Forget guesswork. Recent data shows a big change in how you handle books. Over half of small businesses now use accounting software to manage their P and L statement.

Many large firms use smart systems to check revenue streams every day. Steve Jobs said great products bring profits. But even great products fail without a clear P and L statement. This income statement guide helps you move past basic math. Use a financial statement template to track your bottom line.

Watch your operating expenses during this fiscal year. Your gross profit matters. A solid P and L statement increases your net income. Stop guessing. Lead with data to scale your business.

Why Every Modern Business Needs a P and L Statement in 2026

Managing your P and L statement is no longer a chore for tax season. It is your daily dashboard. Use this income statement guide to spot trends before they hurt your bottom line.

A) Moving Beyond the Annual Tax Filing

Checking your P and L statement once a year is a mistake. Top businesses review their net income every month to stay ahead.

Track revenue streams to see what sells.

Identify "leaks" in your operating expenses.

Compare monthly data to improve your gross profit.

B) Distinguishing P&L from Cash Flow and Balance Sheets

Your P and L statement shows performance over time. While cash flow tracks actual money in the bank, the P&L measures the health of your business model. Use a financial statement template to see the difference clearly.

In 2026, you must know your EBITDA to attract investors. Unlike a balance sheet, this document tells the story of your fiscal year. A clear P and L statement proves your business works. Now, let's look at the steps to build one using a financial statement template

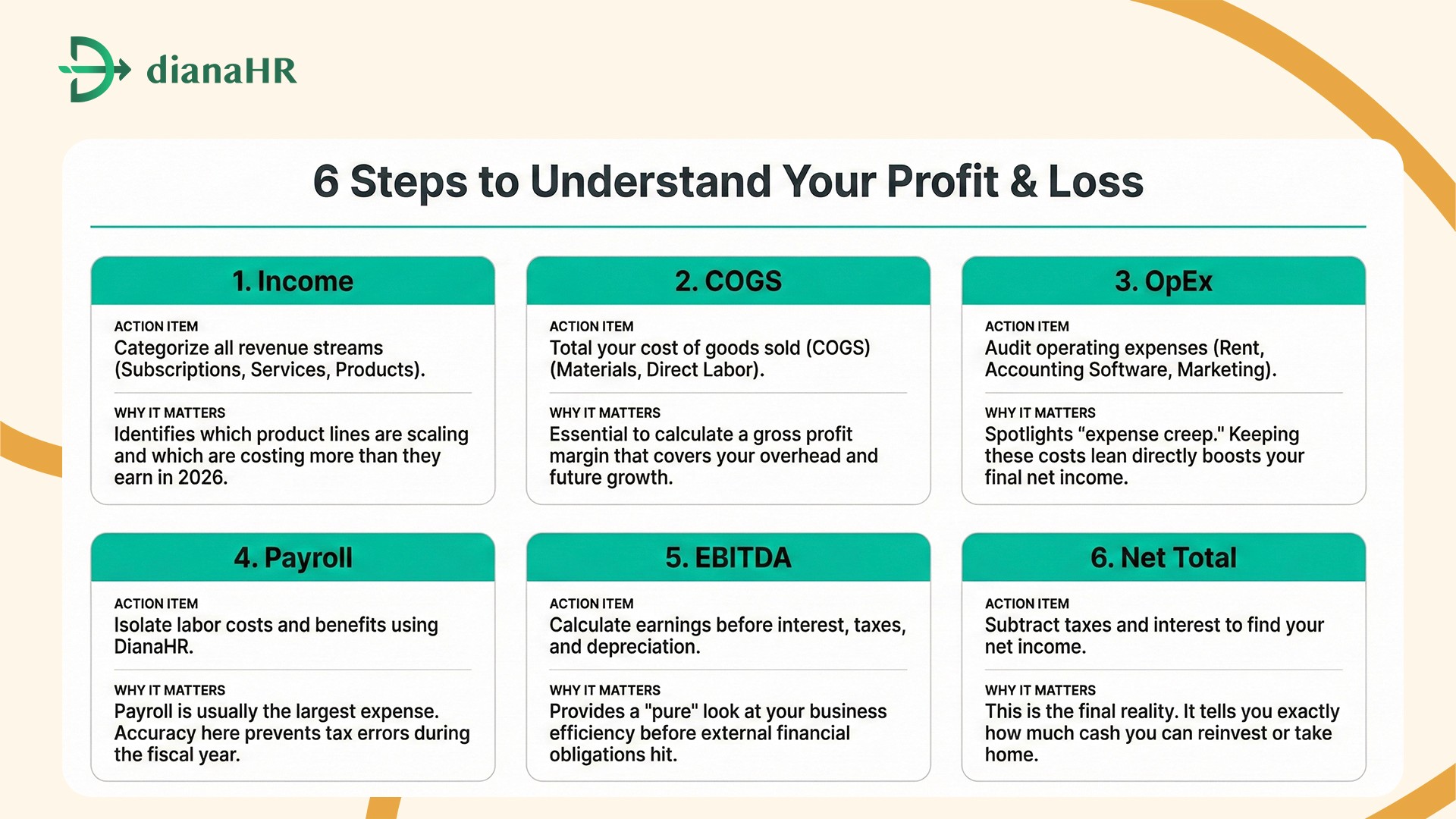

Step-by-Step: Building Your P and L Statement with a Financial Statement Template

Building your P and L statement requires a logical flow. Use a financial statement template to organize your data so you can see your net income without any confusion.

Step 1: Documenting Your Diverse Revenue Streams

Start with your total sales. Your financial statement template should list every source of income separately.

Include direct product sales and service fees.

Track recurring subscriptions and one-time payouts.

Separate your main revenue streams from side earnings like affiliate commissions.

Step 2: Isolating Cost of Goods Sold (COGS)

Subtract the direct costs of making your products. This includes raw materials and labor. Once you subtract the cost of goods sold (COGS) from your total revenue, you find your gross profit. If this number is low, you need to check your pricing.

Step 3: Tracking Operating Expenses (OpEx)

List everything it costs to keep the lights on. This part of the income statement guide focuses on operating expenses like rent, marketing, and accounting software fees. Split these into fixed costs that stay the same and variable costs that change with your sales volume.

Step 4: Arriving at EBITDA and Net Income

Before you pay taxes, calculate your EBITDA. This shows how well your business runs at its core. Finally, subtract interest and taxes to find your bottom line. This final net income tells you exactly what you earned during the fiscal year.

P&L Creation Guide: From Data to Decision:

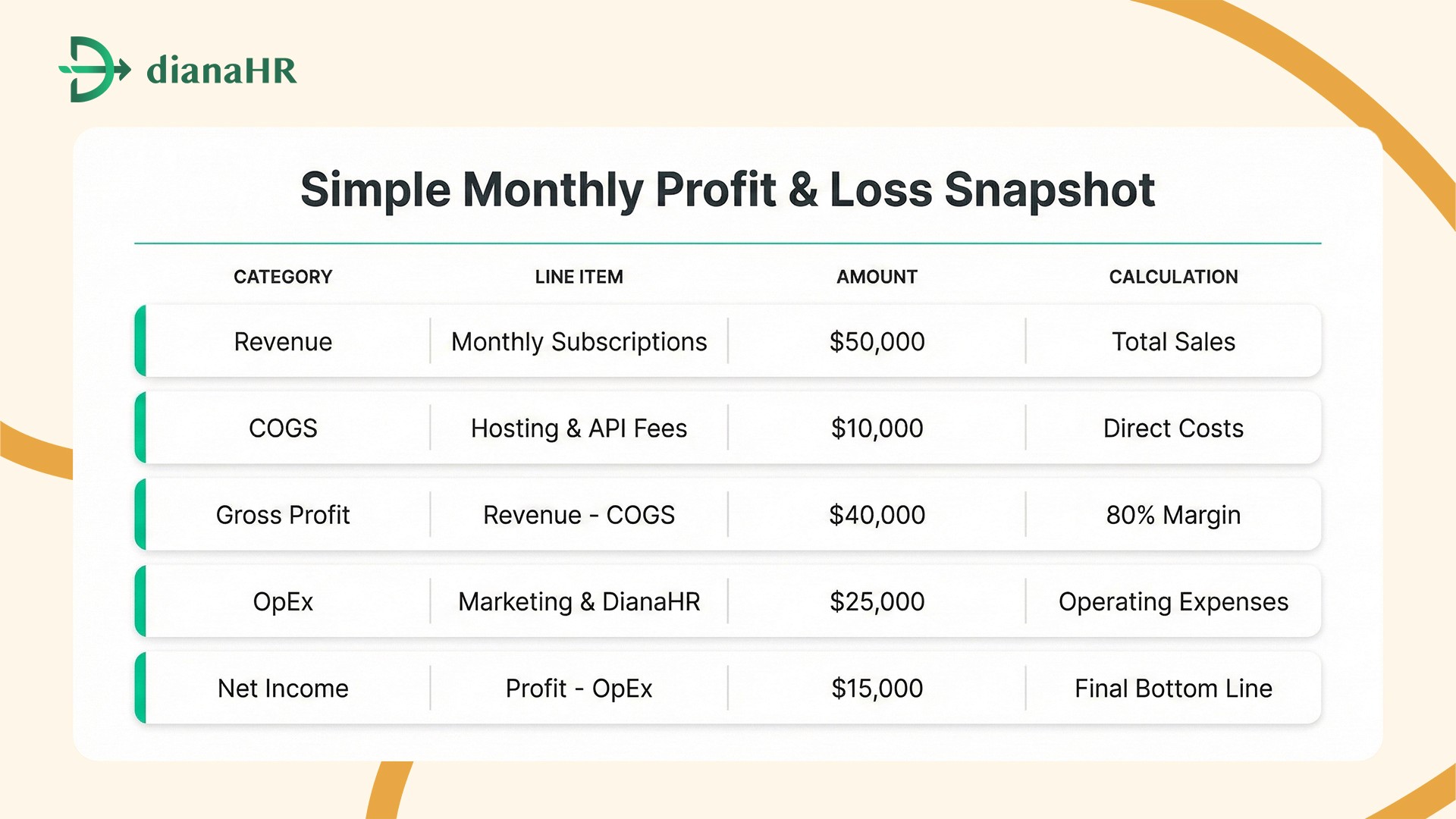

1. SaaS & Digital Subscription Template

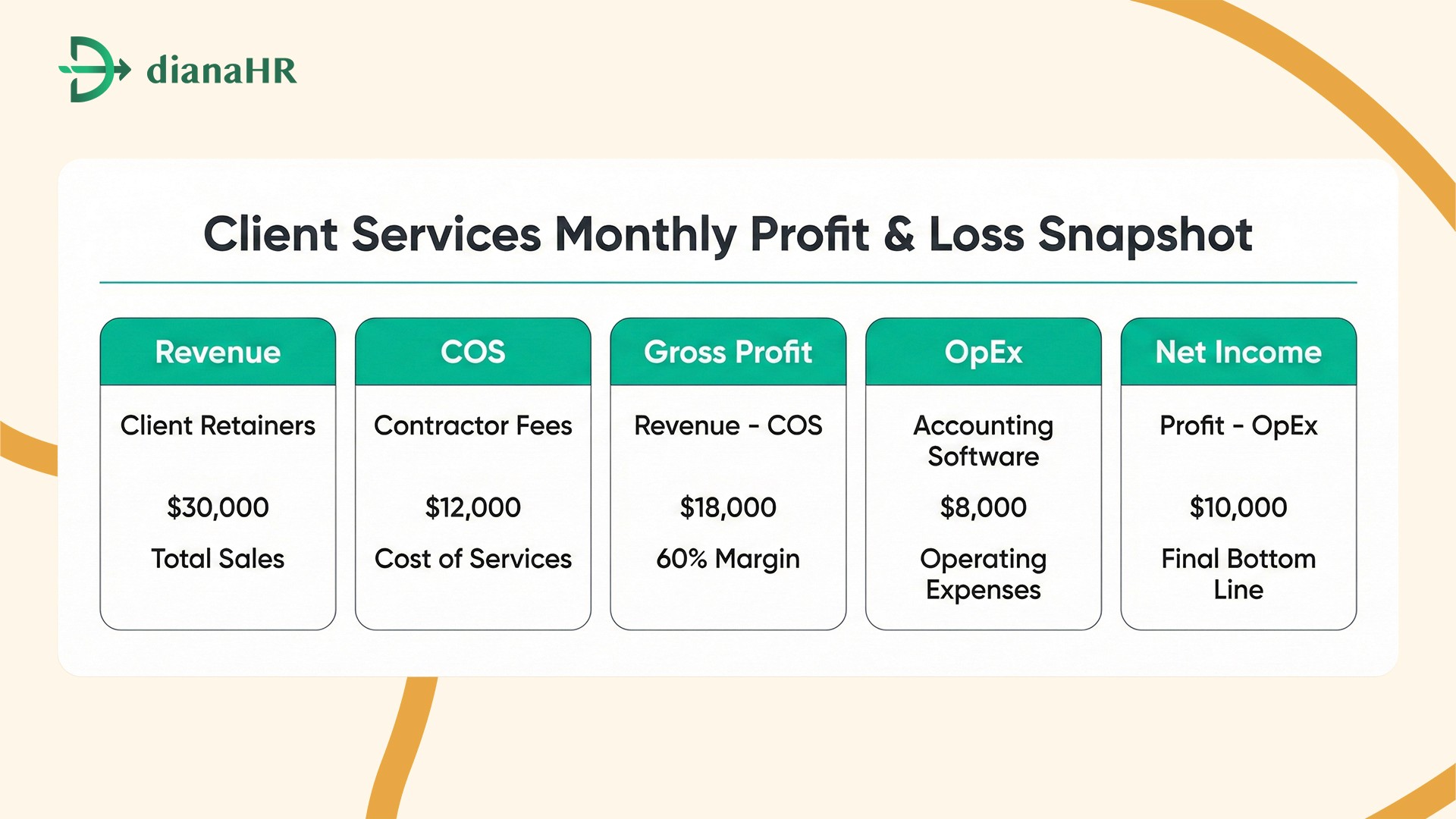

2. Professional Services & Agency Template

3. Retail & Ecommerce Template

Getting these numbers right helps you hit the right targets. Next, we will see how your P and L statement compares to others in your industry.

Utilizing an Income Statement Guide for 2026 Industry Benchmarks

Comparing your P and L statement to your peers helps you stay ahead. Use this income statement guide to see where you stand in the market.

A) Are Your Margins Competitive?

Healthy numbers change by industry. In 2026, tech firms aim for a gross profit of at least 75%. Established SaaS models often see a net income between 20% and 30%. If you run a manufacturing plant, a 5% to 8% margin is normal. Retailers often struggle with a bottom line under 5% due to high cost of goods sold (COGS).

If your P and L statement shows you falling behind, check your operating expenses. Use your accounting software to compare your data to these 2026 averages. High-performing firms use the "Rule of 40" to balance growth and EBITDA.

B) The Rise of "Sustainable Profit" Metrics

Modern investors now look at ESG impact. Many businesses include "Carbon Costs" in their operating expenses to prepare for new rules. This "Shadow Pricing" helps you see the true cost of your revenue streams.

A modern financial statement template often includes these sustainability metrics to help you attract green investors during this fiscal year.

Comparing your results is the first step toward optimization. Next, let’s see how to lower costs on your P and L statement by managing your team better.

How DianaHR Optimizes Your P&L by Cutting HR Costs by 60%

Manage your P and L statement better by cutting operating expenses with DianaHR. This platform simplifies your bottom line by reducing HR costs by 60%.

A) Streamlining the "Labor Cost" Line Item

Payroll is often the largest part of your operating expenses. DianaHR uses smart tools and experts to manage your fiscal year needs.

AI-Driven Compliance: Handles payroll taxes and benefits across 40+ states.

Human Expertise: A dedicated specialist manages your specific P and L statement needs.

Seamless Integrations: Works with your current accounting software like Gusto or ADP.

B) Reducing Administrative Overhead

Save 15+ hours every week on manual tasks. By automating payroll and onboarding, you improve your net income and focus on new revenue streams.

Explore how DianaHR simplifies your P and L statement and helps your business scale faster.

Conclusion

Creating a P and L statement is about control. Many owners struggle with messy spreadsheets and hidden operating expenses that eat their gross profit. Ignoring these numbers leads to disaster.

You might run out of cash during the fiscal year without knowing why. An incorrect P and L statement causes tax audits and failed loans. This risk stops your growth. Avoid these traps by using a modern income statement guide.

A solid financial statement template keeps you safe. DianaHR fixes the labor cost mess. Their experts automate your payroll data, so your net income stays accurate. Stop the leaks and start scaling with a clear P and L statement.

Connect to DianaHR to automate your P and L statement data and scale your business with confidence.

FAQs

1. How often should I update my P and L statement?

Update your P and L statement monthly using accounting software. This practice helps you track revenue streams and catch spikes in operating expenses early. Regular reviews during the fiscal year ensure your bottom line stays healthy and your goals remain reachable.

2. What is the difference between Gross Profit and Net Income?

Gross profit is revenue minus cost of goods sold (COGS). Your net income is the final amount after subtracting all operating expenses, taxes, and interest. Use an income statement guide to see how both impact your bottom line and growth.

3. Can I use a P and L statement for a service-based business?

Yes, a P and L statement works for any model. Instead of cost of goods sold (COGS), track labor and tools. This income statement guide helps you monitor operating expenses and revenue streams to maximize your net income every month.

4. Why does my P&L show a profit but my bank account is empty?

This happens because a P and L statement often uses accrual accounting. It records revenue streams when earned, not when cash arrives. Check your accounting software to see if high operating expenses or unpaid invoices are draining your actual cash.

5. Is EBITDA more important than Net Profit?

EBITDA shows operational strength by ignoring taxes and interest. However, net income is your true bottom line. Use a financial statement template to track both metrics. This ensures you understand your efficiency and the final net income you keep.

Share the Blog on: