breaking that promise breaks their trust. Research indicates that 49% of workers start job hunting after just two paycheck errors. Workforce management depends on stability. If automated timekeeping fails or a check arrives light, your team questions your company's solvency.

Retention Tip: You cannot build a high-performance culture on shaky administrative ground. Reliable HR outsourcing solutions act as a retention strategy by guaranteeing tax filing accuracy and timely payments.

3. Operational Drag Wastes Time

Correcting a payroll mistake is not a five-minute fix. It involves recalculating taxes, voiding checks, issuing new payments, and amending W-2 forms. This forensic accounting takes an average of 10 hours of administrative HR support per error. That is 10 hours you are not selling, building, or leading.

The Fix: Human resource outsourcing services reclaim this lost productivity. They handle the complex payroll processing corrections, allowing you to focus on revenue rather than paperwork.

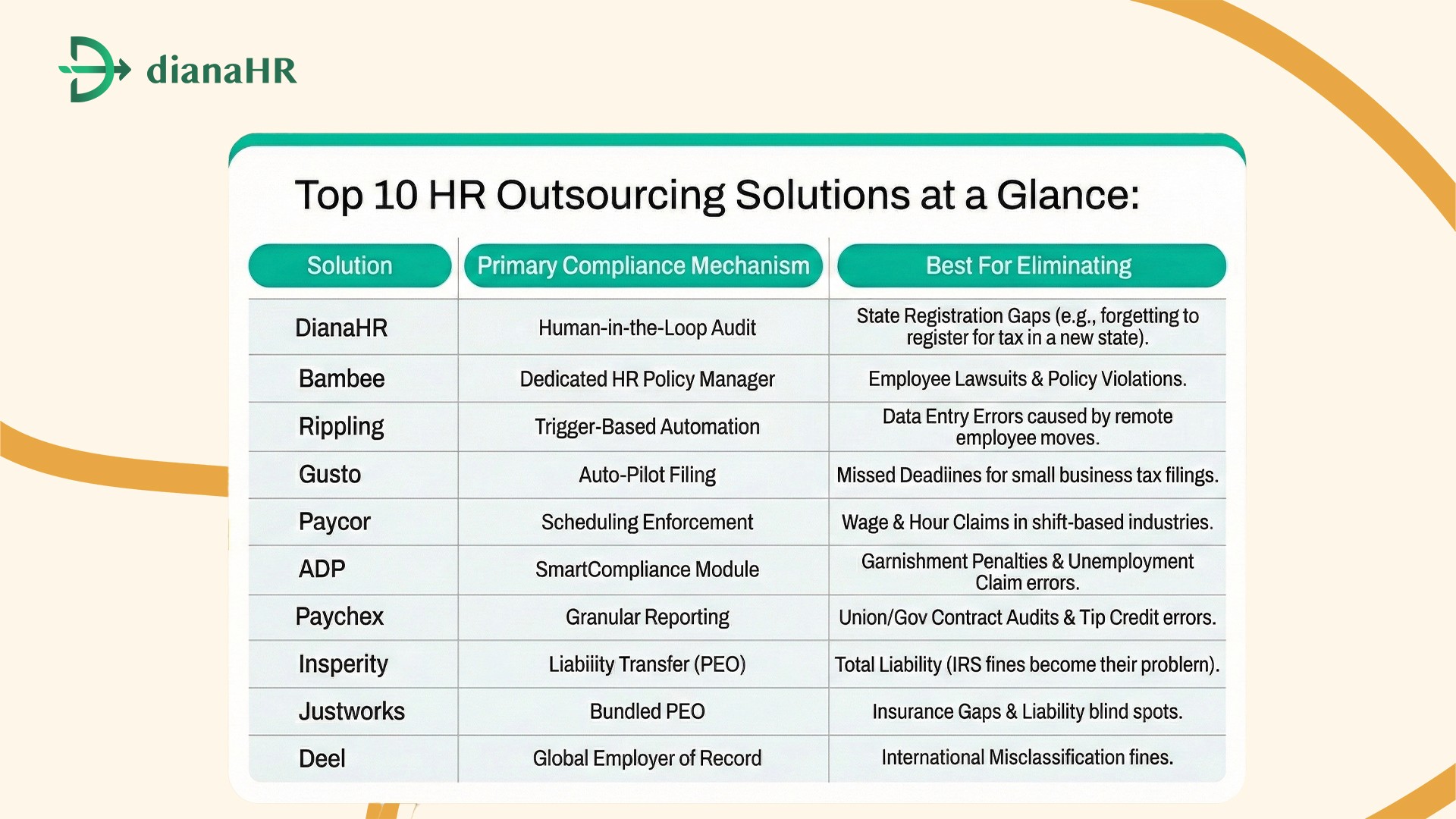

Top 10 HR Outsourcing Solutions at a Glance:

Solution | Primary Compliance Mechanism | Best For Eliminating |

1. DianaHR | Human-in-the-Loop Audit | State Registration Gaps (e.g., forgetting to register for tax in a new state). |

2. Bambee | Dedicated HR Policy Manager | Employee Lawsuits & Policy Violations. |

3. Rippling | Trigger-Based Automation | Data Entry Errors caused by remote employee moves. |

4. Gusto | Auto-Pilot Filing | Missed Deadlines for small business tax filings. |

5. Paycor | Scheduling Enforcement | Wage & Hour Claims in shift-based industries. |

6. ADP | SmartCompliance Module | Garnishment Penalties & Unemployment Claim errors. |

7. Paychex | Granular Reporting | Union/Gov Contract Audits & Tip Credit errors. |

8. Insperity | Liability Transfer (PEO) | Total Liability (IRS fines become their problem). |

9. Justworks | Bundled PEO | Insurance Gaps & Liability blind spots. |

10. Deel | Global Employer of Record | International Misclassification fines. |

Conclusion

Managing a team in 2025 is exhausting. You face constantly changing tax rules and strict labor law adherence requirements every week. Trying to handle payroll processing manually while growing a business creates a bottleneck you simply cannot afford.

Ignorance is expensive. A single mistake in worker classification invites aggressive regulatory audits. These errors do not just cost money; they threaten your business's future. Without proper risk mitigation, "DIY payroll" becomes a liability that exposes you to IRS penalties and employee lawsuits.

You need a shield, not just software. That is where robust HR outsourcing solutions come in. For a true "sleep at night" fix, add a fractional partner like DianaHR. They audit your systems to guarantee tax filing accuracy and handle the heavy lifting of payroll compliance management.

Book a consultation with DianaHR to guarantee your tax filing accuracy and eliminate compliance risks immediately.

FAQs

1. How do HR outsourcing solutions improve payroll accuracy?

HR outsourcing solutions boost accuracy by merging automated timekeeping with expert oversight. This dual approach eliminates manual data-entry errors during payroll processing, ensuring high tax filing accuracy. By validating data before submission, they also catch worker classification issues, guaranteeing strict labor law adherence and preventing costly fines.

2. What is the difference between a PEO and standard payroll outsourcing?

Standard human resource outsourcing services process payments but leave you liable. In contrast, PEO providers act as the "Employer of Record," assuming legal responsibility for labor law adherence and regulatory audits. They also manage employee benefits administration, shielding your business from compliance risks while you retain daily operational control.

3. What happens if the outsourcing provider makes a mistake?

Reputable providers offer tax filing accuracy guarantees. If their payroll compliance management fails and triggers a penalty, they typically pay the fine. This financial protection is essential for risk mitigation, ensuring your business is safe from the costs of unexpected regulatory audits caused by vendor errors.

4. Is outsourcing worth the cost for small businesses?

Yes, because administrative HR support often costs less than a single non-compliance fine. Outsourcing saves valuable time on workforce management and prevents expensive error corrections. Investing in professional HR outsourcing solutions effectively insures your profit margins against the high financial risks of IRS penalties and state labor lawsuits.

5. Will I lose control of my employees?

No. You maintain full leadership over culture and daily tasks. The provider simply handles backend employee benefits administration and complex worker classification paperwork. This arrangement allows you to leverage professional human resource outsourcing services to handle the bureaucracy, freeing you to focus entirely on managing and growing your team.

Share the Blog on: